China is never too far away from EUR/USD, and this was very relevant at the wake of 2017. What’s next after the dawning days? Here is the view from Danske:

Here is their view, courtesy of eFXnews:

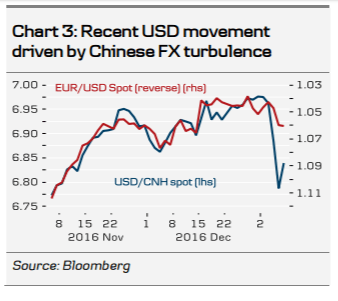

One of the most noteworthy trends in the early days of 2017 has been the volatility in the CNH/CNY markets. Similar to last year, the main driver appears to be concerns about rising outflows and fears of an acceleration in January following the resetting on 1 January of the USD50,000 quota that all Chinese citizens can buy every year. The Chinese authorities have in our view pre-emptively been tightening liquidity conditions in the CNH market to put a stop to the depreciation of the CNY versus the USD as well as introducing more administrative curbs on buying FX by Chinese citizens. Given that many hedge funds and other investors entered 2017 with significant short positions, the sharp rise in the CNH seen over the past two days probably relates to a squeeze of these short positions. Despite the strengthening of the CNH/CNY against the USD in recent days we still see a weakening of the CNY throughout 2017 due to the combination of weakening growth and concerns about high debt levels.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

The squeeze of short CNH positions is also one of the reasons for the upward move in the EUR/USD in our view, together with Fed worries about the strength of the USD in the minutes from the meeting in December.

We still see the USD gaining strength vs. the EUR in the next months followed by an upward move in EUR/USD later this year.