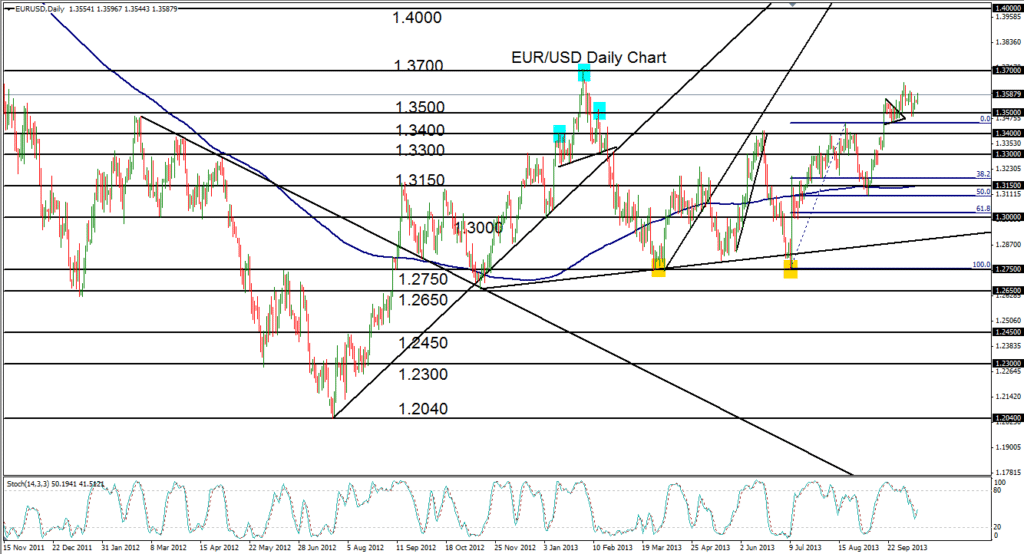

October 14, 2013 – EUR/USD (daily chart) has been entrenched in a slightly bullish consolidation for the past three weeks, unable as of yet to reach its upside price target at 1.3700. This consolidation has recently established the 1.3500 area as a key support region, and the pair used this level to initiate another attempt to advance during the latter part of last week. Early October saw a high of 1.3645, which was an eight-month high for the pair, before price pulled back slightly below the 1.3500 support area.

With the U.S. debt ceiling timeline quickly approaching without any concrete deal in place, the euro strengthened further against the dollar on Monday. With downside support currently still in place around the 1.3500 price region, the major upside objective continues to reside at 1.3700, last reached back in February. Subsequently, any strong breakout above 1.3700 should begin to target the key 1.4000 psychological level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.