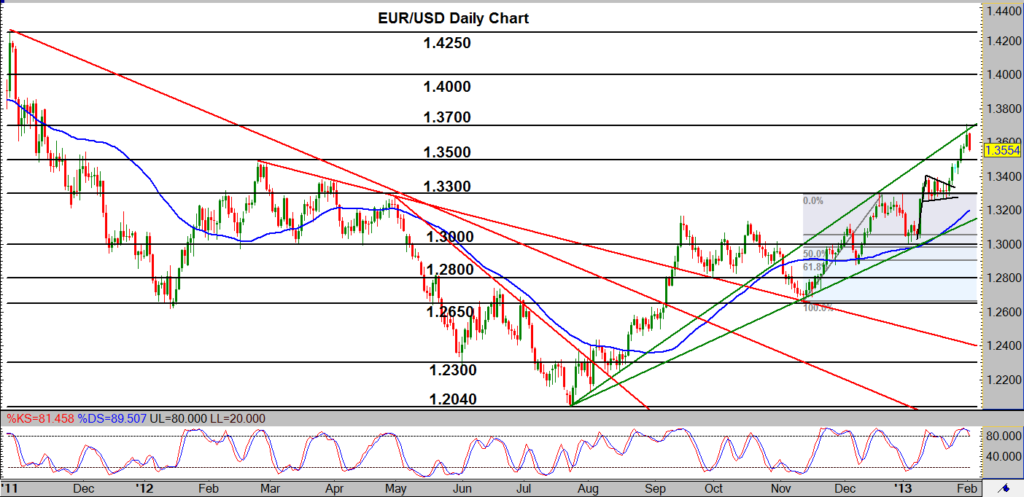

EUR/USD (daily chart) as of February 4, 2013 has retreated after having reached and slightly surpassed its 1.3700 price objective late last week, when it established a new 14-month high for the pair. This occurs within a strong bullish trend that has been in place for the past six months. The 1.3700 target area where price just pulled back represents a strong confluence of resistance, as it is not only a key historical support/resistance level, but it also resides around the underside of a major trend line extending back to the July 2012 1.2041 low. Despite the current retreat and pullback from 1.3700, the trend bias for EUR/USD continues to be strongly to the upside. Strong support to the downside on the current pullback can be found around the major 1.3500 level, and then the 1.3400 area, which represents the top point of the pennant pattern that was broken to the upside more than a week ago. The key upside level to watch for a bullish trend continuation remains at the 1.3700 level. A breakout above that level, which would confirm a continuation of the current uptrend, could move towards the major 1.4000 resistance level as its primary price objective.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.