The tension is certainly rising towards the important ECB decision on October 22nd.

Here is a full guide of how to trade it, according to the team at Barclays:

Here is their view, courtesy of eFXnews:

The ECB will take center stage this week as markets anticipate further monetary easing in the months ahead, notes Barclays Capital.

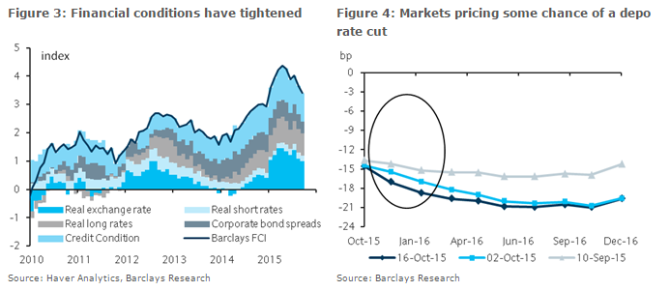

“An increasingly cautious Fed, coupled with an uncertain EM outlook, has benefited the EUR recently, contributing to tighter euro area financial conditions. Coupled with the recent drop in inflation expectations, such tightening has significantly raised expectations for additional ECB stimulus, making this week’s ECB meeting (Thursday) the market’s key focus.

Notwithstanding recent statements by ECB staff, the most likely scenario, in our view, is a continuation of the dovish rhetoric, followed by the announcement of a QE time extension in December, when the ECB updates its Q4 15 staff economic forecasts,” Barclays projects.

Given additional stimulus expectations as early as this week, we see a risk for EURUSD to squeeze higher should President Draghi withhold any signals regarding further policy measures. We would be looking to fade such upticks, however, preferably via options as a stronger EUR would only exacerbate recent tightening, adding even further pressure to the ECB,” Barclays advises.

“Moreover, recent price action in front-end euro rates suggests that the market is pricing a non-zero probability for a further deposit rate cut. While we do not rule out this possibility, we do not think it is an option for the next two meetings. However, we estimate that the rates market is already pricing a 20% likelihood of a 10bp deposit rate cut before year-end. In our view, a likely trigger for a rate cut would be a further material appreciation of the euro, possibly related to more signs that the Fed will remain on hold for longer. Although a measure of last resort, such policy action would be the most effective in weakening the EUR,” Barclays adds.

“We expect more monetary easing before year-end. We believe that the details and magnitude matter for the price action of the EUR, as an extension and increase in the QE program would probably have less of an effect than an outright cut in the deposit rate. We think that it is just a matter of time until the ECB decides to drive EURUSD lower.

We believe that amid a lack of policy options, the ECB will step in in the months to come to try to fulfill its inflation mandate. As such, we expect further EUR downside. Our view should be supported by further USD strength, as monetary policy expectations in the US seem too benign compared with the healthy dynamics of internal demand in the US,” Barclays argues.

In line with this view, Barclays recommends buying a 3m 25delta EURUSD risk-reversal (EUR put/USD call) for a cost of 13.2bp (strikes: 1.1004, 1.1737, spot ref: 1.1357, atm vol: 9.19%), which offers a compelling risk-reward should EURUSD break below its recent range.

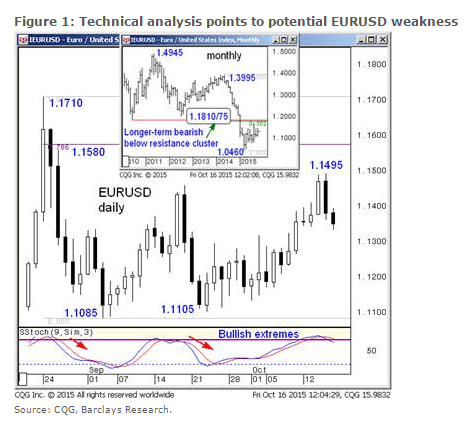

In spot, Barclays maintains a short EUR/USD from 1.1278 targeting a move to 1.0460, with a stop at 1.1562.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.