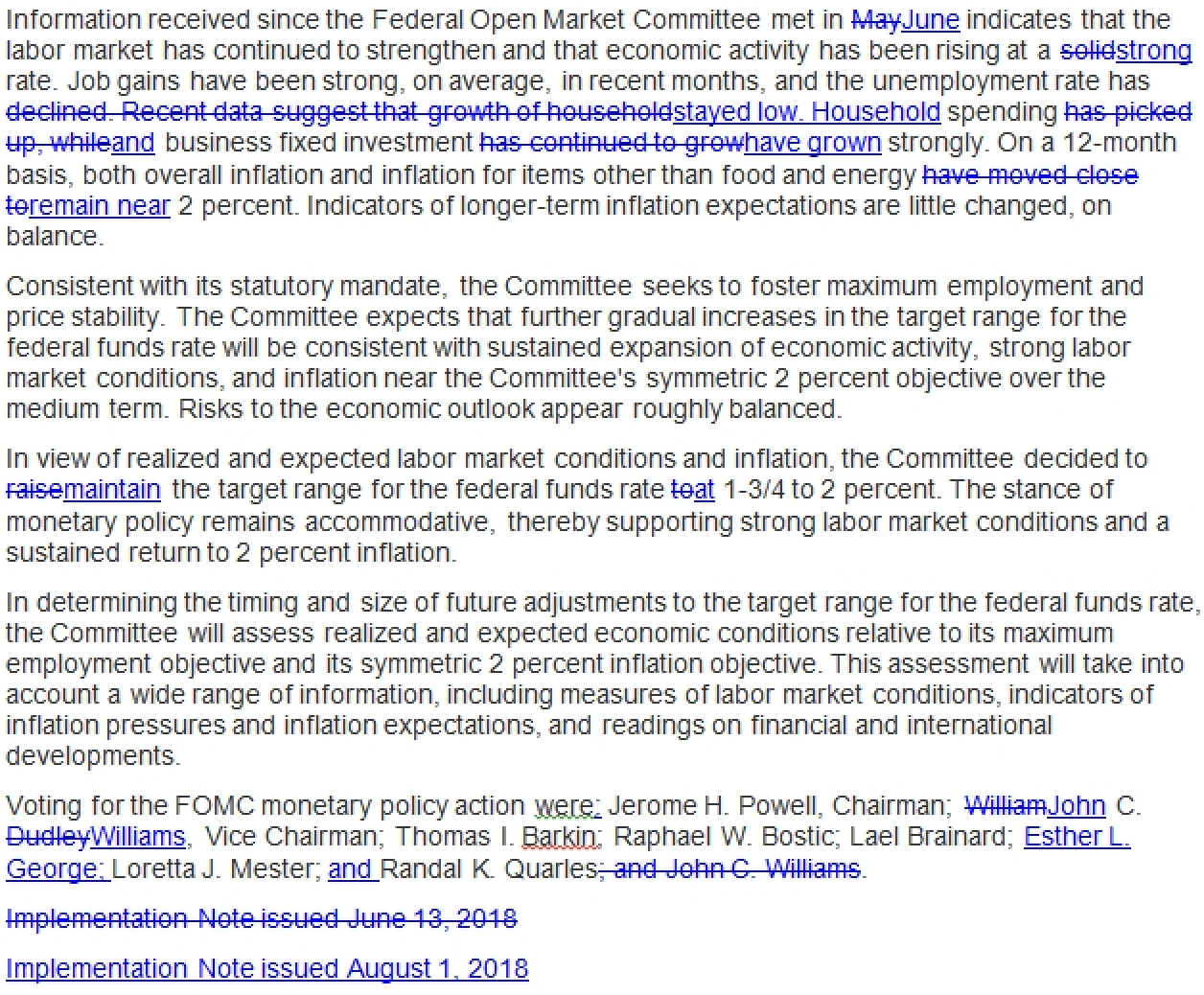

Analysts at TD Securities offered the following which highlights the changes between June 13, 2018 and August 1, 2018 FOMC meetings.

Side-by-side statement changes

Key notes from the statement:

- The unemployment rate has ‘stayed low’ versus ‘declined’.

- 12-month inflation ‘remains near’ 2% versus ‘moved close to’ 2%.

- Monetary policy stance remains accommodative.

- Job gains have been strong in recent months with the unemployment rate staying low.

- No changes in guidance or balance of risks.

- Household spending has ‘grown strongly’ versus spending ‘has picked up’ previously.

- Economic activity has been rising at a ‘strong’ rate versus ‘solid’ rate.

About the FOMC statement regarding monetary policy:

Following the Fed’s rate decision, the FOMC releases its statement regarding monetary policy. The statement may influence the volatility of USD and determine a short-term positive or negative trend. A hawkish view is considered as positive, or bullish for the USD, whereas a dovish view is considered as negative, or bearish.