Our free forex signals service trade today is a sell order on the AUD/USD. The pair will go downside if it fails at the resistance level.

The AUD/USD pair rallies at the time of writing as the DXY drops. The greenback depreciates versus its rivals as the Dollar Index resumes its sell-off in the short term.

The price action signaled a bearish divergence, announcing that the buyers were exhausted. Still, a corrective phase is far from being confirmed. The Australian Retail Sales registered a 1.8% growth versus 0.9% expected. Yesterday, the US data came in mixed.

JOLTS Job Openings 11.00M expected

The USD needs strong support from the US economy to take the lead again. The JOLTS Job Openings is expected to drop from 11.26M to 11.00M. In addition, the CB Consumer Confidence could drop from 110.5 to 106.9 points. Poor US data could weaken the USD. The USD actually depreciated ahead of US economic figures as the traders are expecting worse data than the last reporting period.

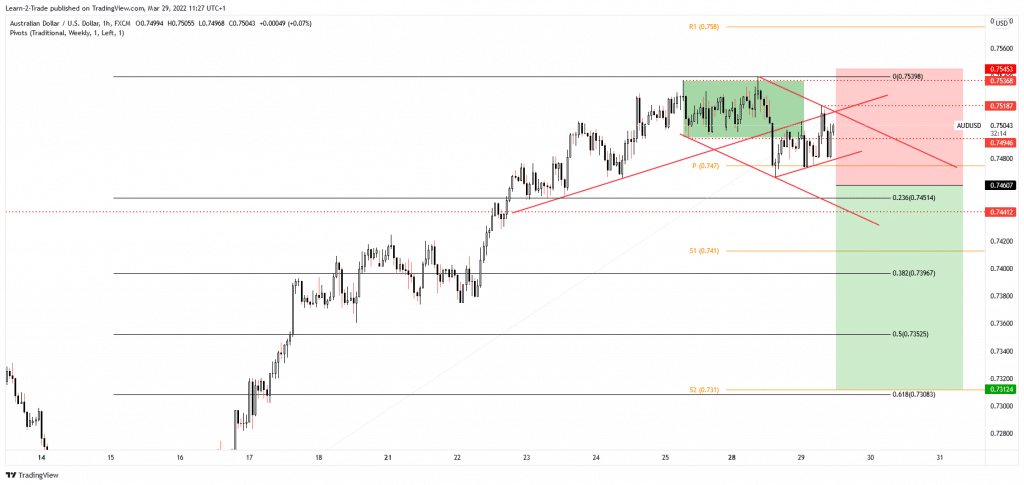

Technically, the AUD/USD pair showed exhaustion signs. A new lower low could activate a downside movement, a corrective phase. The weekly pivot point of 0.7470 stands as a critical support level.

3 Free Forex Every Week – Full Technical Analysis

Free forex signals – Sell AUD/USD at 0.7460

Free forex signals entry price and take-profit

Instrument: AUD/USD

Order Type: SELL STOP

Entry price: 0.7460

Stop Loss: 0.7545

TP1: 0.7312

My Risk: 1%

Risk / Reward Ratio: 1:1.75

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money