- GBP/JPY bears seek a sizeable retracement to the downside.

- Daily support is holding off the bears, for now.

GBP/JPY bears taking on the bulls at a critical support structure.

Following a series of higher monthly closes, the price is facing headwinds and would be now expected to head south towards weekly demand territory.

The following is a top-down analysis that illustrates the next probable swing trading opportunity.

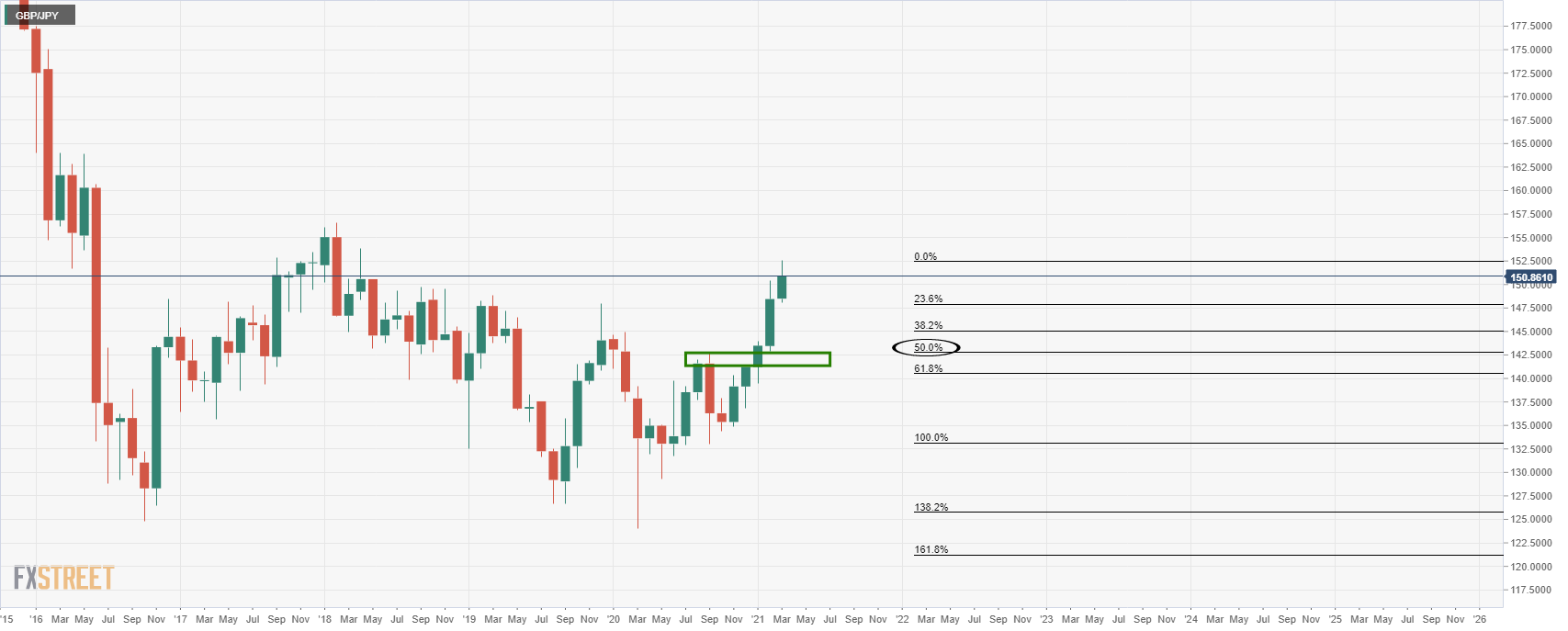

Monthly chart

As illustrated, this is a strong rally that has taken place on the monthly chart following a series of higher closes in 4 consecutive months, not including March, yet.

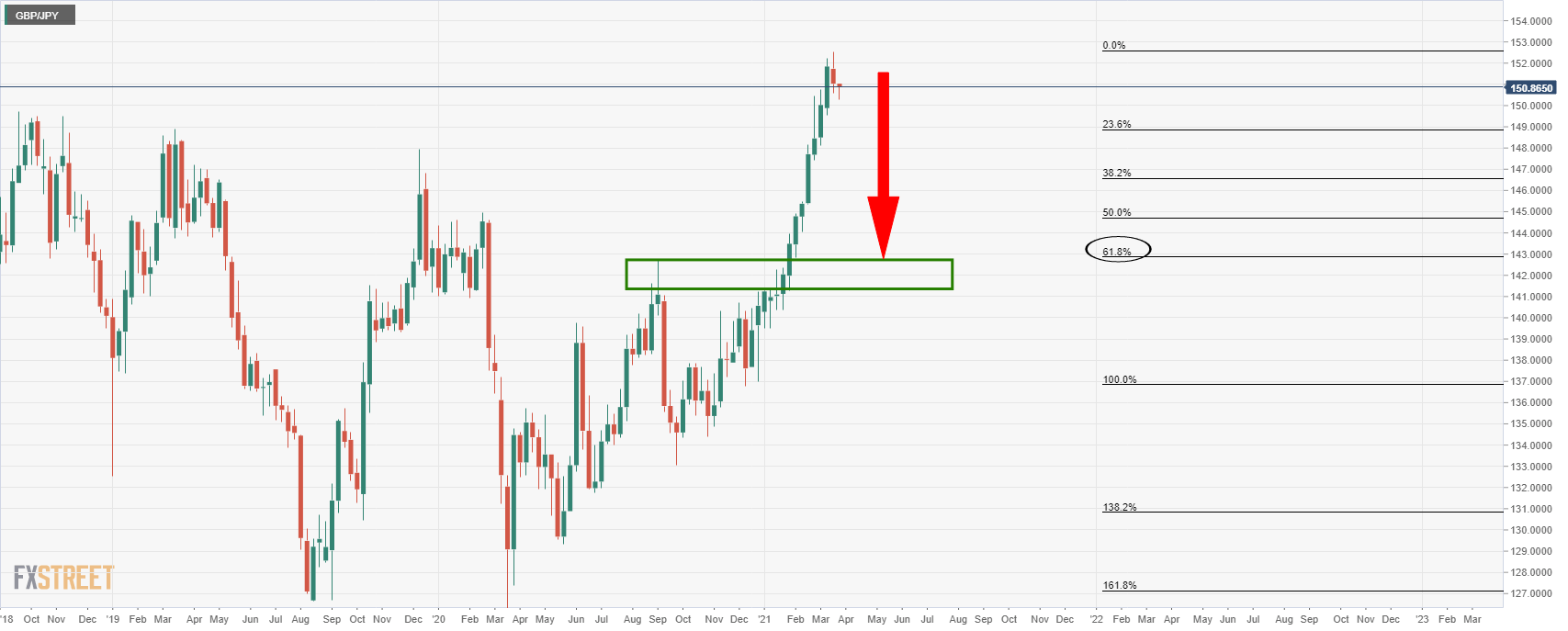

Weekly chart

However, the prospects for a higher close in March are growing dimmer by the week.

Notably, there is also a confluence of the Fibonaccis between the monthly, weekly and prior resistance structure reinforcing the downside prospects to this area.

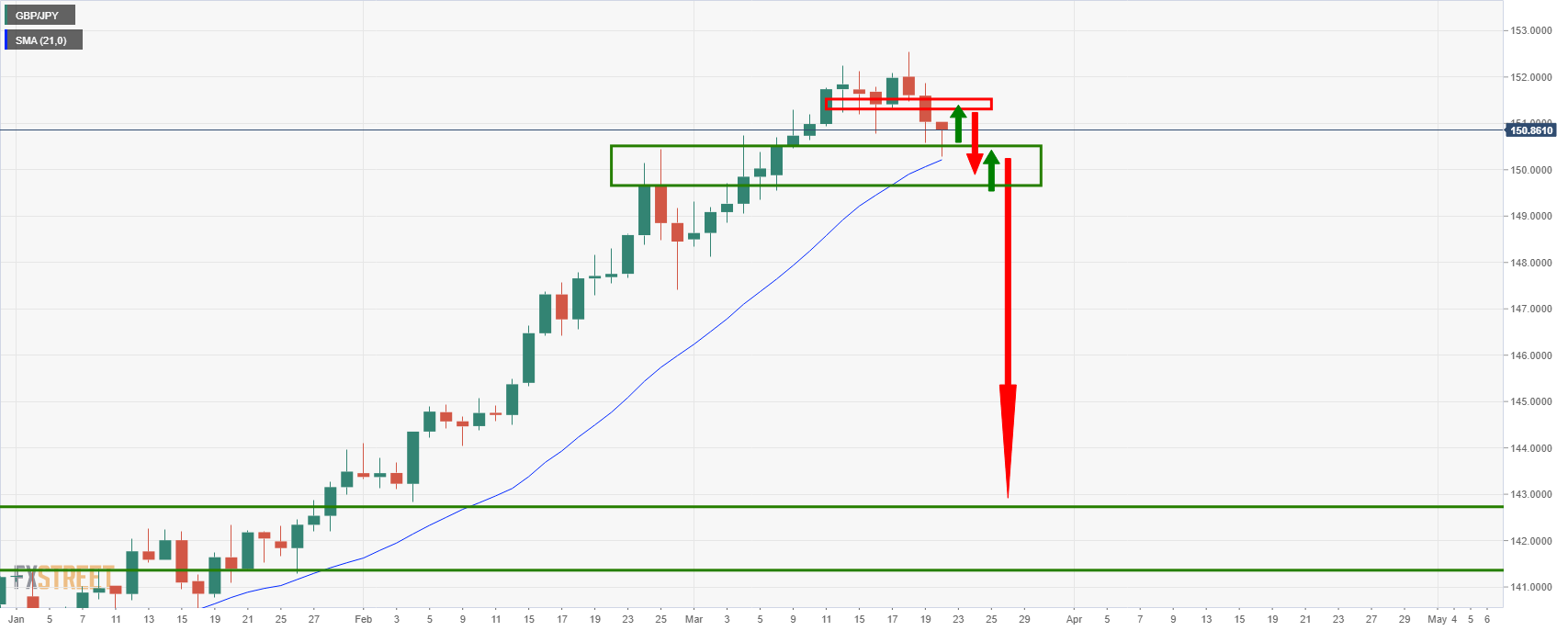

Daily chart

However, there is still work to be done by the bears before there is a convincing bearish case.

A restest of the prior support would be expected to hold.

On a break of the current support, then the bears will be in control and the market would be expected to melt towards the weekly downside target area.

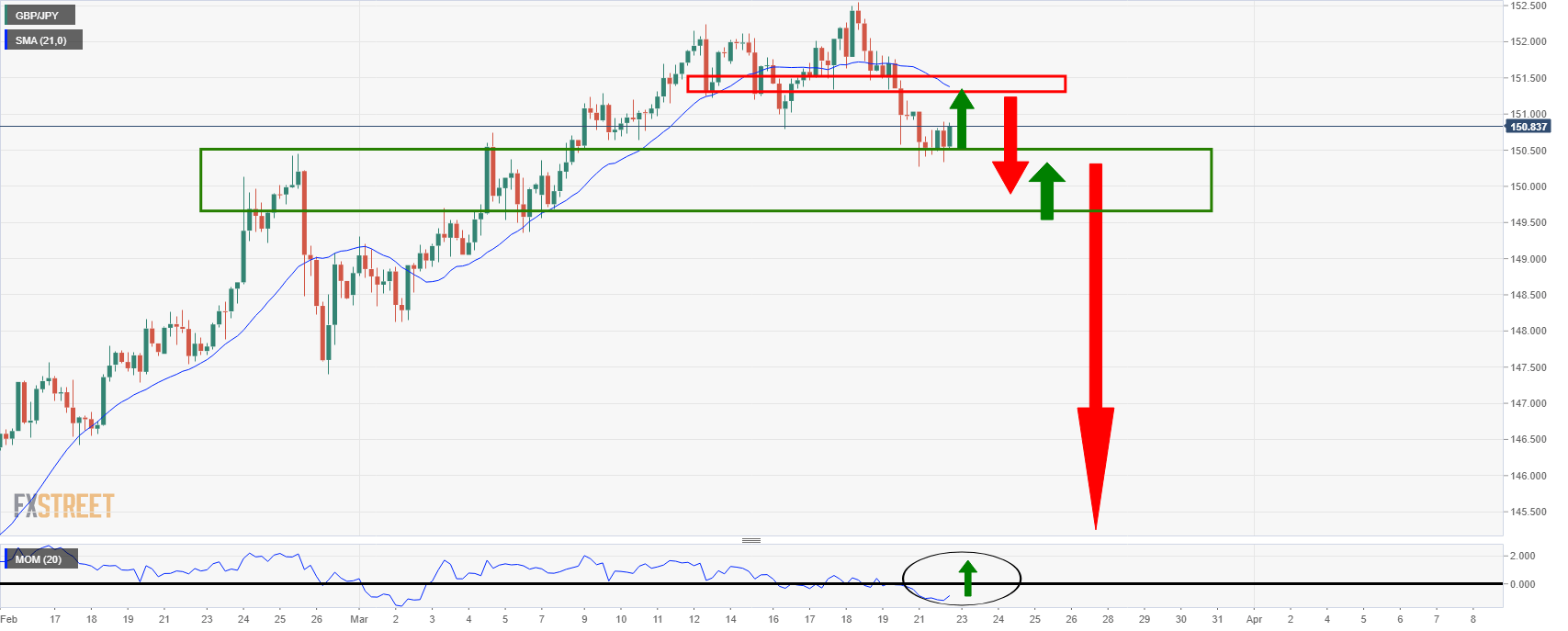

4-hour chart

The conditions are bearish on the 4-hour chart, but there is room for a significant retest of the prior lows and confluence of the 21-SMA.