EUR/USD enjoyed the safe haven flows to move back up to higher ground, covering the losses it made on New Year’s Eve. But as more traders get back to their desks, it’s back to reality.

Preliminary German inflation numbers for December missed on all fronts: Year over year, prices rose by only 0.2% against 0.4% expected and 0.3% beforehand according to the European Standard, HICP. The picture isn’t different for the national CPI and the both monthly measured: all missed expectations.

The numbers from the euro-area’s locomotive feed into the all-European data which in turn impact the ECB, which meets on January 21st. Will the ECB add more stimulus? The open door became a bit more open.

But the euro isn’t on its own in sliding against the greenback: the safe haven yen is off the highs with USD/JPY settling above 119. And this isn’t a “risk on” event either: commodity currencies continue sliding against the might US dollar.

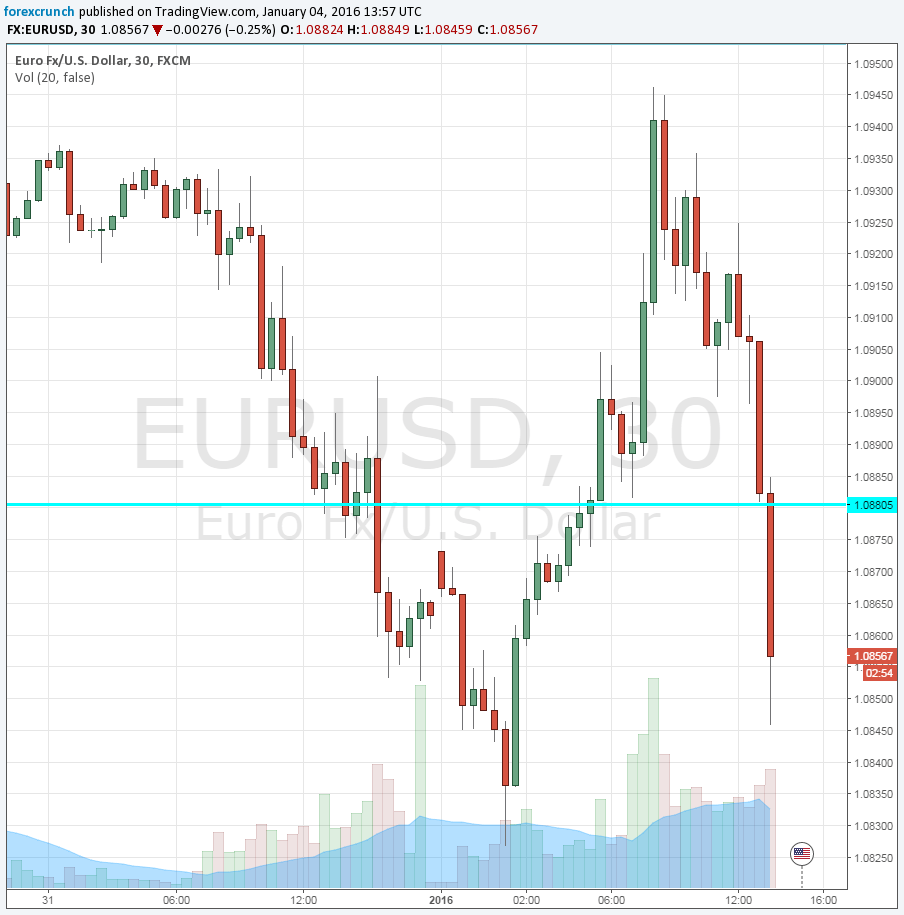

This one-two punch sends EUR/USD back down to 1.0850 at the time of writing, below support at 1.0880 and still above support at 1.08.

Tomorrow we have the all-European inflation figures. Here is how to trade the CPI Flash Estimate with EUR/USD.

Here is how it looks on the chart: