Our free forex signals for today is the NZD/USD pair and we have the entry, stop and take profits levels for you

The New Zealand dollar has continued to drift lower in a downtrend since its near-term high of 0.7317 reached on 26 May.

NZDUSD is currently priced at 0.6956, down 0.5%

But the ongoing correction notwithstanding, the Reserve Bank of New Zealand has indicated that it will hiking rates later this year and that is bullish for the Kiwi.

Analysts at ING expect NZDUSD to hit new cycle highs before the year is out. That provides much food for thought for forex trading.

This bullish scenario has been buried by the dominance of what the analysts describe as “global risk dynamics” – although the interest rate hike might be priced in, tapering appears not to be, but the reasons for it are surely near to being redundant. The danger of over-juicing economies is becoming more real, if inflation worries are to be believed.

NZD/USD: tapering on the way

“Markets have likely turned a blind eye to domestic factors for many pro-cyclical currencies over the past few weeks, with global risk dynamics driving most losses. This was the case for NZD too.”

“Markets are almost fully pricing in a rate hike by year-end from the RBNZ, which is now looking increasingly likely. 1Q GDP jumped to 2.4% YoY (exceeding expectations), inflation may have moved to the 2.5-3.0% region in 2Q, housing inflation has remained high, and a weaker NZD is surely welcome by the Bank.”

“We think the chances of a late-2021 hike are 50/50, but surely the reasons to keep the stimulus going in other forms are lacking, so some material tapering should be on the way. This should keep the rate profile of NZD significantly more attractive than AUD and support a move to 0.75 in NZD/USD by year-end.”

Today’s 0.5% fall in the European session suggest there are opportunities for a buy on the pair based on oversold conditions

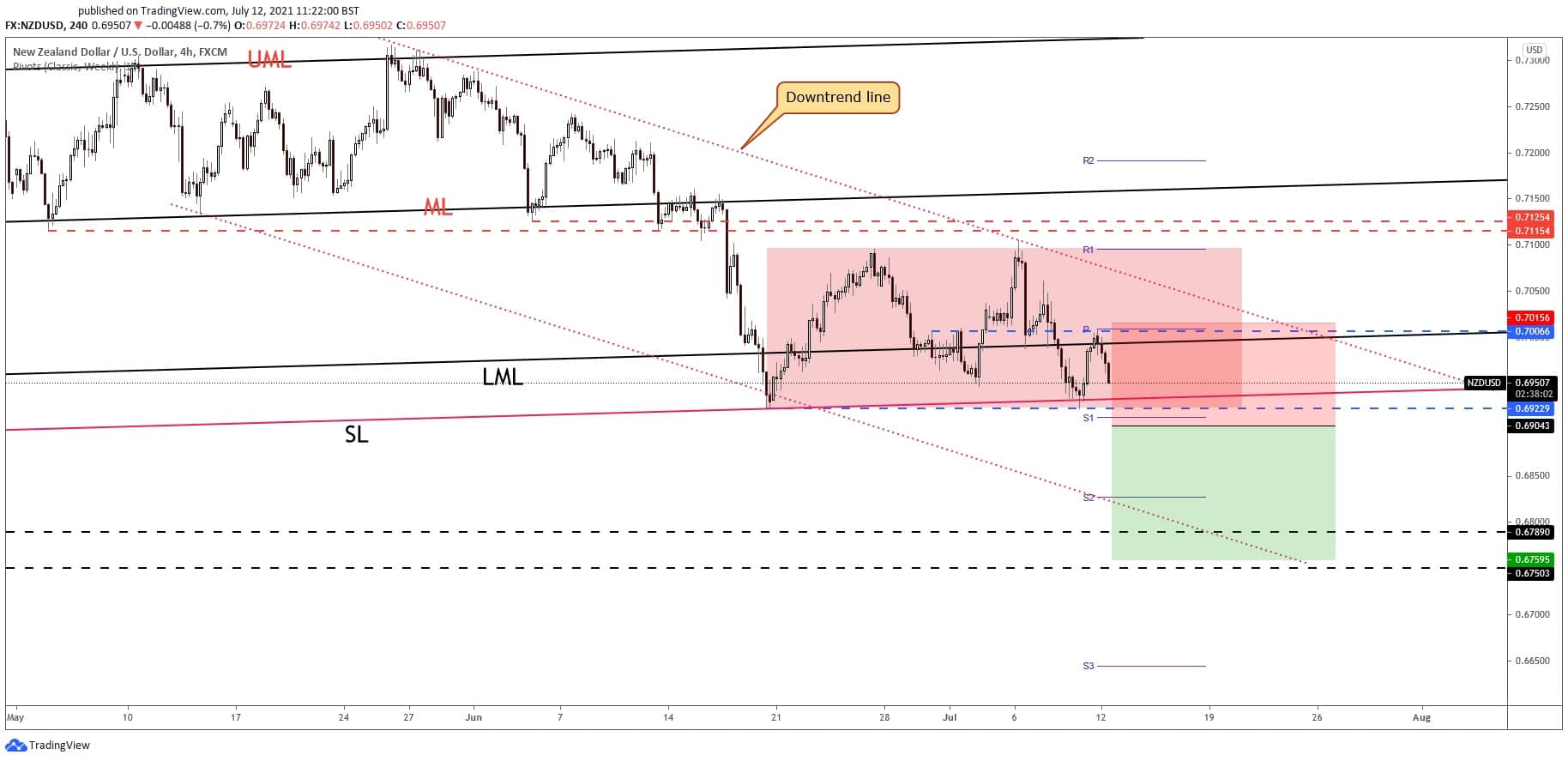

Free forex signals – buy NZDUSD

Instrument: NZD/USD

Order: SELL STOP

Entry price: 0.6904

Stop Loss: 0.7015

TP1: 0.6759

Recommended Risk: 1%

Risk / Reward Ratio: 1:1.3

Signal validity period: Good until cancelled

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.