- The Federal Reserve is set to leave its policy unchanged in its post-election decision.

- Upbeat economic data may outweigh concerns about coronavirus.

- A plea from newly elected lawmakers to act could be seen as a sign of helplessness.

There is life after the elections – and the Federal Reserve’s decision may mark a return to the basics and fundamentals of market moves. The world’s most powerful central releases its rate decision on Thursday, a day after its usual timing and is set to leave its interest rate and bond-buying scheme unchanged.

The Fed refrained from rocking the boat in the pre-election decision and is in no rush to introduce new measures now. It is committed to leaving borrowing costs at low levels through 2022 at a minimum and clarified that negative rates – potentially introduced by the Bank of England – are not on the table.

Will the Fed increase its bond-buying scheme? That option is always open, but imminent action is unlikely.

Upbeat recovery vs. rising covid

Recent economic figures have been mostly upbeat. America’s labor market continues restoring jobs lost at the peak of the pandemic, and Gross Domestic Product bounced by 33.1% annualized. While US output is still below pre-pandemic levels, the comeback has been impressive.

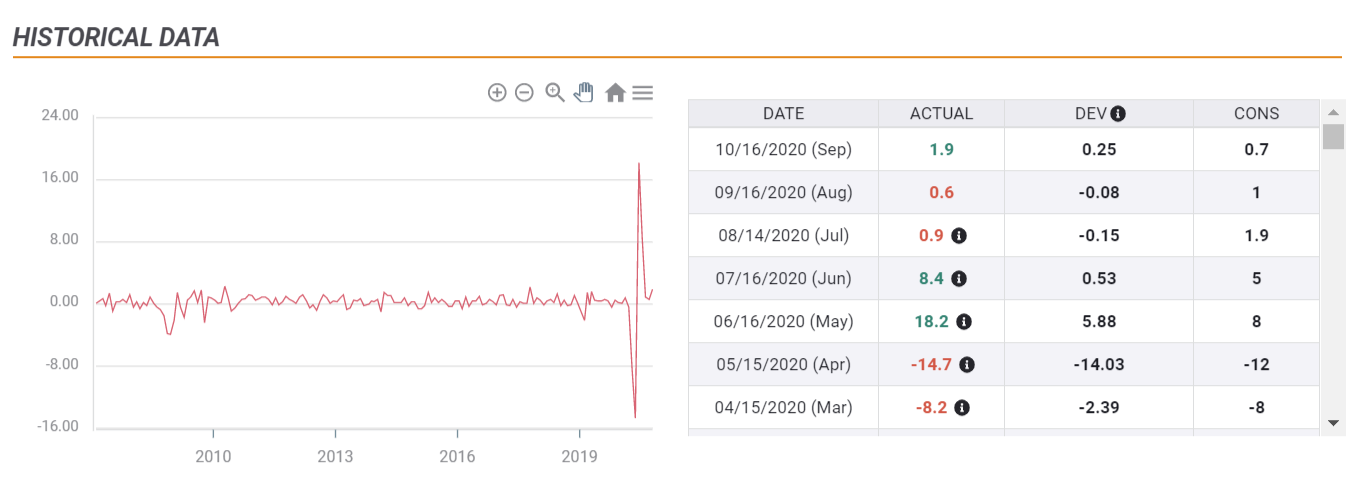

Optimism comes from retail sales, which have staged a V-shaped recovery- partially buoyed by massive fiscal support. The most recent business and consumer surveys are also upbeat:

Source: FXStreet

Jerome Powell, Chairman of the Federal Reserve, has been a vocal supporter of approving additional fiscal stimulus. Officials at the central bank have called on lawmakers to act, albeit to no success. Congress adjourned ahead of the vote without approving a new multi-trillion relief package.

Will Powell push newly-elected officials to act now? On the one hand, recent economic statistics have been encouraging and the Fed would not like to sound anxious. A plea for more stimulus would cause some to think the Fed is out of ammunition and helpless, perhaps triggering a downfall in markets.

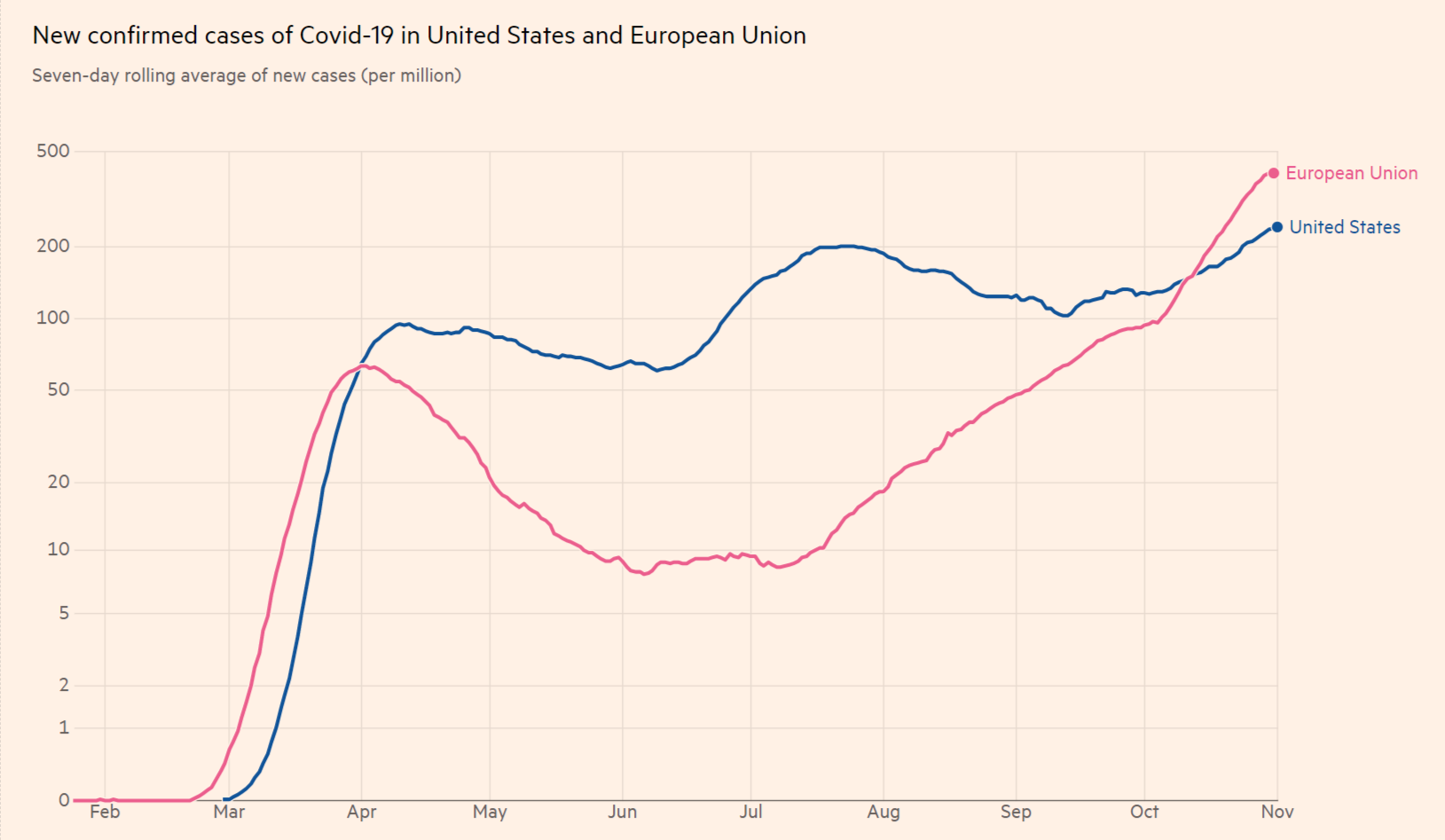

On the other hand, the bank is also watching the increase in COVID-19 cases, hospitalizations, and mortalities – not only in Europe but also in the US. That clouds the economic outlook for the next months.

US covid is on the rise

Source: FT

Glass half-full

The Fed does not release new forecasts in this November meeting, but the statement and Powell’s tone at the press conference could make a difference. The Fed Chair will likely see a glass half full – cautious optimism – that would keep markets happy while stressing that more certainty is needed.

In case Powell paints a gloomy picture, stocks could stumble and the safe-haven dollar would have room to rise. In addition, it could serve as a warning sign ahead of Friday’s Nonfarm Payrolls report due out on Friday. The Fed will probably have the figures ahead of markets, and it would be embarrassing to paint a rosy picture only to see a downbeat report less than 24 hours later.

Conclusion

Overall, the Fed is unlikely to rock the boat in the post-election decision, and opt for a cautiously optimistic tone that would keep markets and the dollar stable. If Powell expresses concerns, it could boost the dollar, sink stocks, and lower expectations for the jobs report – yet the chances are slim.