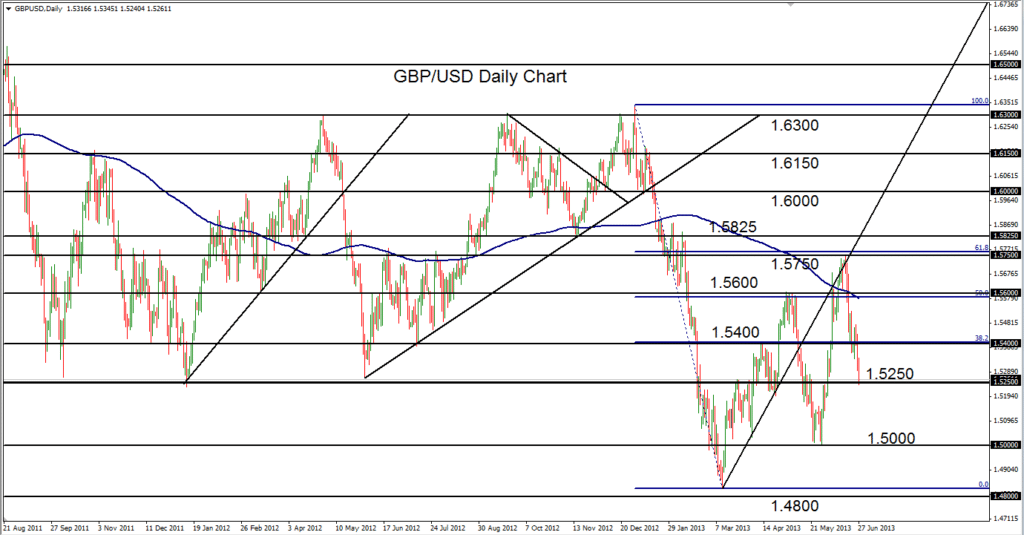

June 27, 2013 – GBP/USD (daily chart) has extended its steep plunge of the last week-and-a-half to drop tentatively below major historical support around the 1.5250 price region. Within the past few years this level has served as a pivotal support point (October 2011, January 2012, and June 2012), and more recently as a key resistance level. The fact that price has just dropped below this important level is a substantial bearish indication for the currency pair that hints at further downside momentum to come. The next major bearish objective resides around the 1.5000 figure, last hit in late May, and then a potential retest of the March 1.4830 low. Any further breakdown below that long-term low would confirm a continuation of the bearish trend extending back to the very beginning of the year, of which the most recent bullish correction retraced a rather precise 61.8%.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.