- GBP/JPY remains positive while holding recovery gains from the multi-week low.

- 50% Fibonacci retracement, November 2019 low add to the resistance.

- A downside below 61.8% Fibonacci retracement highlights September 2019 high as the key support.

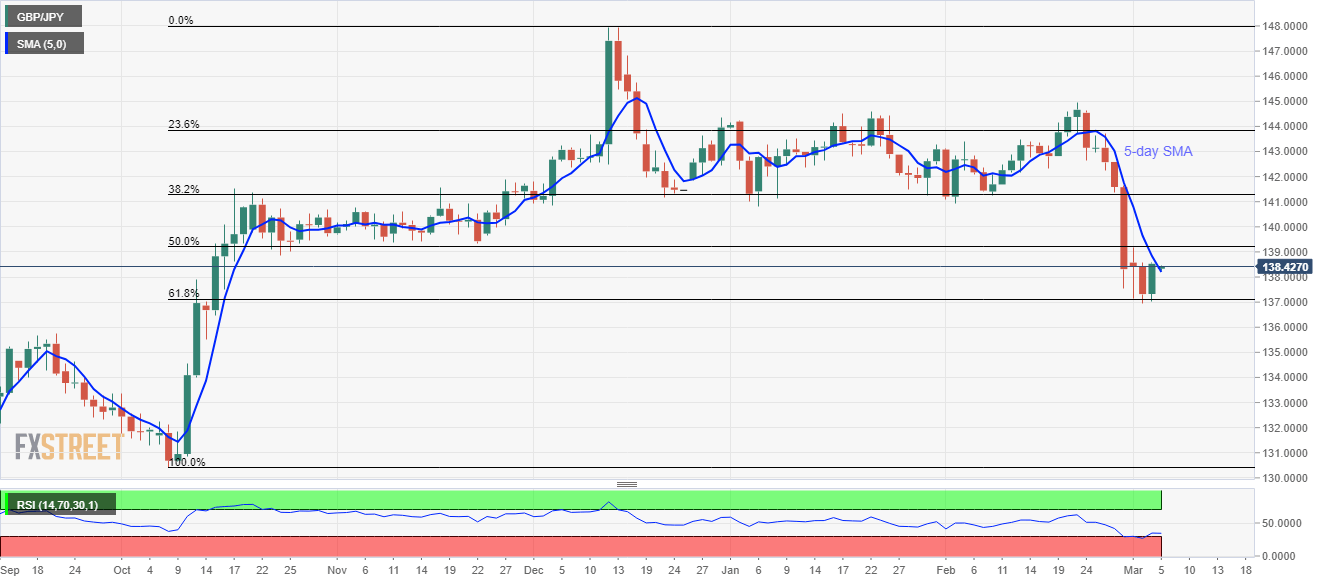

GBP/JPY rises 0.14% to 138.53 during the Asian session on Thursday. With this, the quote manages to extend its U-turn from 61.8% Fibonacci retracement of October-December 2019 upside while also clearing 5-day SMA.

That said, buyers are now looking towards 50% Fibonacci retracement and November 2019 low, respectively around 139.20 and 139.35, as immediate upside targets.

However, multiple barriers around 140.00 and 140.70 could challenge the bulls past-139.35.

On the downside, the pair’s declines below 61.8% Fibonacci retracement level of 137.10 can drag the quote to September 2019 high of 135.75.

GBP/JPY daily chart

Trend: Pullback expected