Our free forex signals service trade today is a buy order on the USD/MXN. The pair will go up if the US dollar finds bullish momentum.

The USD/MXN pair registered a strong rally in the short term as the Dollar Index edged higher. The currency pair retreated a little, but this could only be a temporary drop. It could test and retest the immediate downside obstacles before resuming its growth.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

The pair is trading at 19.952 at the time of writing. In the short term, the price action developed a bullish continuation pattern. Still, we’ll have to wait for confirmation before taking action. Yesterday, the US economic data came in mixed.

Retail Sales indicator rose by 0.5% versus 0.6% expected, Core Retail Sales registered a 1.1% growth compared to 1.0% estimates, while the Unemployment Claims indicator was reported at 185K in the last week. The USD remains bullish as the FED is expected to hike rates in the upcoming monetary policy meetings.

US Industrial Production 0.4% growth expected

Today, the US economic data could bring more volatility. For example, the Empire State Manufacturing Index is expected at 0.9 points versus -11.8 in the previous reporting period. Furthermore, Industrial Production may report a 0.4% growth In March, while the Capacity Utilization Rate could appear at 77.8%.

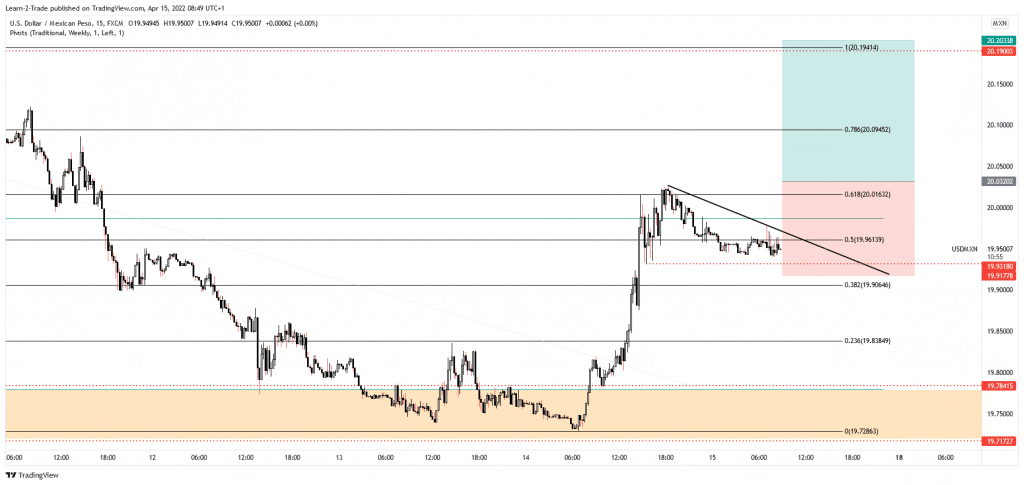

Technically, the price could try to resume its growth if it makes a valid breakout from the down-channel pattern.

3 Free Forex Every Week – Full Technical Analysis

Free forex signals – Buy USD/MXN at 20.004

Free forex signals entry price and take-profit

Instrument: USD/MXN

Order Type: BUY STOP

Entry price: 20.004

Stop Loss: 19.917

TP1: 20.203

My Risk: 1%

Risk / Reward Ratio: 1:2.3

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money