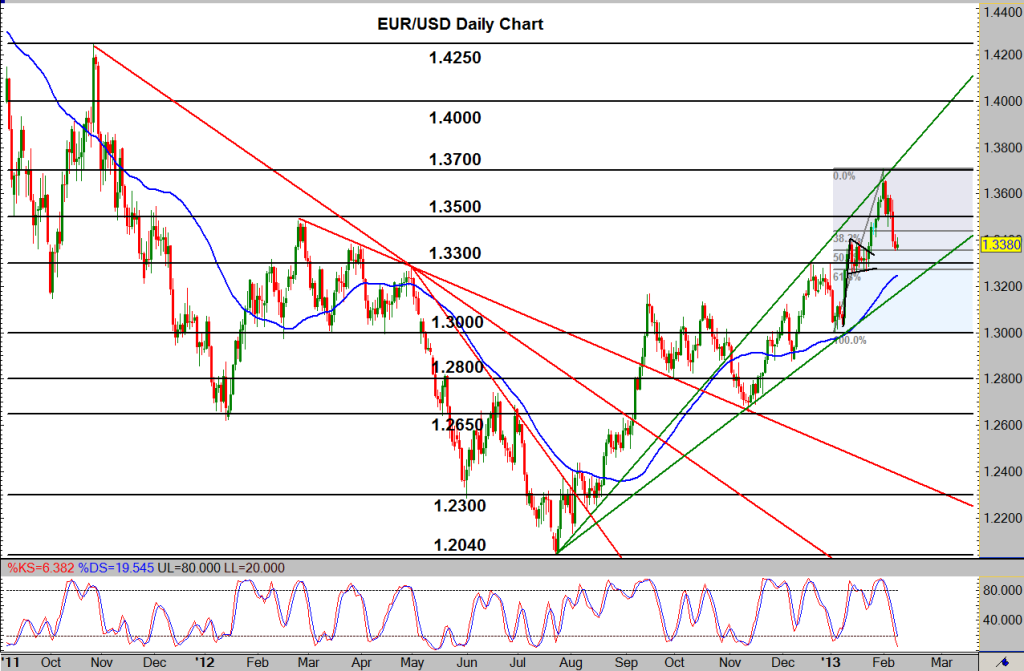

EUR/USD (daily chart) as of February 11, 2013 has tentatively stalled in its bearish correction of the last week. This correction brought price down substantially from its 14-month high slightly above strong 1.3700 resistance in the beginning of the month. Although this correction has been significant, it only represents approximately a 50% Fibonacci retracement of the last major bullish run (between 1.3000 in the beginning of January to 1.3700 in the beginning of February), thus far.

As price currently stands, fluctuating below 1.3400, EUR/USD is still well within the confines of a strong bullish trend that extends back to the 1.2040 area low in July of 2012. In the event of further weakening within the current bearish correction, key near-term support resides around the 1.3300 price region. A bounce at or above this area could once again prompt a trend move back up towards 1.3500 and then 1.3700. To the upside, a breakout above 1.3700 would be the key event to watch for, as it would signify and confirm a continuation of the entrenched bullish trend.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.