- GBP/JPY pulls back from the one-week low.

- Multiple support lines, RSI condition question further downside.

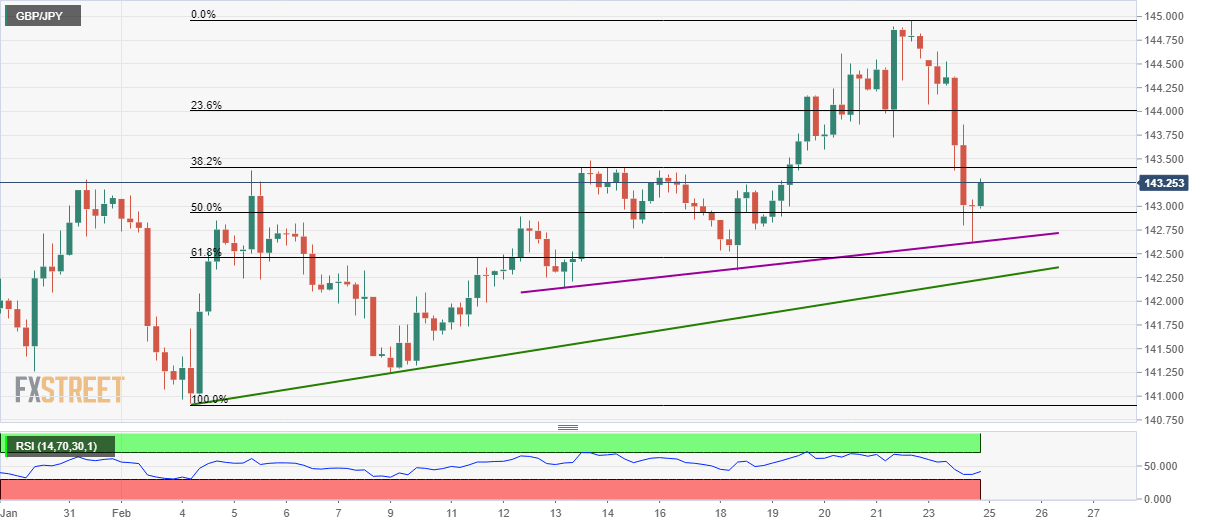

- 38.2% Fibonacci retracement acts as the immediate resistance.

GBP/JPY stays mildly positive, +0.05%, to 143.20 by the press time of Tuesday’s Asian session. The quote recently recovered from an eight-day-old rising trendline and is up for challenging 38.2% Fibonacci retracement of the February month upside.

Should the quote manage to stay positive beyond 143.40 immediate resistance, which is more likely considering the recovery in RSI conditions from the oversold region, Friday’s low near 143.70 will be on the buyers’ radar.

In a case where the bulls dominate beyond 143.70, 23.6% Fibonacci retracement of 144.00 and the monthly top nearing 145.00 could return to the charts.

Alternatively, the said support line around 142.60 and 61.8% Fibonacci retracement, close to 142.45, question the pair’s short-term declines.

However, an ascending trend line from February 04, at 142.22 now, will be important to watch past-142.45 as a downside break of the same could drag AUD/JPY prices towards 141.00

GBP/JPY four-hour chart

Trend: Pullback expected