The November Fed decision is not expected to make huge changes before the elections and as no press conference is scheduled. Here are three opinions:

Here is their view, courtesy of eFXnews:

Nov FOMC: No Surprise; Little Change Only In First Paragraph – Nomura

We expect the FOMC to leave the federal funds rate target range unchanged at 0.25- 0.50% at the conclusion of the 1-2 November FOMC policy meeting. The case and rhetoric for a rate increase this year continues to grow, but given that the election (which will be held the week after the November meeting) has the potential to move markets and the economic outlook, we think the FOMC will wait until the December meeting to raise rates.

We expect the FOMC to reveal little new information after the meeting, as there will be no press conference or update to participants’ economic outlooks (their “dots”).

Instead, there will only be a statement, and we expect that statement to be little changed from September’s. The “economic assessment” section (i.e., the first paragraph) will likely acknowledge that the economy continues to strengthen and that activity has picked up (GDP grew by 2.9% in Q3 vs 1.4% in Q2). Reflecting the details of the GDP numbers, the language for household spending may change from “growing strongly” to “continues to grow.” Also, the statement may nod towards stating that net exports have improved. We see little compelling reason that would force the Fed’s hand to edit its statements on risks: the risk assessment on the outlook doesn’t appear to have changed all that much since the last meeting, which it deemed to be “roughly balanced.”

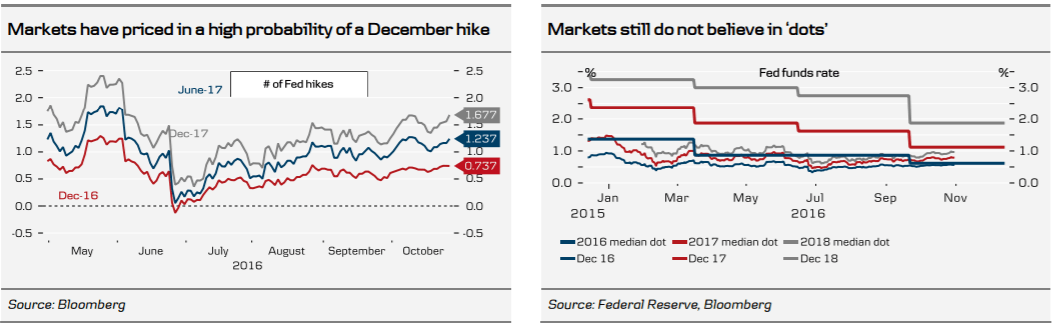

We believe there is a small probability that the Committee could explicitly signal a rate increase for the next meeting like it did last October before raising rates in December 2015. However, we think that it’s unlikely. Given that markets are already pricing in a rate increase for December, we think that the Committee will forgo sending an explicit signal, because the FOMC may not want to set a precedent of constantly telling market participants that it’s likely to raise rates before it does so. Last, the three dissenting voting members (Mester, George, and Rosengren) from the September meeting will again likely vote against the action if the Committee decides to leave rates unchanged.

Beyond the November meeting, we continue to believe that the FOMC is on track to raise rates in December.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

USD Into FOMC: ‘No Tricks, No Treats’; 2 Areas Of Focus – BofA Merrill

The November 2nd FOMC meeting should be considered a placeholder meeting.

If the Fed is successful, the meeting will likely come and go without much action in the markets. We think the Fed’s objective is to signal that a hike is highly likely in December but that the path thereafter will be extraordinarily shallow. The market is pricing in a 72% chance of a December hike, which the Fed is likely to perceive as appropriate. Without a press conference or the release of the Summary of Economic Projections (SEP), the main form of communication is the statement.

There are two areas of focus: 1) statement of risks and 2) forward policy guidance.

We think the Fed will tweak both to show that Fed officials have become incrementally more comfortable with a nearterm hike than they were in the September meeting. One possibility is to change the risks statement to read “near-term risks to the outlook are roughly balanced”, which would be a change from “near-term risks to the outlook appear roughly balanced”. If the Fed wanted to go a step further, they could remove the word “roughly”, but we think they will wait to do so until they actually deliver the hike in December. There are a number of potential changes that the Fed can make to the forward policy guidance statement. One possibility is to add the word “further“ in front of strengthened to read: “the case for an increase in the federal funds rate has further strengthened”. We also suspect that the Fed might want to remove the phrase “for the time being” since they are getting closer to delivering a hike. Importantly, we do not think they will turn to calendar guidance and explicitly mention that a hike is possible at the next meeting. The FOMC took this approach last October to signal a hike in December, but at the time the markets were only pricing in a 36% probability of a December hike. The Fed therefore likely felt it was prudent to take a more aggressive step toward calendar guidance in order to set market expectations. In our view, the Fed does not want to set a precedent of having to enact such strong signaling and will therefore avoid putting such language in the statement.

USD: a million risks but the Fed ain’t one…

A ‘placeholder’ status of the November meeting means it is unlikely to have a lasting impact on the dollar. A more explicit Fed signal of a December hike at the meeting would support but not accelerate the near 3% move in the DXY since the September meeting, in our view. With the market already pricing over a 70% chance of a December hike, we are cautious on chasing the USD move from here.

Additionally, a number of risks between now and the meeting, including the US election, Italian Referendum, and the European Central Bank’s December meeting area also a concern. If anything we see risks of some dollar consolidation near-term.

However, similar to the Fed’s December 2015, we see risks skewed towards further USD strength in the aftermath of a December hike with the market pricing less than one additional hike by end 2017, too low relative to our expectation for June and December hikes. Furthermore, if the new administration pursues a more aggressive fiscal expansion, this would certainly tilt the balance of risks to more hikes, supporting the USD.

Nov FOMC: On Hold; Too Early To Say A December Hike Is A Done Deal – Danske

The FOMC meeting concludes on Wednesday. We expect it to maintain the target range at 0.25-0.50%, in line with consensus, due to the presidential election next week.

It is one of the small meetings without a press conference or updated ‘dots’, therefore, the most interesting part is the FOMC statement. The Fed more and less pre-announced the December 2015 hike at the October meeting but, , this time, unlike last year, the markets have now more or less priced in a Fed hike by year-end as much as possible given that there are still one and a half months before the December meeting. Hence, we do not expect any major changes to the FOMC statement at this meeting, as it was already quite hawkish last time, as it stated that the case for a rate hike had ‘strengthened’. It may say that economic data have supported its view that growth has picked up pace.

We have, for some time, had this non-consensual view that the Fed will not raise the Fed funds target range this year. While this call has come under pressure given the better US economic data, we still think it is too early to say a December hike is done deal although admittedly the probability has increased significantly.

We still have some important data releases left (not least two jobs report) before the Fed has to make up its mind so we intend to continue monitoring incoming data, as there are still valid arguments for not hiking this year at all. The FOMC members were very divided at the latest FOMC meeting back in September as three voted for an immediate hike while three members indicated that Fed should not hike at all.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.