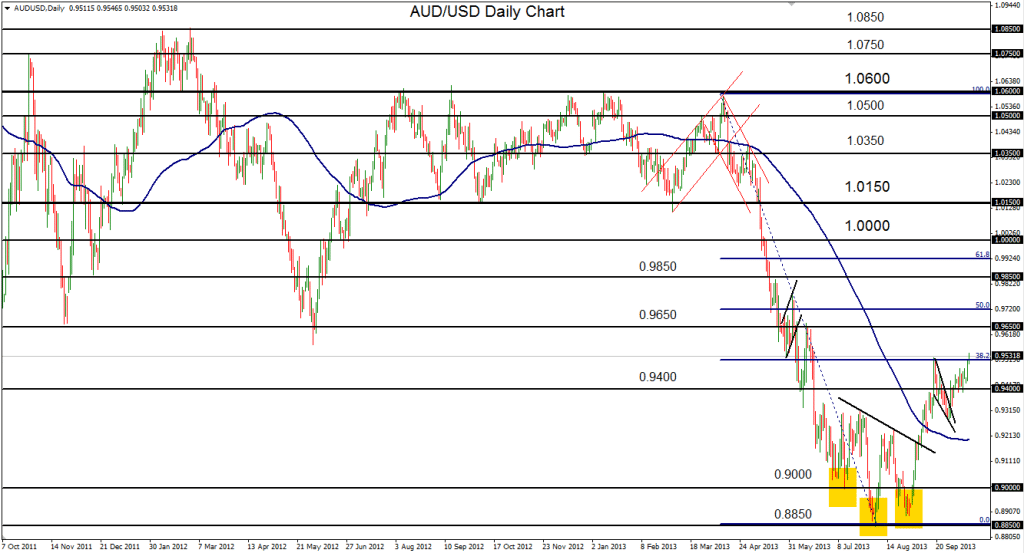

October 15, 2013 – AUD/USD (daily chart) exceeded its September 0.9527 high in early Tuesday trading, establishing almost a four-month high in the process. This new high has also slightly breached the 38.2% Fibonacci retracement level of the long plunge from the April high near 1.0600 down to the August low around 0.8850. Current price action extends the bullish reversal that was initiated with a head and shoulders pattern in July and August, whose neckline was broken to the upside in early September.

The reversal was advanced further after the pair pulled back in a falling wedge pattern and then broke to the upside above the pattern. The first target on that breakout was the noted September 0.9527 high, which has just been reached and tentatively breached. The next major upside target resides around the key 0.9650 resistance level, which is also in the general vicinity of the head and shoulders price target, followed by the 0.9850 resistance level. Major downside support currently resides around the 0.9400 level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.