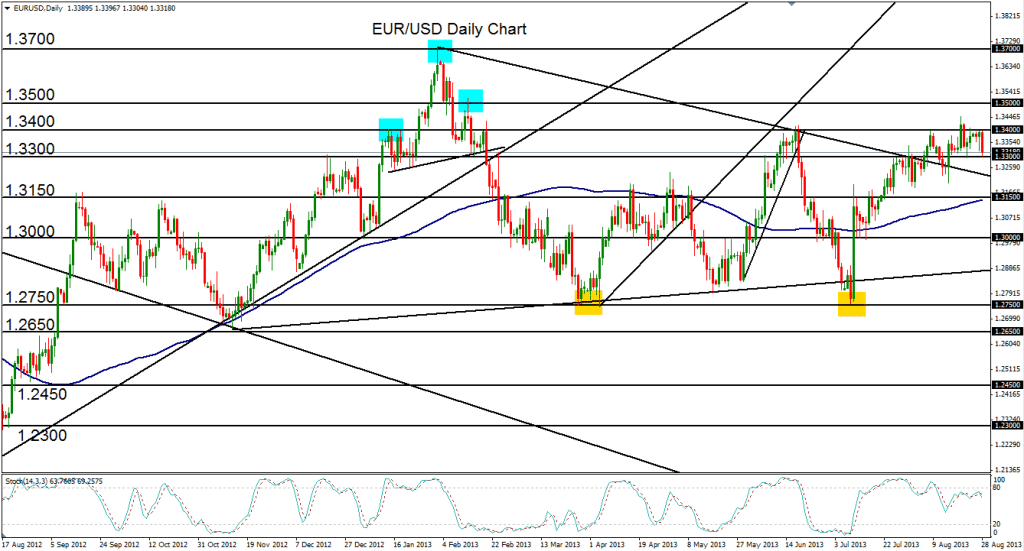

August 28, 2013 – EUR/USD (daily chart) has once again retreated from key resistance around the 1.3400 level after having made a temporary breach above that level last week. The 1.3400 price region has served as key historical resistance, most recently in June when the pair pivoted down from that area, reversing a steep bullish leg. The noted temporary breach last week reached a high of 1.3450 before promptly retreating. Since then, the pair has consistently bumped up against 1.3400, unable to make any further significant breaches. Today’s price action has seen a swift retreat, moving back down to hit a low around 1.3300 support. A breakdown below this 1.3300 level would give further indication of a potential price turn to the downside, thereby continuing the trading range that the pair has been mired in for the past several months. Another breakout above 1.3400 should meet strong and immediate resistance around the key 1.3500 level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.