The Federal Reserve is set to raise rates, in a move which will not be a surprise. But what’s next afterwards? Here is the view from Nomura:

Here is their view, courtesy of eFXnews:

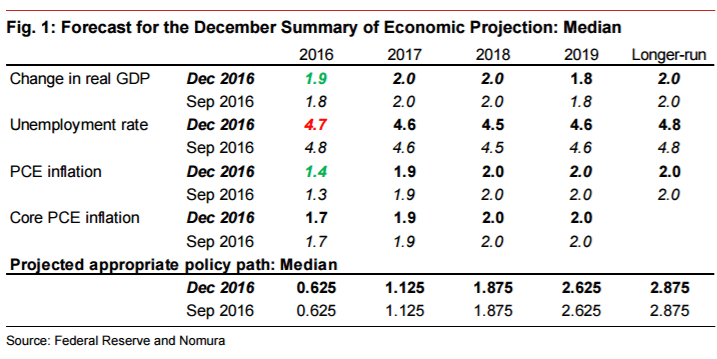

We expect the FOMC to raise its targets for short-term interest rates by 25bp at its meeting this week. Recent public statements by Federal Reserve policymakers suggest that there will be little dissent on this point.

The bigger question is what will the FOMC and Chair Yellen signal about 2017 and beyond? Since the September meeting, three things have happened. First, as noted above, the economy has evolved in a way that is generally consistent with the FOMC’s forecasts. Second, financial conditions have tightened, primarily through increases in long-term interest rates and the appreciation of the dollar. Finally, the US election was held.

The one place where we expect the FOMC to make a change is in its assessment of the balance of risks. For many years, the Federal Reserve and financial market participants have been concerned about how the US economy would respond to negative shocks in part because they assumed that the only substantive policy response would come from monetary policy. In the wake of the election, it seems much more likely that we will get a robust fiscal response to any significant negative shocks to the economy.

This judgment has a number of implications. First, it should probably raise the risk premia in the treasury market, both for nominal and inflation-protected securities. But this should also affect how the FOMC assesses the risks to its outlook. That is, this change in assumptions about the fiscal policy should make the balance of risk more favorable. In their last statement the FOMC noted that “near-term risks to the economic outlook appear roughly balanced.” We expect the FOMC to change this in a way that indicates that the balance of risk has improved.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

FX: USD/JPY En-Route To 120.

If the Fed raises rates this week and carries out two additional rate hikes in 2017, as our economists expect, USD/JPY will likely reach 120 by end-2017.

USD would tend to strengthen more in the latter half of the year, when we would know more about the Trump administration’s fiscal policies. At the same time, there is considerable uncertainty about the US’s economic measures in 2018, and at this point we expect a neutral level of 114 at end-2018.

For USD/JPY to stay above 120, we believe the US economy, which is already entering the last stage of its recovery, has to show a significant rise in productivity.