Euro/dollar hasn’t always reacted in the most predictable way to economic and political developments.

What’s going on? The team at Credit Suisse tries to explain and forecast the next move of the pair:

Here is their view, courtesy of eFXnews:

In its weekly FX note to clients, Credit Suisse explains the current EUR price action outlining why the single currency has lost ground since Friday in spite of the fact that most other risk parameters such as core vs periphery spreads have moved in a traditional pro-risk manner this week.

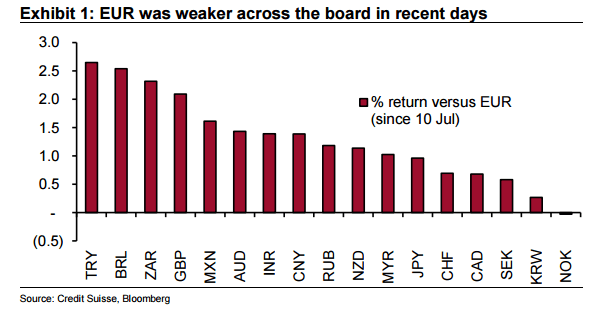

1- “The market’s reaction to the provisional Greek “third bailout” agreement has been predictably pro-risk in some key ways. In times gone by, these developments would almost certainly have also led to another obvious pro-risk outcome: a higher EUR. But the single currency since last Friday’s close has lost ground against all of its key rivals,” Cs notes.

2- “How do we explain this? In our view, this reflects primarily the reality that, unlike EUR “version 2010-13″ where it still traded as a pro-risk and pro-carry currency, “version 2015″ is very much perceived as a funding currency. It is enough to consider the very muted behavior of EURUSD basis over the course of the latest Greek crisis to see just how different things are in 2015,” CS argues.

3- “Why does this matter? Funding currencies tend to do better when the market has to worry about risk,especially when the market was already short the currency before the risk event in question became a hot topic. In this key sense, the perceived elimination of Greek volatility for the time being allows the market room to consider getting back to what it has wanted to do more than almost anything else since ECB President Draghi put ECB QE on the table: short the EUR again,” CS adds.

4- “The renewed fall in oil and commodity prices is another key driver. Aside from its obvious negative implications for currencies like AUD and CAD, any negative pull on European inflation expectations could help put to bed ECB tapering expectations, pulling EUR lower in the process,” CS argues.

In line with this view, CS targets EUR/USD at 1.05 in 3-month and 0.98 in 12-month.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.