GO Markets UK Review 2024

GO Markets is a global CFD broker that offers trading on more than 1,000 assets, including forex, stocks, indices, treasuries and commodities. The broker gives traders access to MetaTrader 4 and 5 along with a raft of automated analysis tools and forex signals.

So, is GO Markets the best place to trade forex and more in the UK? In our GO Markets UK review, we’ll help traders decide if this CFD broker is right for them.

GO Markets Pros & Cons

- Trade 50+ forex pairs and share CFDs from around the globe

- 2 account types, including a commission-free account

- Trade with MetaTrader 4 or 5

- Includes forex signals and automated technical analysis

- Leverage up to 500:1 available

- 24/5 phone and email support

Cons

- Does not offer cryptocurrency trading due to regulations

- Regulated by second-tier financial authorities

64% of retail investor accounts lose money when trading CFDs with this provider.

Assets to Trade at GO Markets UK

GO Markets offers trading on more than 1,000 contracts for difference (CFDs). This brokerage does not offer the ability to buy or sell any assets directly.

Forex

GO Markets UK offers trading on 50+ major and minor forex pairs. Traders can apply leverage up to 500:1 for major forex pairs and trade with spreads starting from 0.0 pips.

Commodities

GO Markets offers trading on major commodities, including spot CFDs for gold, silver, WTI crude oil, and Brent crude oil. Gold can be traded with leverage up to 500:1.

Futures CFDs are available for US and UK oil prices, soybean prices, and wheat prices.

Stock Indices

Traders can go long or short on 12 global stock indices, including the US’s S&P 500 and NASDAQ 100, the UK’s FTSE 100, and Europe’s STOXX 50. Traders can also trade futures CFDs for the China 50 index, the US Dollar index and the Volatility Index.

Index trading offers leverage up to 100:1.

Stocks

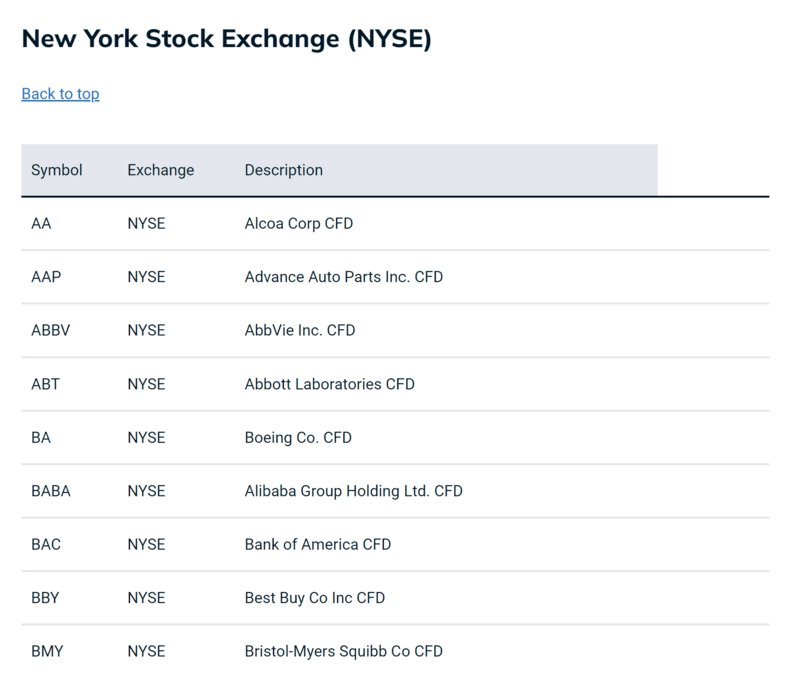

GO Markets UK offers CFD trading on more than 1,000 individual stocks from major exchanges like the New York Stock Exchange (NYSE), NASDAQ, London Stock Exchange (LSE), Frankfurt Stock Exchange (DAX), Australian Stock Exchange (ASX), and Hong Kong Stock Exchange (HKEX). Traders can go long or short on all of the largest US, UK, and European companies as well as major Chinese companies. Stock CFD trading offers leverage up to 20:1

Treasuries

GO Markets enables traders to speculate on future interest rates through treasury CFDs. Available treasury CFDs cover 5-year and 10-year US treasury note futures, Eurozone BUND futures, UK Gilt futures, and Japanese government bond futures.

Treasury futures CFDs can be traded with leverage up to 200:1.

64% of retail investor accounts lose money when trading CFDs with this provider.

GO Markets UK Pricing

GO Markets offers competitive trading fees and nearly no account fees, making it a potentially attractive broker for traders who want to minimize costs.

GO Market Trading Fees

GO Market’s trading fees depend on which type of account traders choose.

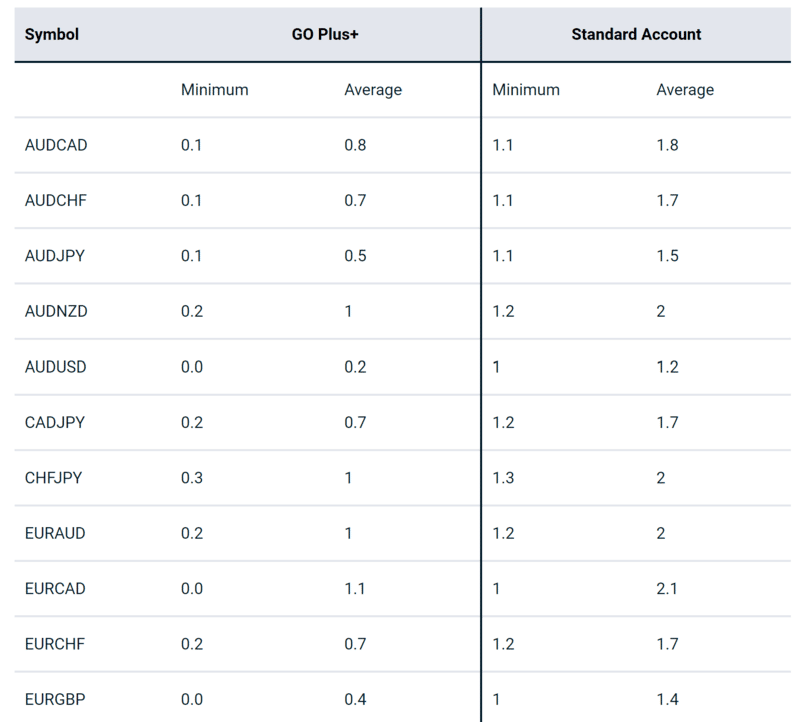

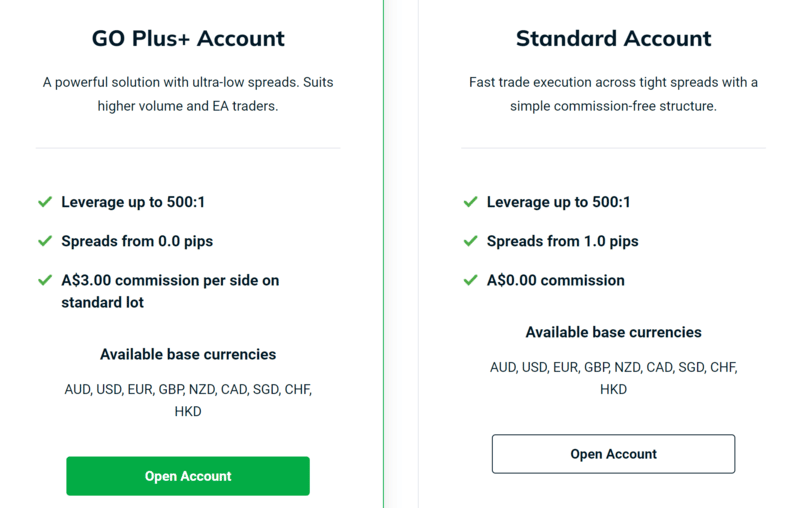

The Standard account offers commission-free trading with forex spreads starting from 1.0 pips. The average EUR/USD spread is 1.2 pips.

The GO Plus+ account charges a flat commission of £3 per lot per side. Spreads start from 0.0 pips, with an average EUR/USD spread of 0.1 pips.

| Standard | GO Plus+ |

| Spread: From 1.0 pips

Commission: None |

Spread: From 0.0 pips

Commission: £2 per lot per side |

Share CFD trading has its own pricing structure, which is the same across Standard and GO Plus+ accounts. Unlike many competitors, there is no minimum commission charge and only Hong Kong shares are around HK$50, depending on the account currency.

There are also data fees for trading Australian or Hong Kong-listed shares. ASX data costs A$22 per month and HKEX data costs HK$120 per month. These data fees are refunded for traders who place at least 4 monthly trades on ASX or HKEX-listed shares.

GO Market Account Fees

GO Market charges no account fees. Traders will not pay to open an account or keep their account open, and there is no inactivity fee. All deposits and withdrawals are also free at GO Markets.

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

64% of retail investor accounts lose money when trading CFDs with this provider.

GO Markets Trading Platforms

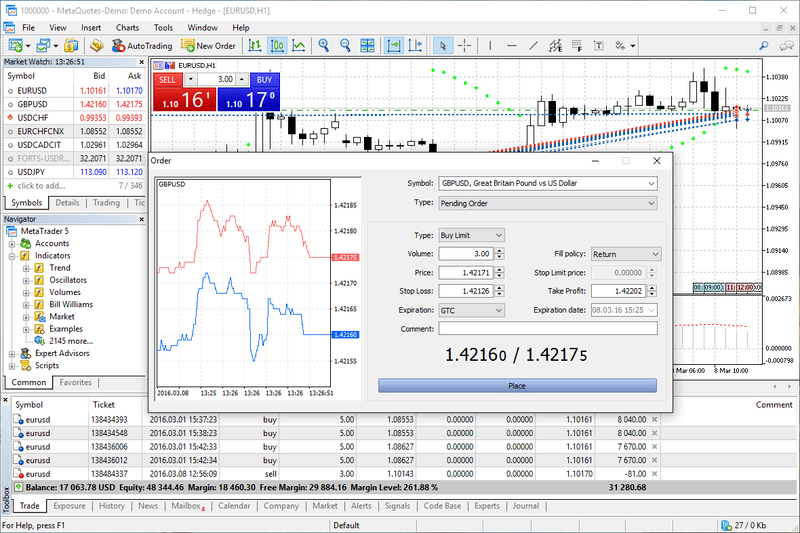

GO Markets UK does not offer its own trading platform, like many other CFD brokers do. Instead, it gives traders access to MetaTrader 4 and MetaTrader 5.

These two trading platforms are extremely popular and are widely considered to be among the best platforms for forex day trading. Both MetaTrader 4 and 5 are available for desktop, web, and mobile.

One thing to note is that MetaTrader 4 does not support individual stock CFD trading. Traders who want to trade share CFDs at GO Markets must use MetaTrader 5. This isn’t a major issue for most traders since the platforms are highly similar.

Is GO Markets User-friendly?

One of the drawbacks to only offering MetaTrader 4 and 5 for traders is that these platforms aren’t especially user-friendly. They have steep learning curves. Both platforms offer a lot of tools, integrations, and add-ons, and it takes a while even for experienced traders to figure out the best way to approach MT4 and MT5.

That said, GO Markets itself isn’t hard to navigate. The broker’s account options are straightforward and the broker is upfront about its pricing. It only takes a few minutes to create a new account and deposits and withdrawals are pretty seamless.

GO Markets Charting and Analysis

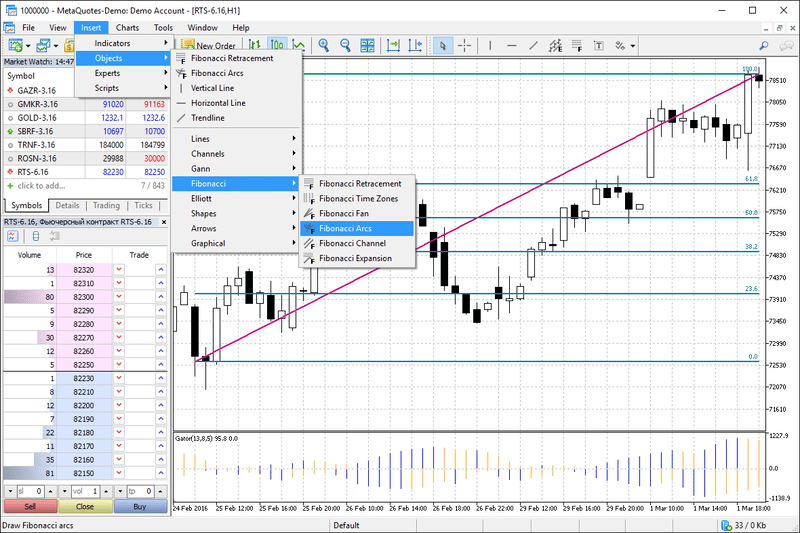

MetaTrader 4 and 5 are jam-packed with charting and analysis tools. These are very advanced trading platforms and traders will find that there is very little they cannot do. We’ll cover some of the highlights of MetaTrader 4 and 5.

To start, both platforms come with dozens of built-in technical indicators and drawing tools. They support advanced pattern analyses like Fibonacci and Gann analyses. Traders can also code their own custom technical indicators or import technical indicators created by others.

MetaTrader 4 and 5 offer one-click trading from charts as well as advanced order entry panels for tight risk management. Traders can use stop losses and take profit orders as well as more complex order types like fill or kill, one cancels the other, and more.

MetaTrader 4 and 5 also support automated forex trading using forex robots. Traders can build their own algorithmic trading strategies or use robots developed by professional traders.

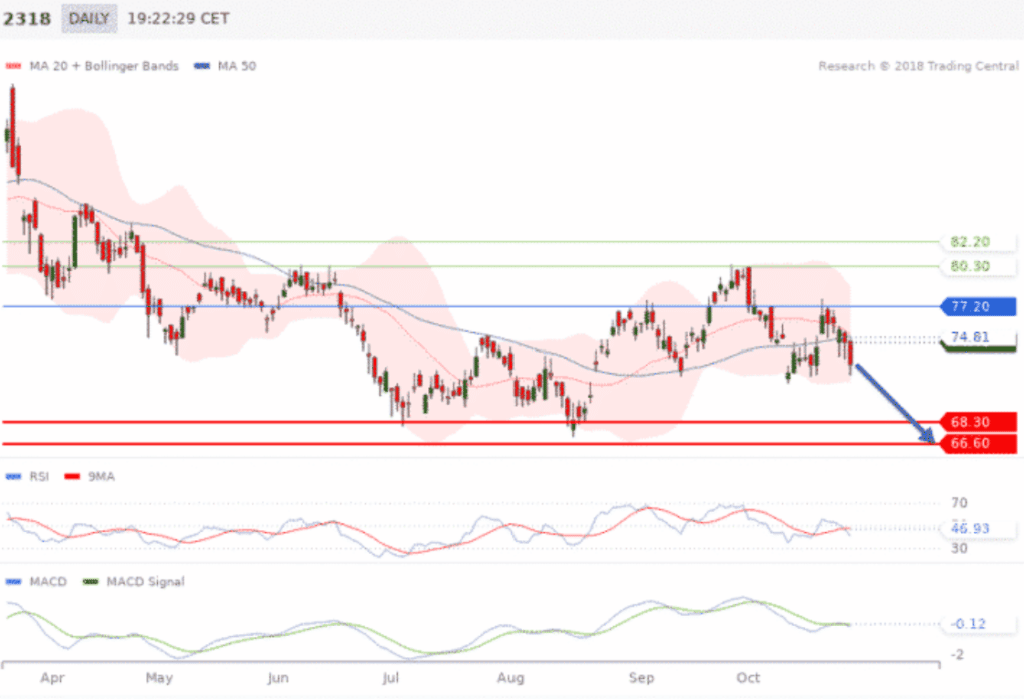

Notably, GO Markets UK includes a variety of additional forex tools for traders. One of these is Autochartist, an automated technical analysis software that can annotate charts in MT4 and MT5. Autochartist detects support and resistance areas, trendlines, and common candlestick patterns.

Another useful tool from GO Markets is a-Quant, a forex signals service that delivers 9-12 trading signals per day. a-Quant uses a proprietary, backtested strategy to identify potentially profitable trades and can be used to generate day trading ideas.

Traders also get access to Myfxbook, a trading journal and performance monitoring software designed specifically for CFD traders.

Finally, GO Markets offers a virtual private server (VPS) for traders who want to run algorithmic trading strategies at high speeds.

GO Markets UK Accounts

GO Markets offers traders a choice between 2 account types: Standard and GO Plus+.

The main difference between these accounts is in how CFD trades are priced. They both require a minimum $200 deposit and neither requires an account fee.

The Standard account is a commission-free account that charges a spread on each trade. Spreads start at 1.0 pips.

The GO Plus+ account is a commission account with reduced spreads. The commission is £2 per lot per side and spreads start at 0.0 pips.

GO Markets also offers a free demo account that traders can use to test out the brokerage and its trading platforms.

GO Markets Mobile Apps

GO Markets does not offer its own mobile app, but MetaTrader 4 and MetaTrader 5 each have mobile apps.

The MT4 and MT5 apps offer all of the same features that you can get on the web or desktop versions of these platforms. They offer advanced charts, the ability to implement automated trading strategies, and plenty of order management tools. Importantly, the mobile apps also enable traders to set up price alerts and indicator-based alerts.

The sheer number of tools in these apps makes them somewhat complex to use compared to other forex trading apps. However, traders won’t find themselves scrambling for a laptop when it’s time to make a trade.

64% of retail investor accounts lose money when trading CFDs with this provider.

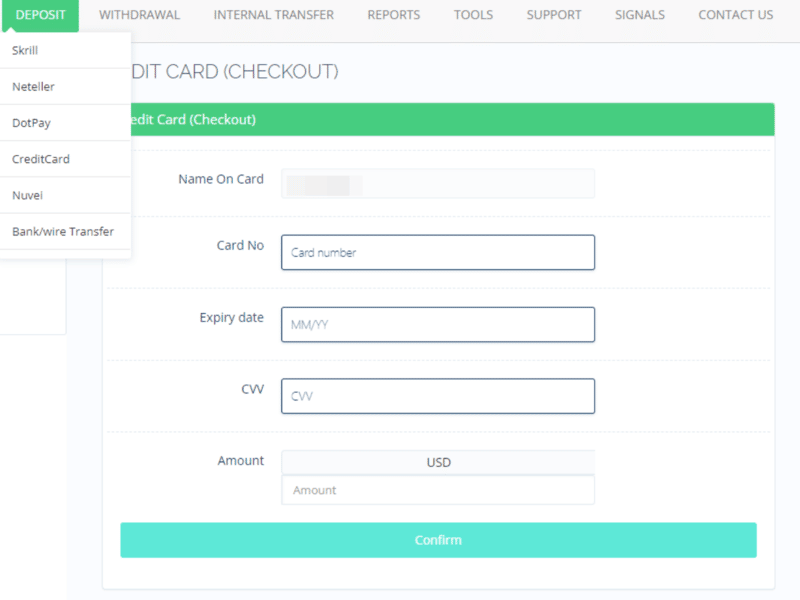

GO Markets UK Deposits and Withdrawals

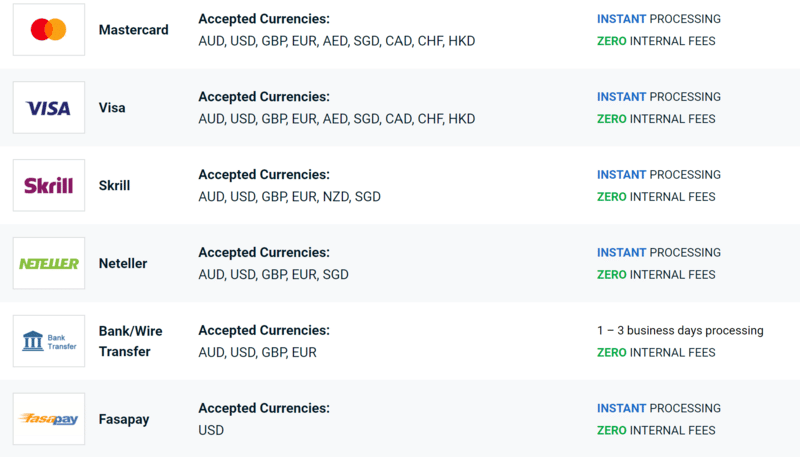

GO Markets offers completely free deposits and withdrawals. Available payment methods include:

- Visa

- Mastercard

- Bank transfer

- Wire transfer

- Neteller

- Skrill

- Fasapay

All deposits except for bank and wire transfers are available instantly for trading. Bank and wire transfers take 1-3 days for funds to reach a trader’s account.

The brokerage accepts numerous base currencies including USD, GBP, EUR, AUD, AED, SGD, CAD, CHF, and HKD.

GO Markets Minimum Deposit

The minimum deposit to open a new account at GO Markets UK is $200.

GO Markets Withdrawals

Withdrawals from GO Markets are free and are typically processed in 1-2 business days. The time it takes for funds to reach a trader’s account after processing depends on the withdrawal method, but is usually 1-3 days.

GO Markets Bonus & Promos

GO Markets is currently offering a welcome bonus for new traders. For every $200 a trader deposits into their account, they can receive $40 in bonus cash.

To claim the bonus cash, traders must trade 1 lot per $200 deposited. That is, if they deposit $1,000, they can claim $200 in bonus cash after trading 5 lots.

The maximum bonus is $2,000 per trader.

GO Markets UK Demo Account

GO Markets offers a free paper trading account that enables traders to test out the brokerage and its MT4 and MT5 platforms. There is no deposit required to open a demo account, but traders must register for GO Markets with their name, email, and phone number.

Traders can choose how much money to start with in their demo account and what base currency to use. Traders can reset their account balance at any time. There is no time limit for using the demo account.

GO Markets Customer Support

GO Markets offers 24/5 phone and email support for customers.

GO Markets UK Regulation & Security

GO Markets was founded in Australia in 2006. It now operates in more than 150 countries around the world and the company is divided into 3 regulatory entities.

In Australia, GO Markets operates as GO Markets Pty Ltd and is regulated by the Australian Securities and Investment Commission (ASIC), a top-tier global regulator.

In the EU, GO Markets operates as GO Markets Ltd and is regulated by the Cyprus Securities and Exchange Commission (CySEC).

In the UK and most other countries around the world, GO Markets operates as GO Markets Pty Ltd (MU) and is regulated by the Financial Services Commission of Mauritius (FSC).

Traders in Australia and the EU receive negative balance protection, but traders using GO Markets Pty Ltd (MU) do not. Traders in the UK are also not protected by the UK’s Financial Services Compensation Scheme (FSCS).

GO Markets is not currently available to traders in the US, New Zealand, Canada, and Japan.

All activity on GO Markets is protected by SSL encryption, but the platform does not offer two-factor authentication during login.

64% of retail investor accounts lose money when trading CFDs with this provider.

How to Start Trading with GO Markets UK

Ready to trade CFDs with GO Markets? Here’s how to get started today.

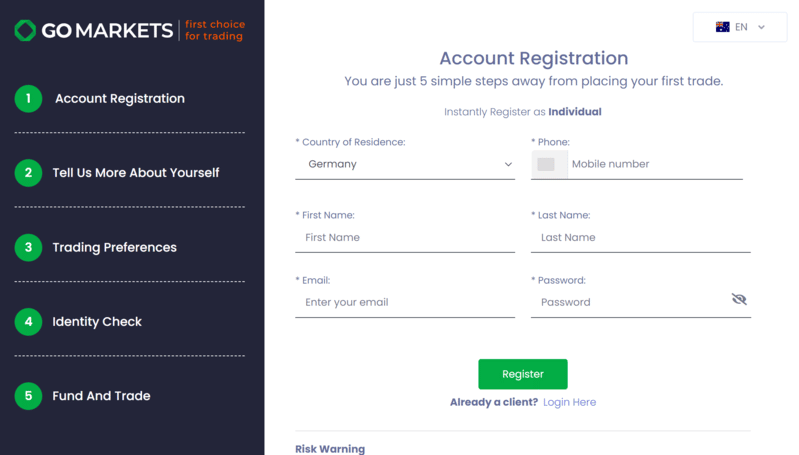

Step 1: Register for GO Markets

Head to GO Market’s website and click Open Account. Traders must select their country of residence and then enter their name, email address, phone number, and an account password.

Step 2: Verify

GO Markets complies with Know Your Customer (KYC) requirements. New customers must verify their identity by uploading a copy of their passport or driver’s license as well as a copy of a recent bank statement or utility bill to verify their residence.

Step 3: Deposit

In the GO Markets dashboard, click Deposit. Select a payment method and then choose the amount to deposit. GO Markets requires a minimum deposit of $200 for new traders.

Step 4: Trade

Install MetaTrader 4 or 5 and open the platform, then log in to GO Markets. Choose a forex pair, commodity, index, or stock CFD to trade and open a new order entry panel. Enter the amount to trade, whether to go long or short, and any other trade details, then click Place to execute the trade.

64% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

GO Markets is a global CFD broker that offers trading on more than 1,000 assets, including forex, stocks, commodities, indices, and treasuries. The broker charges no account fees and offers commission-free and reduced spread accounts. Traders can use MetaTrader 4 or 5 to trade with GO Markets and take advantage of a suite of advanced trading tools.

Register a GO Markets account today to start trading!

64% of retail investor accounts lose money when trading CFDs with this provider.