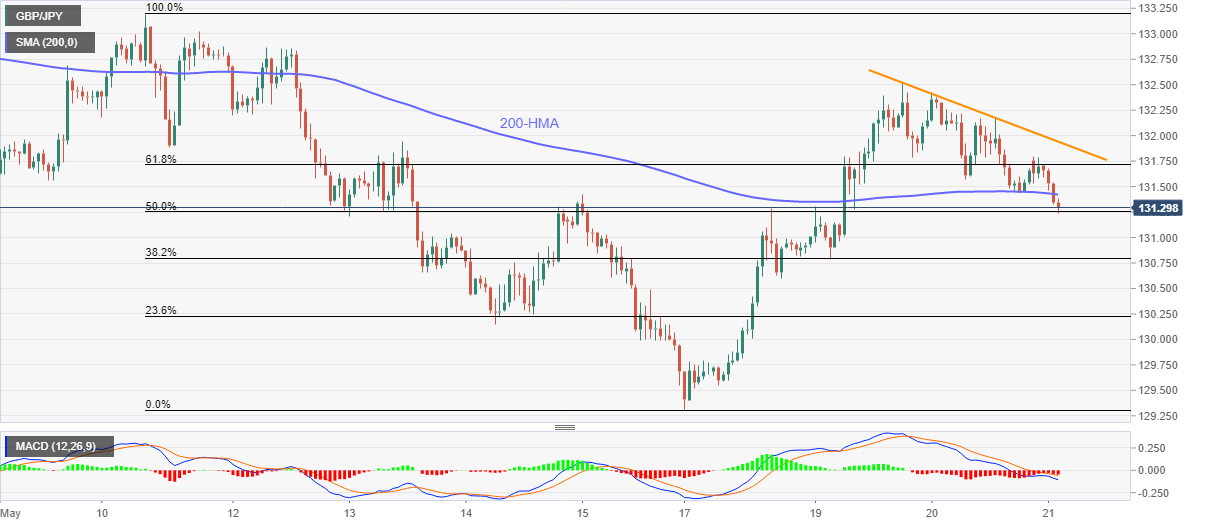

- GBP/JPY holds onto losses from the weekly top surrounding 132.50.

- 23.6% Fibonacci retracement, 130.00 round-figure lures intraday sellers.

- The immediate falling trend line acts as the key resistance.

GBP/JPY drops to the intraday low of 131.23, down 0.31% on a day, amid the initial trading hours of Thursday.

While extending its pullback moves from the weekly top of 132.51, the pair recently slipped below 200-HMA, which in turn signals further downside amid bearish MACD.

As a result, 23.6% Fibonacci retracement of May 11-17 decline, around 130.25, is likely on the bears’ radar as nearby key support.

Though, 130.00 mark could stop further selling, if not then the monthly low near 129.30 can be refreshed.

Alternatively, a pullback beyond the 200-HMA level of 131.45 will have to cross 61.8% Fibonacci retracement level of 131.72 to challenge the two-day-old resistance line, at 132.00 now.

If at all the GBP/JPY prices remain positive beyond 132.00, the weekly high of 132.51 and May 11 top surrounding 133.20 could check the bulls afterward.

GBP/JPY hourly chart

Trend: Bearish