The Yuan is down again, causing the biggest two-day sell off in Asian currencies since 1998.

At the same time we can see a deprecation of the USD against the GBP, EUR and JPY as stocks continue to trade lower.

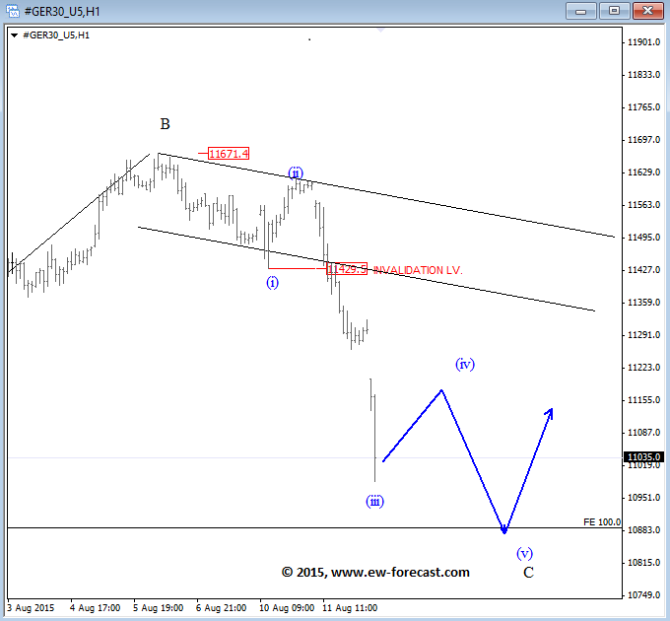

On the German DAX we see a sharp extended leg down to 11000 today which looks like a wave (iii) of an impulsive decline from 11670. That said, the pair will likely move to even lower levels after a wave (iv) bounce that can occur today back to around the 11200 area. On the downside, we see support coming in around 10900.

DAX 1h Elliott Wave Analysis

EURUSD is trading higher, now very close to the highs from July 27 that will likely be taken out today. We see wave C in play now for 1.1170 equality level or 1.1240 (138.2% extension) where an uptrend can slow down this week. It seems like that big and ongoing triangle is going to be more complex.

EURUSD 1h Elliott Wave Analysis

In our latest podcast, we ask: Will they or won’t they? We talk about the Fed and also falling oil and silver.