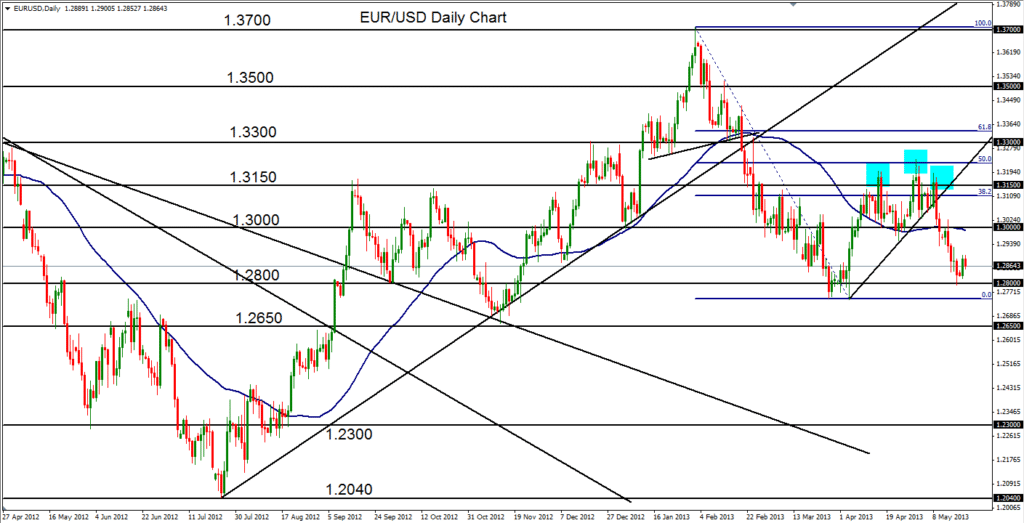

May 21, 2013 – EUR/USD (daily chart) has continued to lean towards a resumption of the entrenched bearish trend, even after having hit and respected major support around 1.2800 late last week. The breakdown below the 1.3000 area about a week-and-a-half ago was pivotal in setting the stage for a resumption of the current downtrend. That 1.3000 level is not only a major round number and important support/resistance level in its own right, but it was also where the 50-day moving average was positioned, as well as the approximate area of a key head-and-shoulders pattern neckline (with its shooting star head right around the 50% Fibonacci retracement of the prior plunge in price).

Currently, the major price event to watch for from a trend continuation perspective would be a breakdown below the 1.2800 level and then a further break below the late March and early April lows right around 1.2750. In that event, the bearish trend should target further downside support objectives around 1.2650, 1.2450, and then 1.2300.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.