Best Managed Forex Accounts – Find the Right Account For You

Did you know that the best managed forex accounts can trade your capital for you? Many of the world’s top brokers have invested in technology which allows traders to build additional sources of revenue.

Having a managed forex trading account is becoming increasingly popular. Unfortunately, this demand has led to a lot of the best forex managed accounts being mixed up with the bad ones.

In this Best Managed Forex Accounts guide, we go through the top 10 forex managed accounts for you to get started with, the fees involved as well as the benefits and risks you need to know about.

Best Managed Forex Accounts List 2021

There are literally thousands, if not millions, of traders offering forex managed funds. But, only a small selection would be considered among the best managed forex accounts to use.

It can be extremely time-consuming to research the different providers and then check their quality and safety. Fortunately, we’ve done this hard work for you by creating a list of the top 10 forex managed accounts for this year.

- eToro – Largest Selection of Fee-Free Managed Forex Accounts via CopyPortfolios

- AvaSocial – Best FCA Regulated Managed Forex Accounts

- VantageFX PAMM – Best Managed Forex Accounts PAMM Provider

- Capital.com MT4 Signals – Best Overall Selection of Forex Managed Funds

- Pepperstone MAM – Top Rated Forex MAM Account Provider

- Dukascopy – Swiss PAMM Broker with Large Selection of Forex Managed Funds

- FxMAC – Range of Investment Programs For Global Traders including the US

- Forex92 – Verified Forex Managed Funds via MyFXBook

- FP Markets PAMM – Top Rated Professional Forex PAMM Accounts

The top 10 forex managed accounts listed above are a great place to get started. In fact, it is worthwhile focusing on the top 5, to begin with, so you can learn more about how it all works, the benefits, and the risks.

Top Forex Managed Accounts Reviewed

In this section, we go through the top 5 best forex managed accounts so you can learn more about their features, pros, and cons, as well as how to open an account with them and get started.

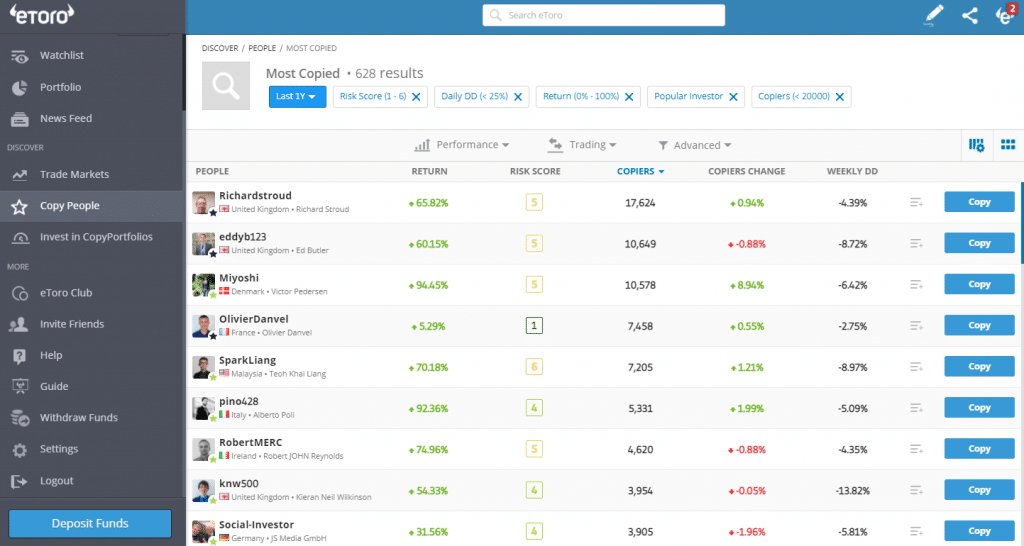

1. eToro – Largest Selection of Fee-Free Managed Forex Accounts via CopyPortfolios

One reason eToro is considered one of the best forex managed account providers is due to its revolutionary CopyPortfolio feature. This is where you can invest in portfolios designed by the in-house dedicated investment team. You can also access the CopyTrader feature where you can find individual forex traders to manage your funds.

One of the best features of the eToro platform is that you can find the best forex managed accounts for yourself! The top of the platform has a filter where you can put in the criteria you are most happy with regarding overall risk, drawdown, returns, etc. Then it will populate a list of forex traders that meet your criteria who can effectively become your money manager!

To start copying their trades and have them effectively manage your capital you simply need to click the Copy icon. It’s as simple as that! To get started you just need to open an account which can be done in a few minutes, deposit funds and then start copying whichever trader you like.

Furthermore, there are zero management fees or revenue share fees. You simply pay the normal spread on the underlying financial instruments the portfolio transacts in. The minimum amount to get started with CopyPortfolios is $5,000 but can be a lot lower with the CopyTrader feature.

- Regulated by FCA, CySEC and ASIC

- Zero management fees

- Keep all of the profits made

- Access forex managed funds and cryptos, stocks, etc

- Low minimum deposit for CopyTrader

Cons

- Minimum investment for CopyPortfolio is high ($5,000) but can start on demo first

67% of retail investors lose money trading CFDs at this site

2. Dukascopy – Swiss PAMM Broker with Large Selection of Forex Managed Funds

The bank is keen to state that they do not endorse, represent or participate in any way with the professional traders offering their services via the PAMM system. However, they do offer their own LP PAMM system via the Dukascopy Wealth Management team who effectively acts as your account manager.

With the Dukascopy LP PAMM account, there are no management or performance fees. However, there are volume commissions and overnight fees that will be charged on certain trades. The basic volume commission for currency pairs is 5 USD per 1 million USD of traded volume.

The minimum investment to get started is only 1,000 USD. While the bank offers a variety of services, their reputation has diminished somewhat as they offer binary options trading which has been banned by most regulators around the world citing it was effectively a method of gambling.

- Regulated in Switzerland

- $1,000 minimum investment

- Zero performance or management fees

Cons

- Recommended investment time more than 1 year

- Average performance over past few years

There is no guarantee that you will make money with this provider. Proceed at your own risk.

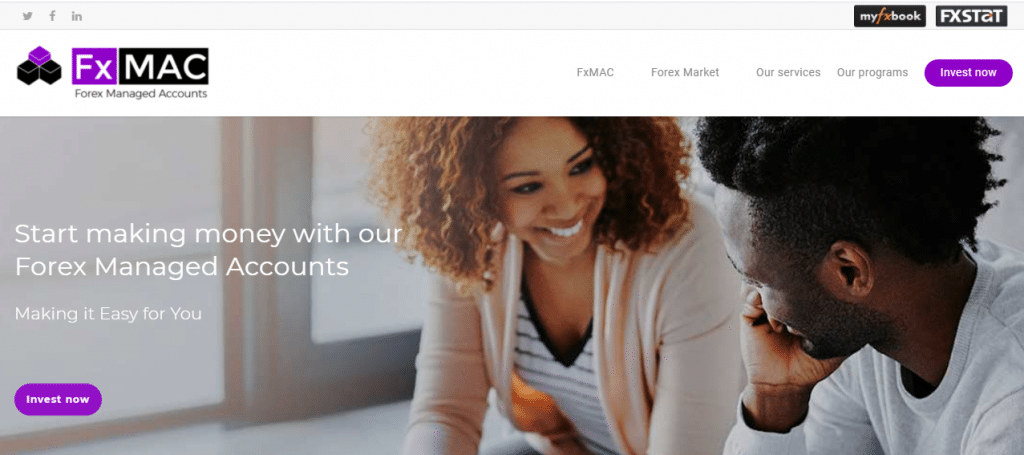

3. FxMAC – Range of Investment Programs For Global Traders including the US

FxMAC is a provider of three different managed forex trading accounts called Investment Programs. While the company’s headquarters is in St.Vincent and the Grenadines – which is an unregulated jurisdiction – they currently only work with regulated brokers.

This is important as your capital is held with the broker so it’s always important to check they are regulated. Of course, this doesn’t mean to say that the company managing your funds is regulated and will provide the same level of safety so it’s also worthwhile doing your own due diligence and read the disclaimer.

For example, FxMAC provides verified track record performance metrics from MyFXBook for each of its three investment programs. They also accept clients from around the world, including the US but as they use a satellite office in the UK, client meetings need to be booked beforehand.

The minimum investment is $5,000 with no option to test their services via a demo account. The performance fee is also higher than the industry average at 35%.

- Works with regulated brokers

- Verified performance from MyFXBook

Cons

- High minimum investment and performance fee

- Based in St. Vincent and the Grenadines, an unregulated offshore jurisdiction

There is no guarantee that you will make money with this provider. Proceed at your own risk.

4. Forex92 – Selection of 3 Forex Managed Account Plans

Forex92 is another forex managed funds provider that offers three different account plans using the MetaTrader 4 PAMM system. The company advertises that they only work with regulated brokers.

The Personal Account plan has a minimum investment of $1,000 with a performance fee of 30% of total monthly profits. The Business Account has a performance fee of 25% on monthly profits but requires a $25,000 minimum investment. The Enterprise Account has a performance fee of 20% of monthly profits but requires a $100,000 minimum investment.

From further research, there were a few issues. The Managed Account service advertises a 25% per month return for the Personal Account, 30% return per month for the Business Account, and a 35% per month return for the Enterprise Account.

It is rare to find a provider who has such exact and specific targets. Also, these numbers are quite high to achieve so consistently. This is evident from the company’s verified results on MyFXBook which shows a more than 50% drawdown on your capital which may be significantly high for most.

- Works with regulated brokers

- Verified results on MyFXBook

Cons

- Advertises exact and specific gains per month (unrealistic)

- More than 50% drawdown on one of the account’s history

There is no guarantee that you will make money with this provider. Proceed at your own risk.

Forex Managed Accounts Fees Comparison

If you’re looking for a quick comparison of the first five companies in the top 10 forex managed accounts list above, then keep on reading!

| Provider | Services | Fees | Rating (out of 5) |

| eToro | CopyPortfolios and CopyTrader accounts | 0% performance fee (just spread and overnight) | 5 |

| Dukascopy | LP PAMM Management | 0% performance fee (volume commission of 5 USD per 1 million traded) | 3 |

| FxMAC | 3 PAMM Investment Programs | 35% performance fee | 2 |

| Forex92 | 3 PAMM Account Types | 35% performance fee | 2 |

As you can see from above the fees vary from provider to provider. However, when choosing the best managed forex accounts trust, security and transparency are important. These factors and others have been taken into account in the above ratings.

What is a Managed Forex Account?

A managed forex trading account is an ideal way for both beginner and advanced traders to capitalise on the trillion-dollar foreign exchange market. The idea of a forex managed trading account is simple – another trader, or a team of traders, manages your funds for you in the forex market.

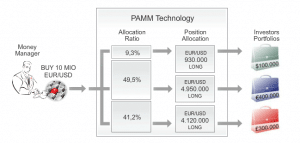

It’s a great way to build an additional revenue stream and has become increasingly popular over the years. This is why many financial markets brokers now offer the technology for individuals to set up a managed forex trading account. With the exception of eToro, the technology used would be either the PAMM or MAM system.

There are three different types of forex managed trading accounts that are available via the MT4 brokers and MT5 brokers.

- PAMM (percentage allocation management module). This system allows for the distribution of trades to be allocated via a percentage basis on each of the investor accounts. This is the most common as it allows for investors to have different account sizes.

- LAMM (lot allocation management module). This system is where the same lot size gets copied from the trader’s account to the investors. It’s the least common as you need to have the same account size.

- MAM (multi asset manager). This allows a trader, or manager, to assign different leverage amounts to different investor accounts.

Benefits of Forex Managed Accounts

There are a variety of benefits in choosing the best managed forex account, whether it is one of the top 10 forex managed accounts listed above or from another provider.

Time

The foreign exchange market operates 24 hours a day, 5 days a week. Most beginner traders simply do not have the time to capitalise on all of the opportunities the forex market can provide.

Having a professional do this for you, dedicating all of their time to finding the best setups, and growing your account is an ideal way to capitalise on the foreign exchange market. It’s also a great way to learn more about how the forex market works and how to trade different investment accounts.

Control

One of the great things about the best forex managed accounts is the fact you have control over when you invest and when to pull out. In some cases, the PAMM system will allow you to put in a stop loss level.

This is an instruction to tell the broker to stop copying the trader’s trades on your account if the account goes below a certain level. This is essential as it is great if you’re winning but what happens in a drawdown? You want to be able to protect your capital.

Safety

The best forex managed accounts will ask you to fund an account with a regulated broker. This is important as unregulated brokers do not have any regulatory oversight and you want to make sure your capital is safe.

One of the best features of forex managed funds is that you only deposit your funds with the broker. The fund manager should never ask you to send them funds to a bank account – if they do, beware!

This is because the PAMM/LAMM/MAM systems operate via a letter of power of attorney. This is where you give the trader authorisation to trade on your account but they cannot withdraw money or move your funds.

How to Get Started with a Managed Forex Account

If you’re looking to get started with the best managed forex account provider Learn2Trade then follow the step-by-step process below. The company not only provides a high level of transparency in what they do but also happens to be the world’s best forex signal provider and works with top regulated brokers like AvaTrade.

Step 1: Register an Account

To get started, you will need to register an account with the globally regulated broker AvaTrade.

Make sure to choose MetaTrader 4 and USD as your base currency for a seamless transition in having a managed forex trading account.

There is no guarantee that you will make money with this provider. Proceed at your own risk.

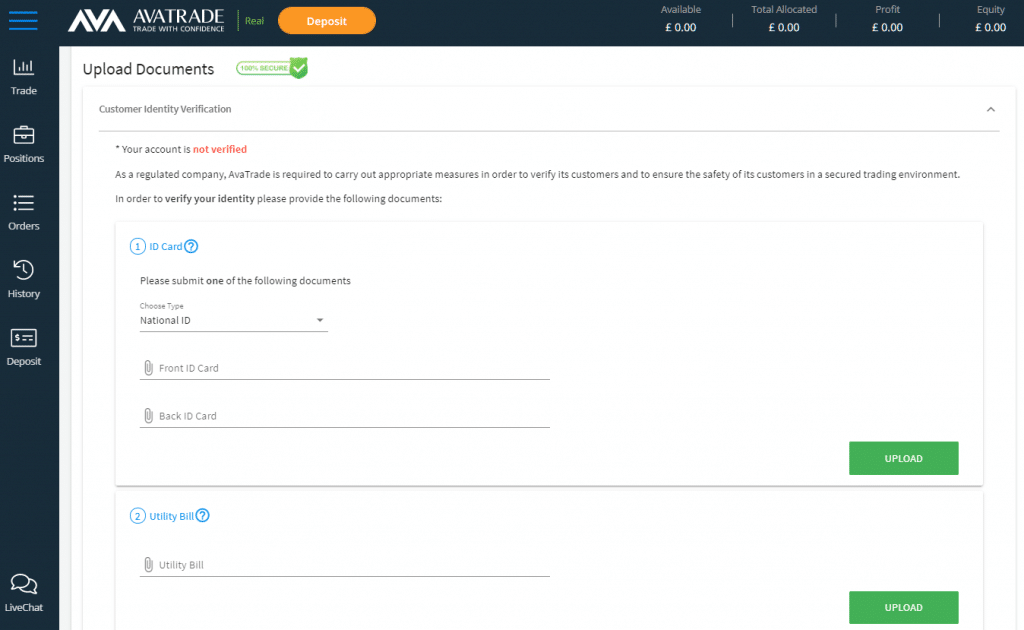

Step 2: Upload your ID

As AvaTrade is a regulated broker you will need to upload ID documents to verify your address and identity. This is a strict regulatory requirement and ensures the safety and security of your account.

ID documents include a utility bill and a passport or driver’s license. You will also need to fill out the Proof of Attorney (POA) form. This allows the Learn2Trade investment team to trade on your account but does not give them access to withdraw or move money.

Step 3: Get Started!

Once you have completed the steps above, start trading!

There is no guarantee that you will make money with this provider. Proceed at your own risk.

FAQs

What is a forex managed account?

How do managed forex accounts work?

What are the best performing managed forex accounts?

How much can you make on a managed forex account?

Are managed forex accounts legit?