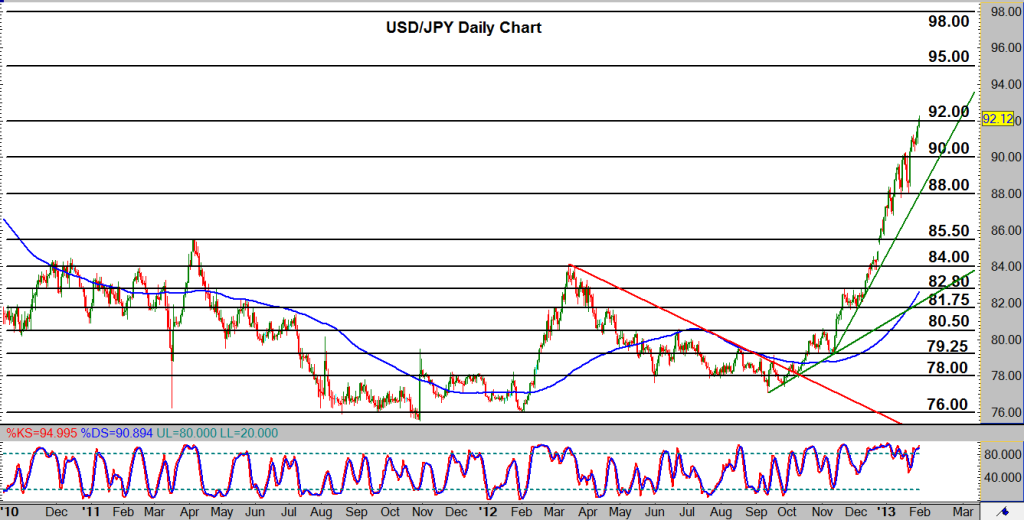

USD/JPY (daily chart) as of February 1, 2013 has reached and slightly surpassed its key 92.00 price objective, establishing yet a new 32-month high in the process. This long-term high is a culmination of more than three months of dramatic bullishness with no major bearish corrections as of yet, and only a few minor pullbacks. The most notable pullback thus far has been back down to the major 88.00 support level last week. But that pullback has since recovered to hit further upside targets at 90.00 and now, 92.00. Considering the sheer steepness and extension of the current bullish trend, another significant pullback may be impending, with key downside support on a pullback residing around the 90.00 level. But the overall trend remains strongly to the upside. With continued bullish momentum above 92.00, subsequent pullbacks notwithstanding, further technical price objectives to the upside are located around the major 95.00 and 98.00 levels.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.