Our free forex signals service trade today is a sell order on gold. The price will go down if the USD continues its upside momentum.

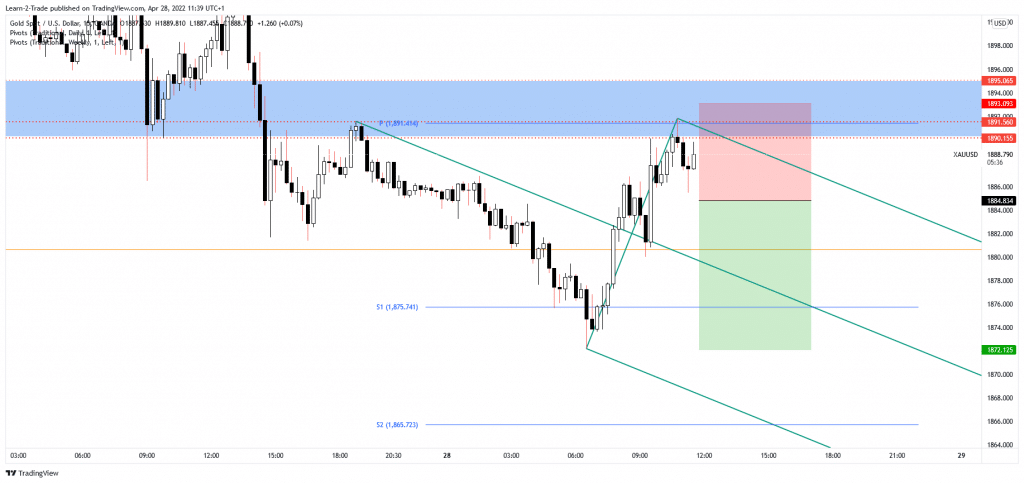

The price of gold rebounded in the short term as the Dollar Index retreated a little. After its massive drop, XAU/USD was somehow expected to register a temporary rise. However, now that it has reached strong upside obstacles, the broken support levels have turned into resistance. The metal is trading at 1889.77 at the time of writing, below 1891.82 today’s high.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

Technically, we still need confirmation before taking action on this market. However, a new higher high could activate potential upside continuation.

Fundamentally, the yellow metal was somehow expected to recover after worse than expected US data reported yesterday. The Goods Trade Balance, Pending Home Sales, and the Prelim Wholesale Inventories indicators disappointed. Today, the BOJ left its monetary policy unchanged as expected.

US Advance GDP 1.1% expected

Later, the US data could bring some action and change sentiment in the short term. For example, the Advance GDP could register a 1.1% growth, Advance GDP Price Index could report a 7.2% growth, while the Unemployment Claims indicator may drop to 178K in the last week.

1,891.56 and 1,890.15 levels represent static upside obstacles.

False breakouts through these levels may signal a new sell-off.

3 Free Forex Every Week – Full Technical Analysis

Free forex signals – Sell gold at 1884.83

Free forex signals entry price and take-profit

Instrument: GOLD

Order Type: SELL STOP

Entry price: 1884.83

Stop Loss: 1893.09

TP1: 1872.12

My Risk: 1%

Risk / Reward Ratio: 1:1.5

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money