The countdown to the UK elections continues with exactly one month left. What does this mean for the British pound?

The team at Goldman Sachs analyzes the battled between fundamentals and politics in the UK and what it means for sterling:

Here is their view, courtesy of eFXnews:

With the the UK election campaign begins in earnest this month, Goldman Sachs updates its outlook for GBP in the context of the election, and two of the main risks to GBP: i) the UK’s current account deficit and ii) policy risks from the BoE. The following are the key points in GS’ outlook along with its forecast and strategy to trade GBP.

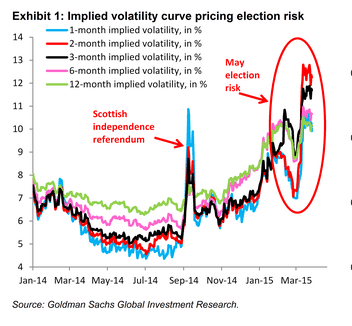

“The upcoming election on May 7, 2015, is one of the most uncertain in living memory. Not only is the election outcome uncertain, but so is the potential market reaction to the different possible outcomes. What is clear is that FX volatility markets have priced in some degree of election risk – and unlike the Scottish independence referendum in September 2014, the market is less likely to be taken by surprise by the upcoming election,” GS notes.

“But what about Sterling in spot currency markets? Given the risk premium that is clearly priced in volatility markets, it may then be reasonable to expect that spot currency markets also price a risk premium,” GS adds.

Overall, GS argues that while GBP may have room to price additional risk premium into the election, ultimately the currency will reconnect with the strong underlying fundamentals of the UK economy, including strong activity and a tightening labour market, and to outperform most of the G10 (ex-USD) throughout 2015.

“We think the level of the current account deficit overstates the risk to Sterling, however a more lasting risk to Sterling comes from dovish BoE policy in response to currency appreciation. Though even here we think that, contingent on our baseline view of the Fed hiking in September, the market is currently pricing outcomes that are likely to prove too dovish,” GS adds.

GBP forecatst and straegy.

“We forecast EUR/GBP at 0.65 in 12 months, and would view any substantial election-related rally in EUR/GBP as an opportunity to sell,” GS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.