EUR/USD is hovering around the lows but is hesitating towards taking the extra step down below the 12 year low of 1.0460. It is also refraining from a meaningful bounce ahead of the ECB meeting.

The team at JP Morgan asks what’s next for the common currency and discusses the various factors moving the pair:

Here is their view, courtesy of eFXnews:

JP Morgan’s EUR/USD forecast profile is unchanged this month and continues to show a slower decline for the rest of the year, after an unprecedented -11% drop in Q1.JPM’s Quarter-end targets are 1.07 in Q2, 1.06 in Q3 and 1.05 in Q4.

“Downside targets would be more aggressive were it not for the US dollar’s valuation problem and the Fed’s gradual pushback on a strong currency,” JPM argues.

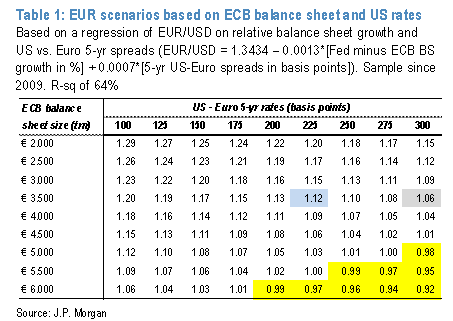

“Based on JPM’s expectations that the ECB balance sheet expands to €3.5trn by end 2016 and that 5-yr spreads might move about 50bp in the US’s favour, EUR/USD’s fair value is about 1.12 (blue cell in table 1). The euro’s current level near 1.06 would be justified if the ECB balance sheet were heading to €5trn (unlikely given how Euro area growth is improving) or the USEuro 5-yr spread would widen to over 300bp over the cycle (unlikely as the Fed dots fall towards the money market curve due to mediocre US growth),” JPM adds.

“So while we know that currencies can undershoot for some time until a macroeconomic or policy catalyst emerges, we are reluctant to forecast trend extensions that have little empirical basis,” JPM argues.

The upside risk to this view, according to JPM, could probably take EUR/USD towards 1.15 over the coming months if one or more of these 2 scenarios materialize:

(1) US economy slows to below trend or fails to generate any wage or inflation pressure, causing the Fed to delay tightening until 2016; (2) Euro area growth accelerates to 3% at some point in 2015, forcing a sharp repricing of money market rates and attracting significant foreign equity inflows.

In the mean time, the downside risk to this view, according to JPM, could probably take EUR/USD below 1.00 if one or more of these 3 scenarios materialize:

(1) the Fed signals commitment to June hikes (not priced); (2) the Greek government decides to exit EMU; or (3) the SNB begins selling euros for dollars now as part of its FX regime change.

JPM also lists the following as potential trigger events:

– ECB meetings on Apr 15, Jun 3, Jul 16 and Sept 3 – ECB TLTROs in Jun, Sept and Dec 2015 –Euro flash HICP reports Apr 30, May 2, June 2, June 30, Jul 31 and Aug 31 – FOMC on Apr 29, Jun 17, Jul 29 and Sept 17, Oct 28 and Dec 16.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.