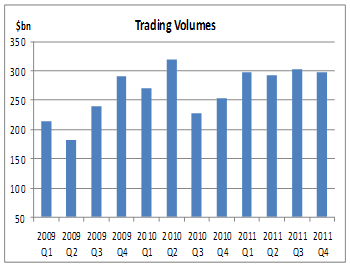

Forex broker FxPro enjoyed a strong 2011 with trading volume up by 11% to $1.18 trillion. Q4 saw a return to normal after a strong Q3.

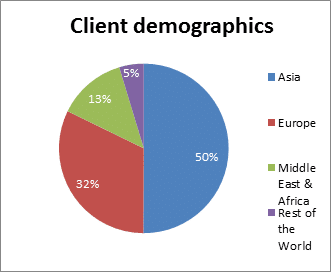

Trade from Asia became an absolute majority, surpassing the 50% mark. This is significantly higher than 2010. Revenue per million traded slid to $71.4, down from $75.

The most traded pair was EUR/USD, which holds on to 50% of volume. The Australian dollar continues to be “good as gold”, rising to 8.8%.

For more data, see the press release below:

FxPro Announces 11% Increase in 2011 Trading Volumes

London, 17 January 2012: FxPro Financial Services Ltd (‘FxPro’), an award winning global forex broker today released the operational metrics for its business for for 2011 and Q4 2011 specifically.

2011 was a record year for FxPro with volumes reaching $1.18 trillion up 11% from $1.07 trillion in 2010. This was the second consecutive year of double digit growth.

In 2011,FxPro’s business from Asia contributed 51.2% to total trading volumes up from 43.8% in 2010. European trading volumes accounted for 33.6% down from 39.4% in 2010. Middle East and Africa contributed for 12%, with the remaining 3.2% coming from the rest of the world.

Revenue per million traded in 2011 was $71.4 slightly lower than 2010 during which FxPro registered $75 per million traded. Volume traded in Q4 2011 was $298 billion, down by 1.32% from Q3 2011 and 17.79% higher than the corresponding quarter in 2010.

After a Q3 characterised by very high volatility and exceptional trading activity, Q4 saw a return to normal activity levels, which also included the quiet holiday period in December.

The most traded currency pair was EUR/USD with accounted for 50% of volumes, with GBP/USD representing only 17% and AUD/USD 8.8%. AUD/USD continues to show increased activity in Q3 it only contributed 5% of total volumes (an increase of 76%).

In Q4 clients from Asia continued to account for 50% of total volumes traded, the same as Q3. European client contribution decreased from 34% to 32% in Q4. Trading volumes from clients in the Middle East & Africa and the rest of the world increased to 13% and 5% from 12% and 4% respectively.

At the end of Q4 FxPro had 18,337 tradable accounts[1] up from 17,932 at the end of Q3 2011.

Denis Sukhotin, Founder of FxPro commented: “As a leading global forex broker, FxPro had another record year in 2011. The scale of the volatility in the market offered traders great opportunities but it was more important than ever to provide them with all the tools and resources they need to trade successfully. In 2011 we had a number of new business initiatives, including our unique ECN solution – FxPro cTrader – which allows direct market access, we expanded our operations with the opening of an office in Sydney, Australia and we launched our institutional services, aiming to service and support a number of financial institutions in the forex market. In 2012 we will continue to enhance our offering in order to achieve our goal of being the world’s preferred forex broker.”