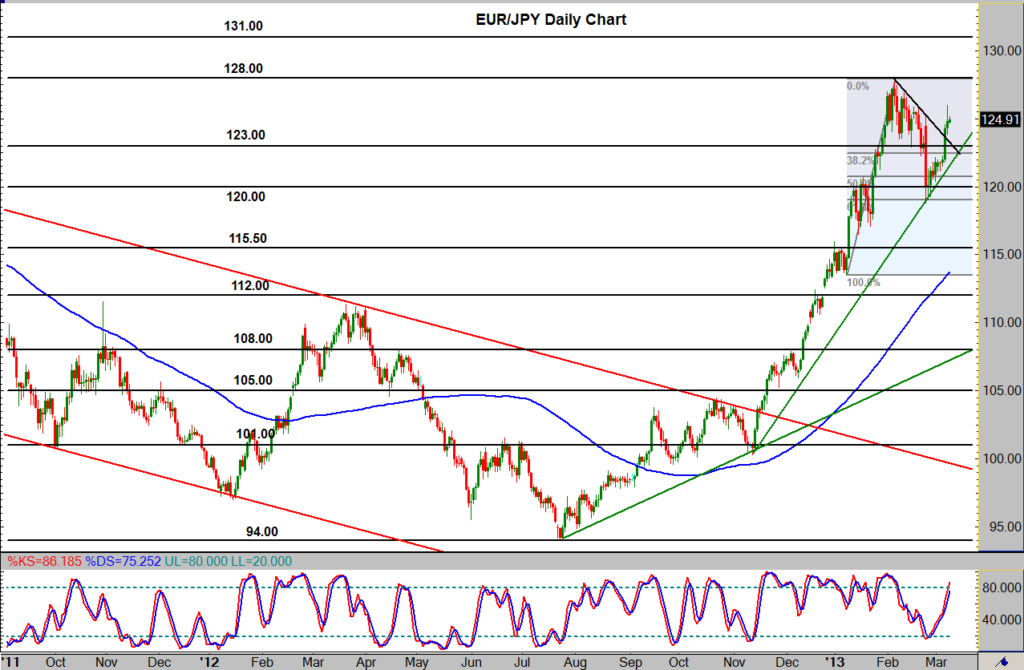

EUR/JPY (daily chart) as of March 11, 2013 has resumed its bullish rebound towards 128.00 after having recovered from a significant downside correction just a few weeks ago that broke below major support areas, including both the 123.00 and 120.00 levels. The pullback brought price down to a 118.73 low, which was around an important 61.8% Fibonacci retracement level, before initiating the rebound in late February. Since then, the pair has re-captured the 120.00 and 123.00 levels in a 2-week rally that has now brought price back up to around the 125.00 level.

With continued bullishness on this rebound, EUR/JPY may be poised to target 128.00 yet again, a major resistance level that it narrowly fell short of when it established a 34-month high at 127.69 in the beginning of February. To the downside, strong support has been re-established around 123.00 within the context of the strong uptrend. In the event of a breakout above 128.00, a bullish trend continuation would be confirmed with a further upside target around the key 131.00 area.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.