Draghi’s drag continues and poor US data is not enough to cheer EUR/USD.

The team at CIBC sees more to come, with clear targets.

Here is their view, courtesy of eFXnews:

The language used by President Mario Draghi following the ECB’s October meeting implies that the central bank is primed for action, notes CIBC World Markets.

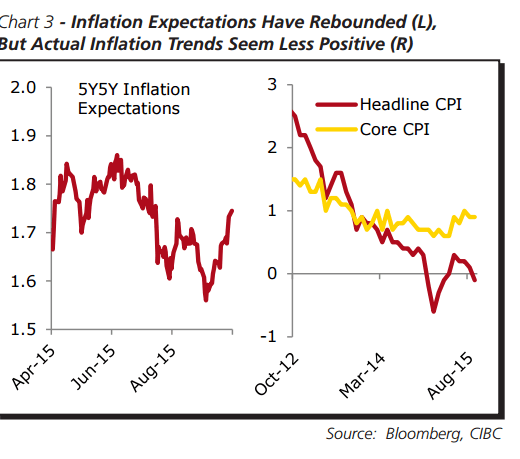

“Although medium-run inflation expectations have rebounded recently, it seems the ECB is not prepared to leave anything to chance. As headline CPI continues to exhibit disinflationary trends and core inflation remains well below the central bank’s target, the overall environment currently favours additional stimulus.

“As a result, in the context of President Draghi’s rhetoric, it would now take a significant surprise in the data to stand in the way of a further dose of stimulus being unveiled by the ECB in December,” CIBC argues.

The December decision will be released alongside the publication of new ECB staff economic forecasts, which seem likely to be used as a justification for any action.

Additional stimulus will most probably come via committing to prolong bond purchases into Q1 2017. As with all QE programs, the goals include increasing asset prices and forcing investors to tilt their portfolios toward riskier assets. However, the most immediate aim remains encouraging a further depreciation in the currency. A weaker EUR will not only increase inflation, but it will also make the monetary union more competitive on the global stage,” CIBC adds.

“Look for further weakness in the EUR to take the level of the currency to 1.06 versus the USD by year-end and 1.04 in Q1 2016,” CIBC projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.