The Bank of England is about to lay out its new policy and the pound is slightly lower. What’s next for the pound? Here is the view from Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

We expect the BoE to cut Bank Rate on Thursday. They have nothing to gain by waiting: better to get ahead of the issue. – We look for 40bp cut, but see a good chance of only 25bp: Carney has said he is concerned about taking rates “too low”.

We remain bearish GBP and would sell any bounce.

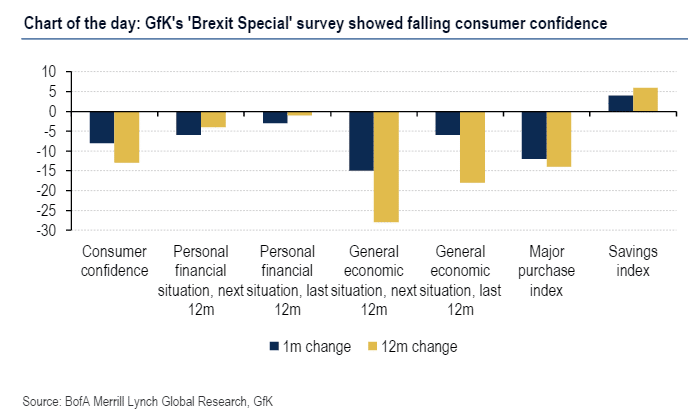

Our concerns for GBP are two-fold: the macroeconomic impact as data for the full post–Referendum period emerge and the constraints placed on the currency by virtue of the UK’s sizeable current account deficit. Financing of that deficit, which was under close scrutiny headed into the Referendum, will now be front and center for investors. We believe the deficit will be increasingly exposed as the volatile macro and political backdrop deters foreign investment decisions (short and long term) into the UK. In our view, a rate cut should come as no surprise, but even a more conservative 25bp rate cut will not likely provide any relief for the pound and we would use any bounce as an opportunity to sell into.

We reiterate our long July MPC dated Sonia on expectations of a cut.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.