- GBP/JPY bears are seeking a downside extension beyond support.

- Cable has already attempted a 38.2% Fibo.

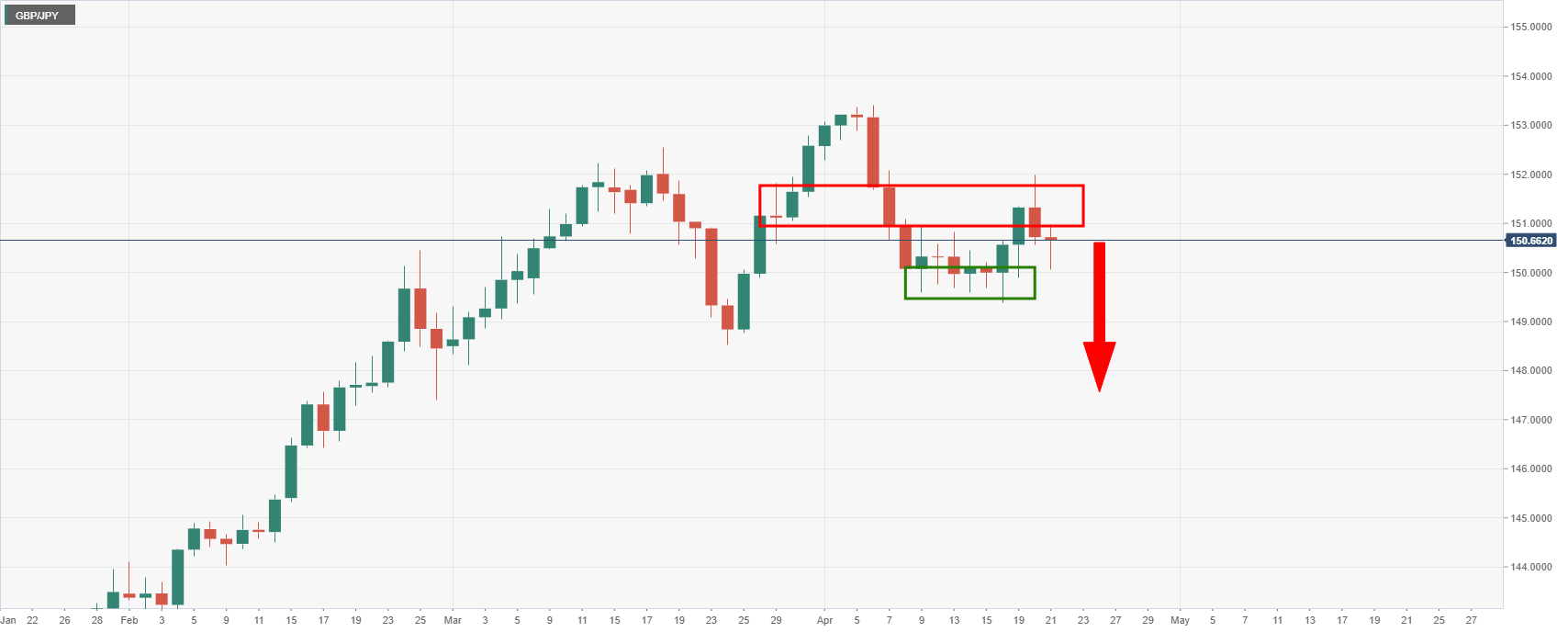

As per the prior analysis, ‘GBP/JPY bulls coming up for their last breath?’, the pound has started to melt.

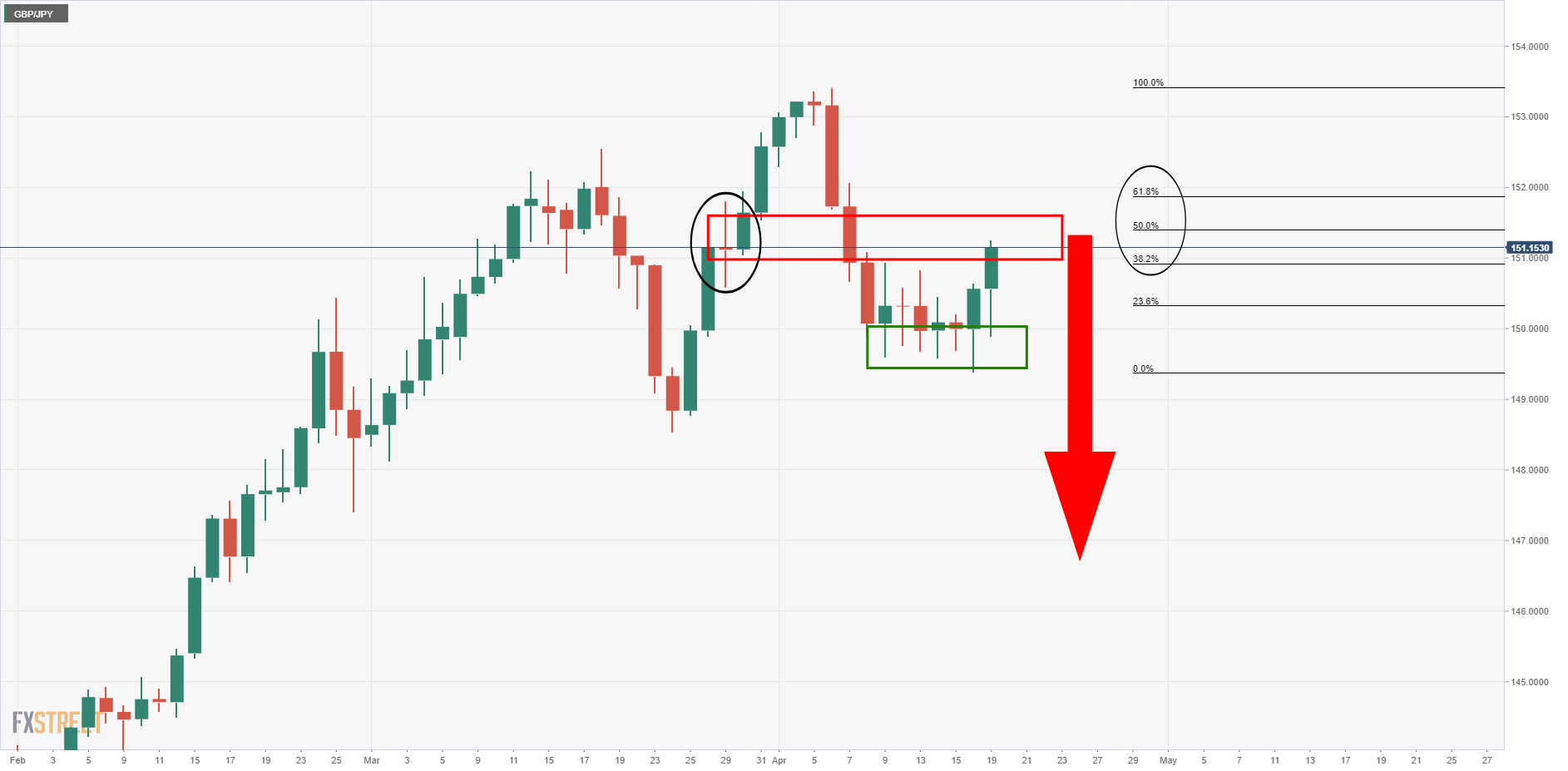

Prior analysis, daily chart

As per the prior analysis and laws of gravity (overextended monthly and weekly trend), GBP/JPY Price Analysis: Bears in control, target significant downside levels, the path of least resistance while below 151.35 is to the downside:

Live market, daily chart

As it stands, if the daily candle closes with a lower close, the candle will be bearish and the wick would be expected to be filled in if not exceeded in subsequent bearish closes on lower time frames.

With that being said, cable will be worth paying attention to also.

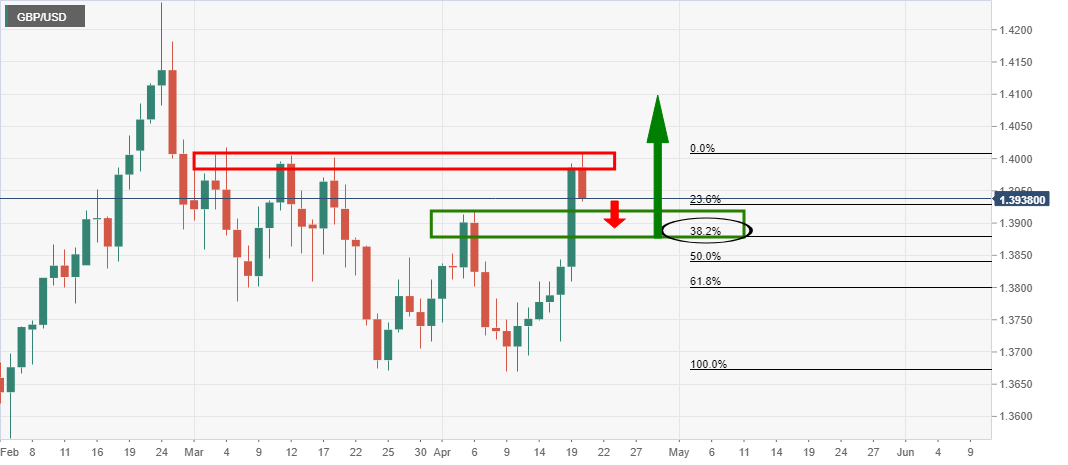

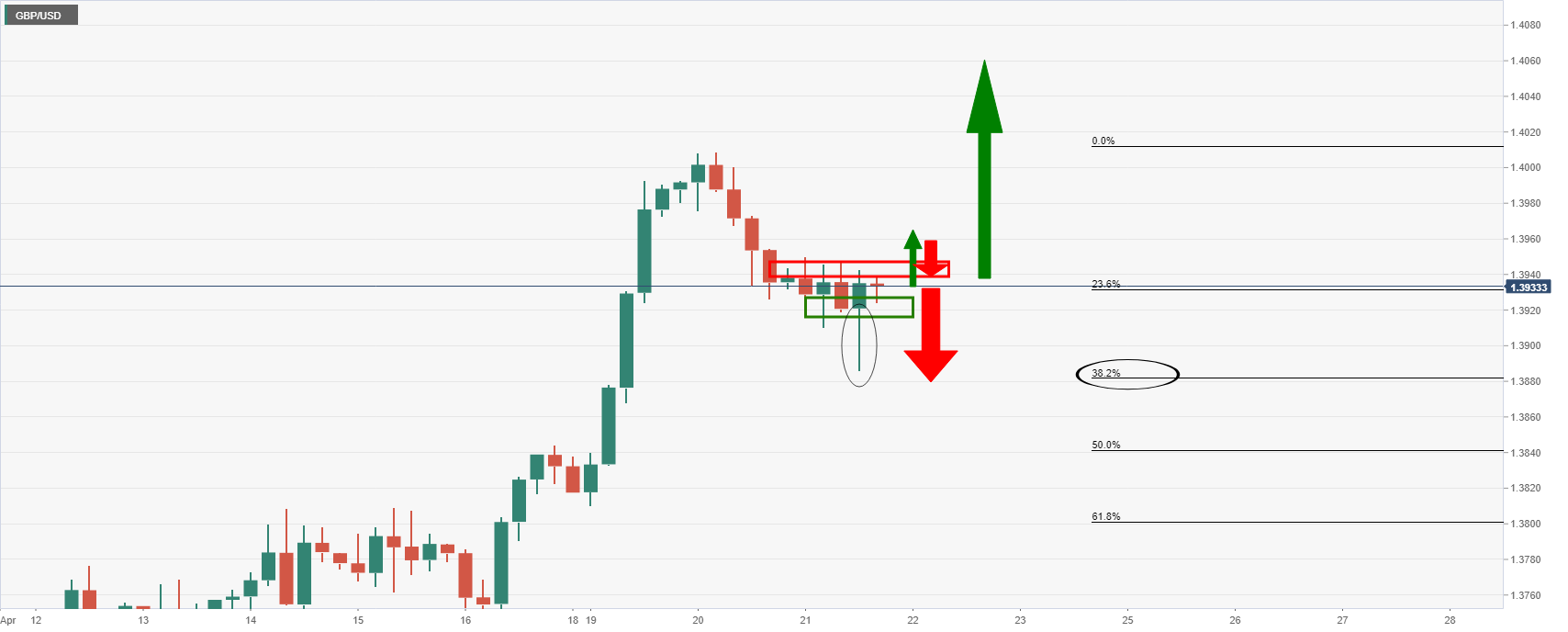

As per the prior analysis, ‘GBP/USD bears set on a 38.2% Fibo 1.3880 target’, the price has indeed moved in on the target as follows:

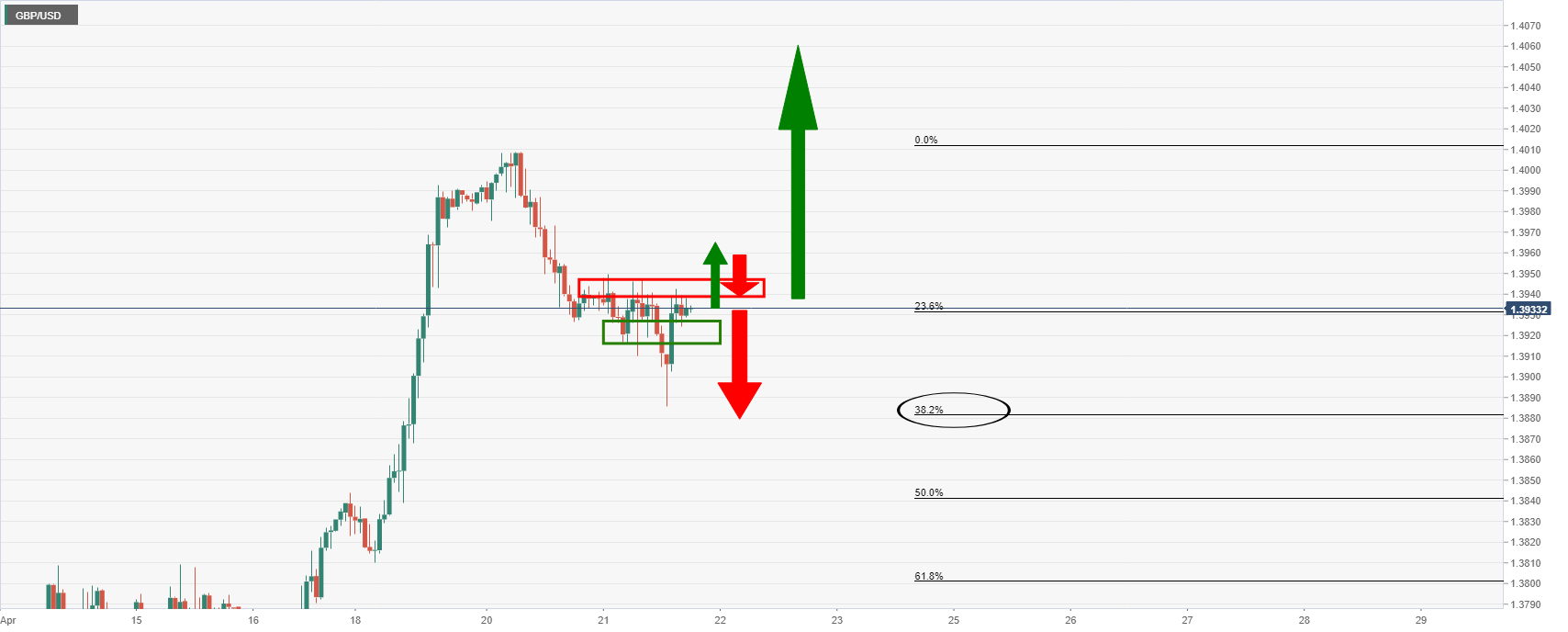

Prior analysis, daily chart

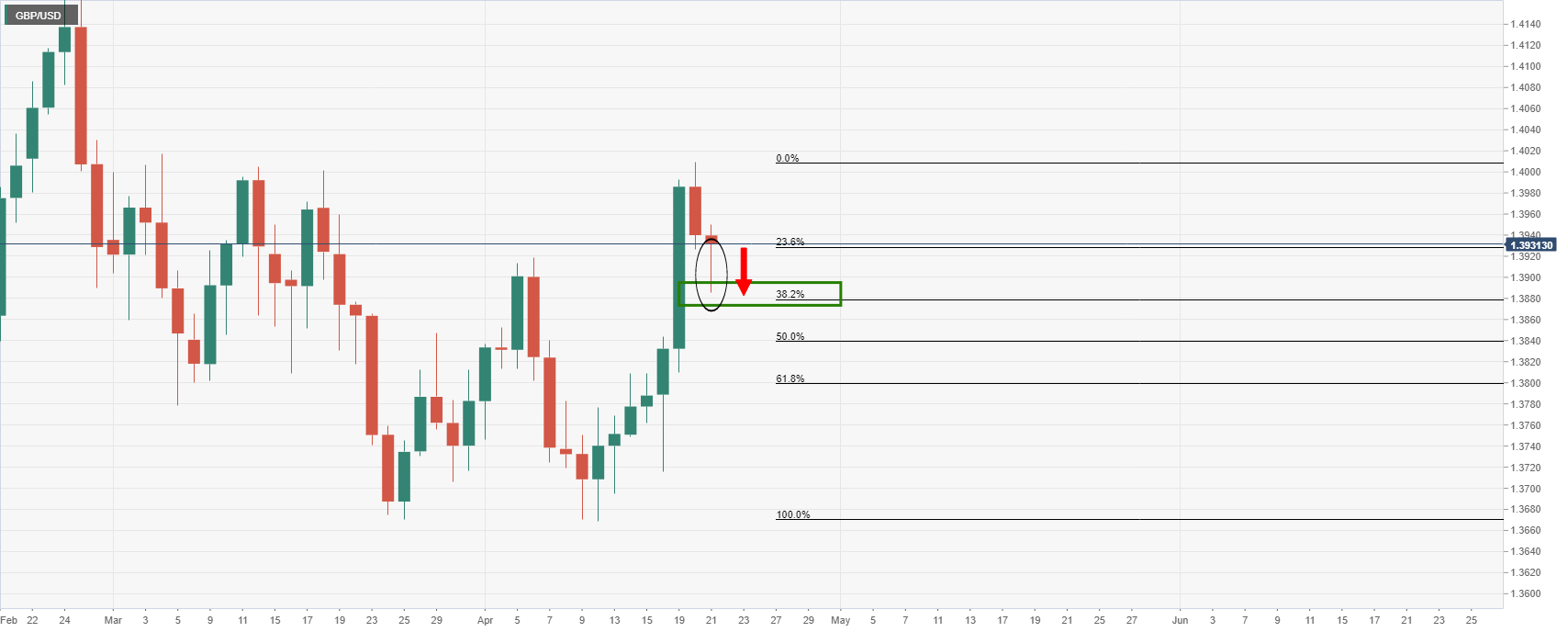

Live market

Meanwhile, the same theory applies to cable with the current daily candle’s wick expected to be filled in for a fuller test of the 38.2% or beyond.

Nevertheless, this depends on a break of hourly support:

At this juncture, the bias is to the upside according to the 4-hour price action:

The 4-hour bullish close may mean that the 38.2% attempt has been thwarted by the bulls and that will be all we will see of the downside for the mean time.