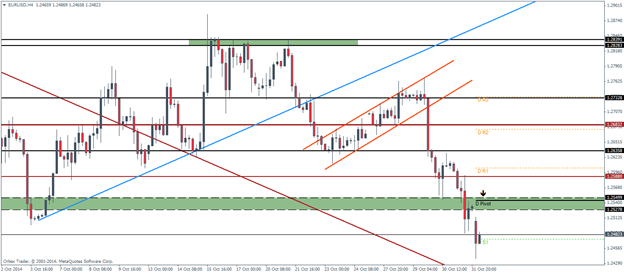

EURUSD Daily Pivots

| R3 | 1.2734 |

| R2 | 1.2674 |

| R1 | 1.2604 |

| Pivot | 1.2544 |

| S1 | 1.2473 |

| S2 | 1.2413 |

| S3 | 1.2342 |

EURUSD broke through the major support at 1.25 handle and opened this week lower at 1.2506 making a small down gap. We can expect price to rally towards filling this gap while also retracing the losses back towards the daily pivot level at 1.2544, a retest of this broken support for resistance. This could possibly pave way for more declines but could bounce off the down sloping trend line. Alternatively, if the resistance at 1.25 gives way, we can see a major correction towards 1.2635 handle.

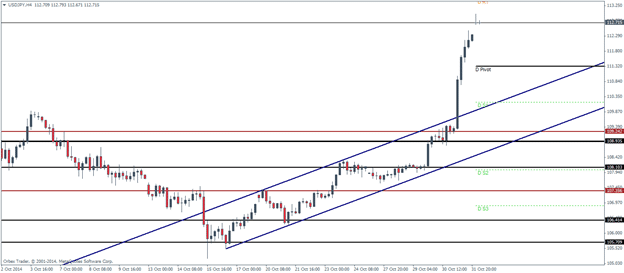

USDJPY Daily Pivots

| R3 | 116.741 |

| R2 | 114.604 |

| R1 | 113.365 |

| Pivot | 111.3 |

| S1 | 110.162 |

| S2 | 108.103 |

| S3 | 106.886 |

USDJPY looks to be retracing some of its past gains with this week opening higher and thus forming an up gap. The previous H4 candle closed to form a doji while the current candlestick also looks to be closing lower. The candlestick patterns are indicative of a corrective move, perhaps towards filling the gap or towards the daily pivot level at 111.314. To the upside, a longer term resistance level at 116.15 will likely to stall any further gains in USDJPY.

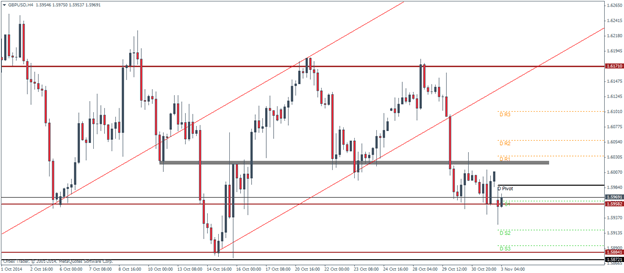

GBPUSD Daily Pivots

| R3 | 1.6101 |

| R2 | 1.6056 |

| R1 | 1.6032 |

| Pivot | 1.5987 |

| S1 | 1.5963 |

| S2 | 1.5918 |

| S3 | 1.5894 |

GBPUSD continues to paint a bit of a confusing picture with the H4 and daily charts still showing the inverted head and shoulders patterns being formed. On the H4 charts, current price action looks to be heading upwards to close in on the down gap formed over the weekend and the daily pivot level of 1.5987. The previously broken support level will have to hold as resistance to cap any upside gains. A break below 1.595 could invalidate GBPUSD’s potential inverted head and shoulders pattern and we could see more declines on this pair. Alternatively, if the resistance at 1.60 handle fails to cap prices, we could see the Cable set itself up for some major gains.