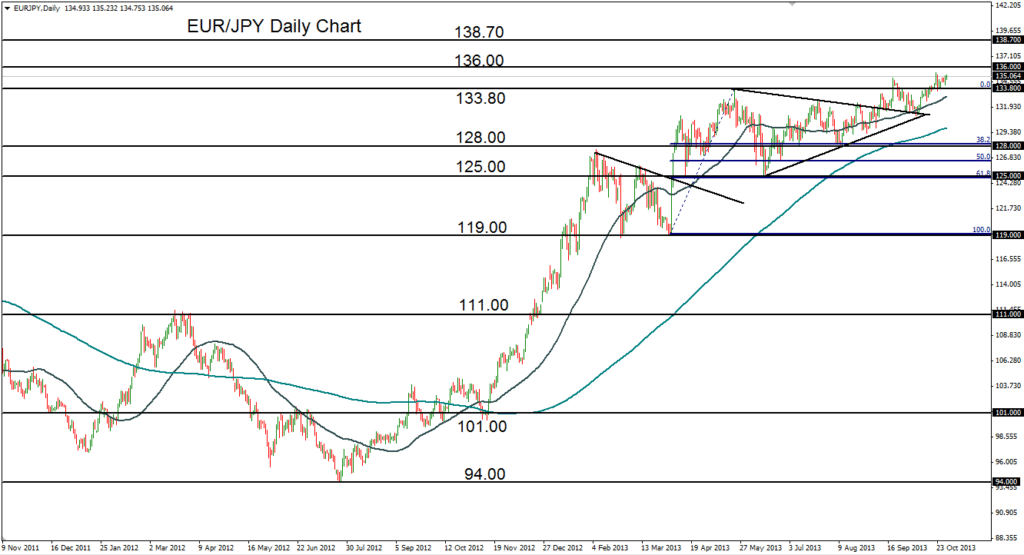

October 30, 2013 – EUR/JPY (daily chart) has re-approached its long-term high of 135.50 that was established just last week. This represented close to a 4-year high, as the last time these heights were reached was in November 2009. The past four months have seen the currency pair drift steadily upwards as the euro has maintained marked strength against the dollar while the yen has been entrenched in a prolonged sideways trading range against the dollar. From a broader perspective, EUR/JPY has been in a sustained uptrend for over 15 months since the July 2012 low around 94.00. For the past year, the pair has stayed well above its 200-day moving average, and has recently bounced and risen well above its 50-day moving average as well. Currently, the pair is on target to reach towards its continued long-term price objective around the 138.70-139.00 price zone, while downside support now tentatively resides around the 133.50-133.80 area.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.