EUR/USD rallied hard following the ECB “sitting on the fence” stance in the rate decision.

Despite this volatility, the team at Bank of America Merrill Lynch sees the pair going down to parity. Here is their reasoning:

Here is their view, courtesy of eFXnews:

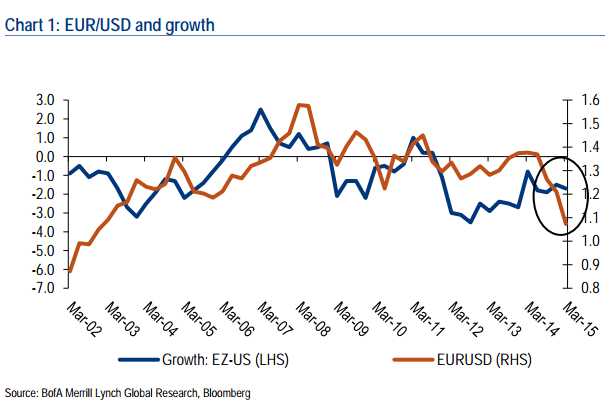

Bank of America Merrill Lynch continues to expect a gradual EUR/USD weakening towards parity by the end of the year.

“Divergence of monetary policies, as the ECB continues with QE and the Fed starts hiking rates (in September according to our call) should help weaken the Euro further in the months ahead. We have also argued the ECB is more likely than not to continue with QE after September 2016, as inflation remains below its target path,” BofA adds.

However, BofA also argues that further EUR/USD weakening will be more gradual and more volatile than what took place up to 1Q.

“The Euro adjustment since May last year started from an overvalued level; the introduction of open-ended ECB QE in particular triggered a sharp correction. Looking ahead, we would expect EUR/USD to move more consistently with data and relative monetary policies, suggesting a more gradual weakening,” BofA clarifies.

“Positive risks to our EUR projections include a Fed rate hike in December or even later, and a comprehensive deal in Greece. Negative risks to our projections include Grexit scenarios and US inflation,” BofA adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.