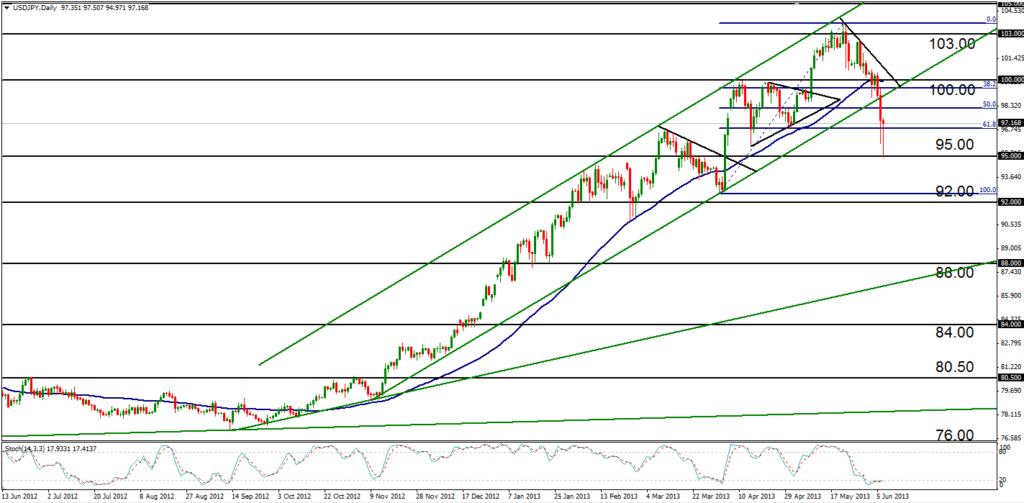

June 7, 2013 – USD/JPY (daily chart) extended its decline substantially down to key support around the 95.00 level on Friday, before rebounding and recovering that loss intra-day. The current bearish correction from the long-term high of 103.72 in late May down to Friday’s 95.00-area low can be considered the decline of the greatest magnitude since the steep bullish trend began in October of last year. In the process, price has broken down cleanly below a parallel uptrend channel extending back to November of 2012 and has just established a new two-month low.

Because Friday’s intra-day recovery has been substantial, USD/JPY could be moving in the direction of a broader recovery back up towards 100.00 and then 103.00. This view would be strengthened on a strong push above 98.00. To the downside, the key level to watch has been established at 95.00 support, a breakdown below which could signal a significantly larger correction targeting potential downside around 92.00 and then 90.00.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.