Our free forex signals service trade today is a buy order on the USDCAD.

The USD/CAD pair drops at the time of writing as the Dollar Index has slipped lower after reaching a new high of 94.30. The DXY was expected to decline after registering an amazing rally on Friday. The currency pair moves sideways, that’s why we need a strong bullish confirmation before considering going long.

In the short term, the USD/CAD pair seems undecided after the United States Advance GDP registered a 2.0% growth versus 2.6% expected, while the Canadian GDP reported only a 0.4% growth compared to 0.7% estimates.

3 Free Forex Every Week – Full Technical Analysis

US ISM Manufacturing PMI Decisive

Today, the United States is to release its ISM Manufacturing PMI which is seen as a high-impact event. The economic indicator is expected to drop from 61.1 to 60.4 points. Furthermore, the Final Manufacturing PMI could remain steady at 59.2 points, the ISM Manufacturing Prices is expected to grow from 81.2 to 82.5 points, while the Construction Spending may register a 0.6% growth.

On the other hand, the Canadian Manufacturing PMI will be released as well later. The fundamentals could drive the rate, so you should keep an eye on these figures.

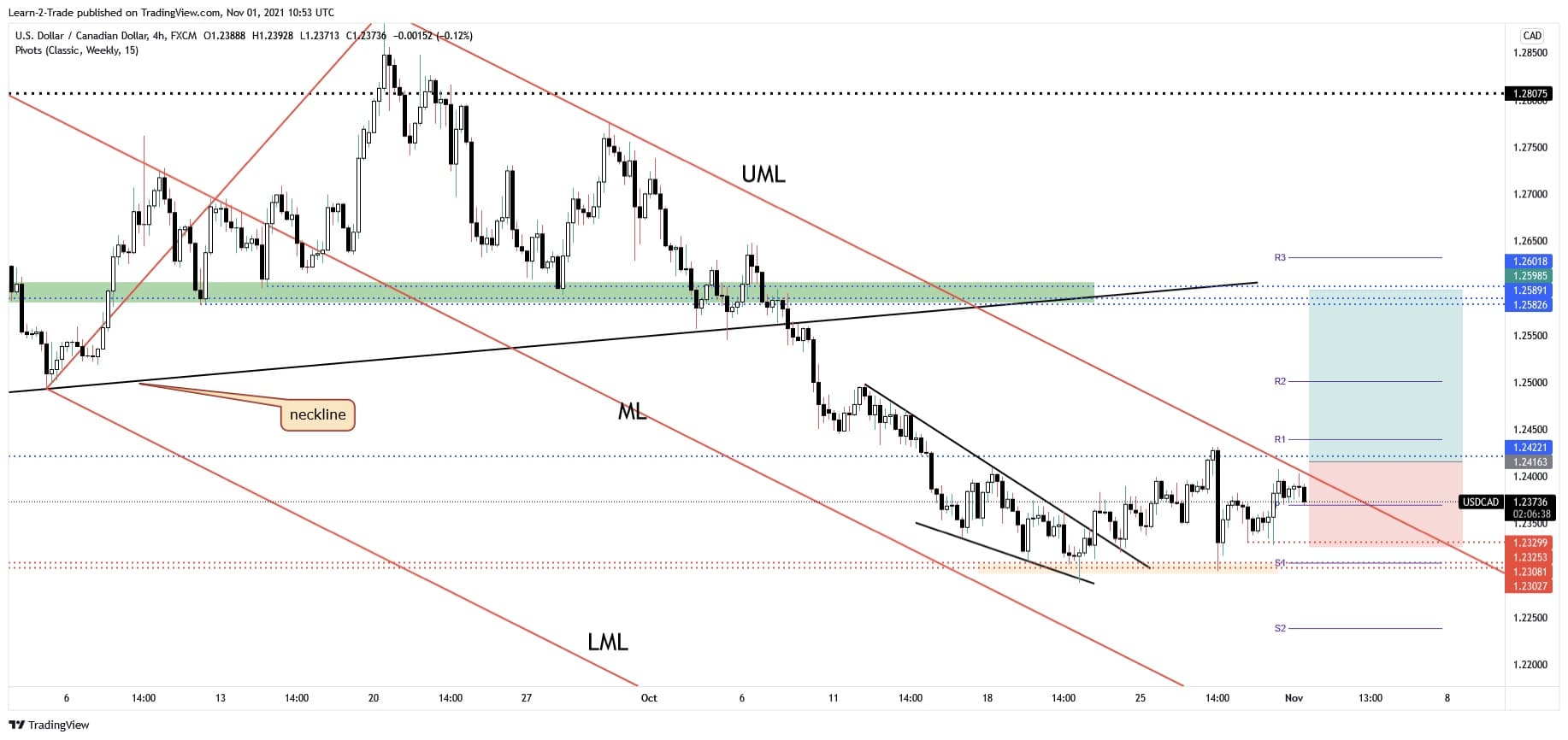

Technically, the USD/CAD pair moves sideways in the short term and it continues to stay near the descending pitchfork’s upper median line (UML). It has failed to reach this line in its previous attempts, so personally, I still believe that the rate could reach it soon. A valid breakout above it could announce potential growth.

Free forex signals – BUY USD/CAD at 1.2416

Free forex signals entry price and take profit

Instrument: USD/CAD

Order Type: BUY STOP

Entry price: 1.2416

Stop Loss: 1.2325

TP1: 1.2598

My Risk: 1%

Risk / Reward Ratio: 1:2

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.