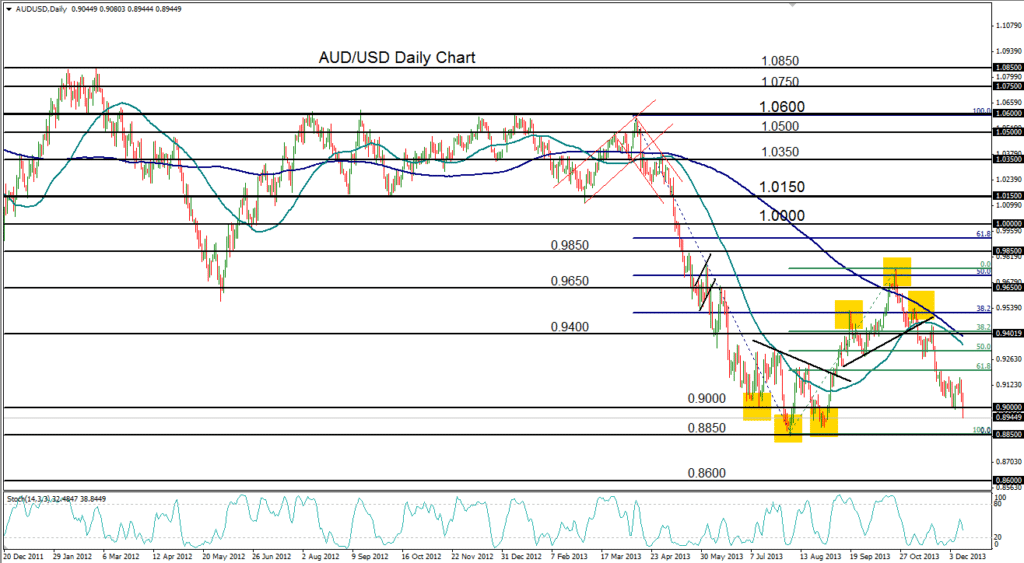

December 12, 2013 – AUD/USD (daily chart) has broken down below key support at 0.9000, establishing more than a three-month low for the pair. This occurs within a sharp bearish trend that has been in place for the past seven weeks since the head-and-shoulders pattern high of 0.9756 that was hit in late October. That high was a 50% retracement of the steep plunge from April to August. Just last week the pair declined to the major 0.9000 support level, but respected it with a slight rebound.

The current breakdown below 0.9000 extends the bearish trend with a clear target immediately to the downside at 0.8850, which was nearly a three-year low that was established in early August. A further breakdown below 0.8850 would confirm a continuation of the overall bearish trend from April, with a further downside objective around the 0.8600 support level. If there is a daily close below 0.9000, upside resistance within the current bearish run would tentatively reside around that 0.9000 former support level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.