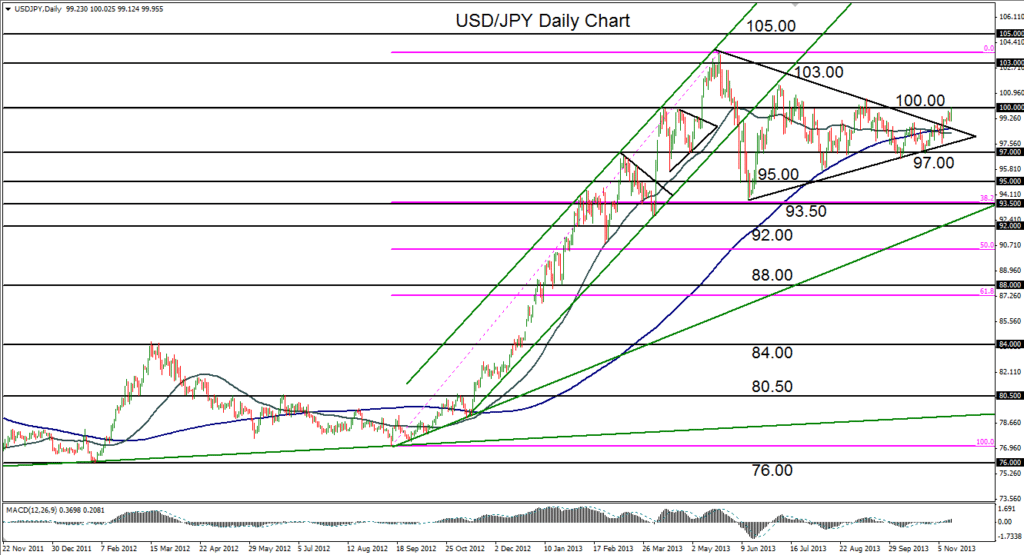

November 14, 2013 – USD/JPY (daily chart) has advanced to hit its key 100.00-level resistance target in early trading Thursday, establishing a two-month high for the pair. This occurs within a trading range consolidation that extends back to the multi-year high of 103.72 that was reached in May. Since that high, the pair has formed a large triangle pattern with diminishing volatility, as was reinforced by the convergence of the 50-day and 200-day moving averages.

Price action broke out of that triangle just one week ago, with its primary near-term objective at the 100.00 psychological level. Having just reached 100.00, the pair is at a critical juncture. If it is able to make a strong upside breach, bullish momentum could push the pair back up towards its long-term highs around the 103.00 level. A turn back down from 100.00 would likely prolong the current trading range environment, with key support once again around the 97.00 price region.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.