- Economists expect an improvement in Markit’s preliminary UK PMIs for January.

- The data is critical for the Bank of England’s upcoming decision.

- GBP/USD may react in five different ways in reaction to the data.

To cut or not cut – this is still an open question for the Bank of England after Tuesday’s jobs report beat expectations with 3.2% annual wage growth. Until that moment, all previous indicators fell short of expectations. The disappointing retail sales, inflation, and growth statistics – joined by dovish words from BOE officials – have convinced markets to price in a rate cut on January 30.

Final forward-looking word

After the positive surprise in salary figures, some are casting doubts. So far, the past week’s data referred to 2019 – either November or December. And now, the last word belongs to Markit’s forward-looking gauges for the first month of 2020.

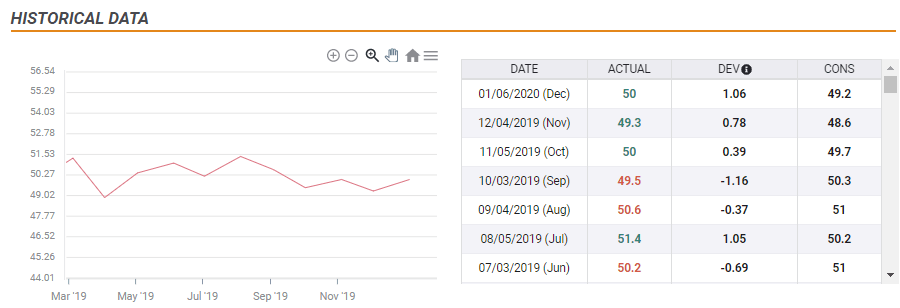

The highly regarded survey for the manufacturing sector is projected to show an increase from 47.5 to 48.9 points – below the 50-point threshold separating expansion from contraction.

The services sector – which is the UK’s largest – carries upbeat expectations for an increase from 50 to 51 points. If realized, it would indicate a return to growth in post-elections Britain.

The publication of two figures at the same time complicates the picture. Moreover, some investors are looking beyond one rate reduction and into the next one. This opens the door to five different scenarios.

1) Both above 50 – GBP/USD shoots higher

In case both the services sector – and surprisingly enough the manufacturing sector – return to growth, GBP/USD has room to rally. In this rosy scenario, the odds of a rate cut in January and perhaps for the next meeting are off. The BOE may signal that it will wait for the next Monetary Policy Report (MPR) in May.

The chances are low as this is well beyond expectations.

2) Beat on manufacturing, but below 50 – GBP/USD rises

If the services sector returns to growth and the manufacturing sector comes close, some investors may have second thoughts about an upcoming cut, but it will probably be underway. Nevertheless, the talk in markets may return to seeing this cut like only a “one and done” – without any additional reductions down the road.

In this case, pound/dollar has room to rise. The chances are medium as this case is not very far from previous figures.

3) As expected – GBP/USD choppy

There is no specific reason to doubt the consensus – no recent figure from January or shocking political statement to change investors’ minds. In this case, sterling may trade choppily but eventually, remain within its familiar trading ranges.

The probability is high.

4) A miss, but services return to growth – GBP/USD slides

Similar to second scenario, in this scenario, the services sector’s score is above 50 and manufacturing below that threshold, but seeing red on economic calendars could send the pound down. It would remove any doubts about the upcoming rate cut, and leave a meaningful chance of seeing another one in the spring.

The probability is medium.

5) A contraction in both – GBP/USD plunges

The worst-case scenario is that both sectors are in contraction territory – a big disappointment for the hopeful services sector.

GBP/USD would plunge in this case, as some market participants would foresee a cut one cut in January another in March.

The chances are low for such a gloomy outcome.

Conclusion

Markit’s PMIs are critical for the BOE’s rate decision coming only six days afterward, as traders are confused after a surprising upbeat wage figure. The publication of two figures at once – with one carrying expectations for growth and another for a downturn – adds complexity to the picture. One thing that has higher probabilities is that the pound is set to rock.