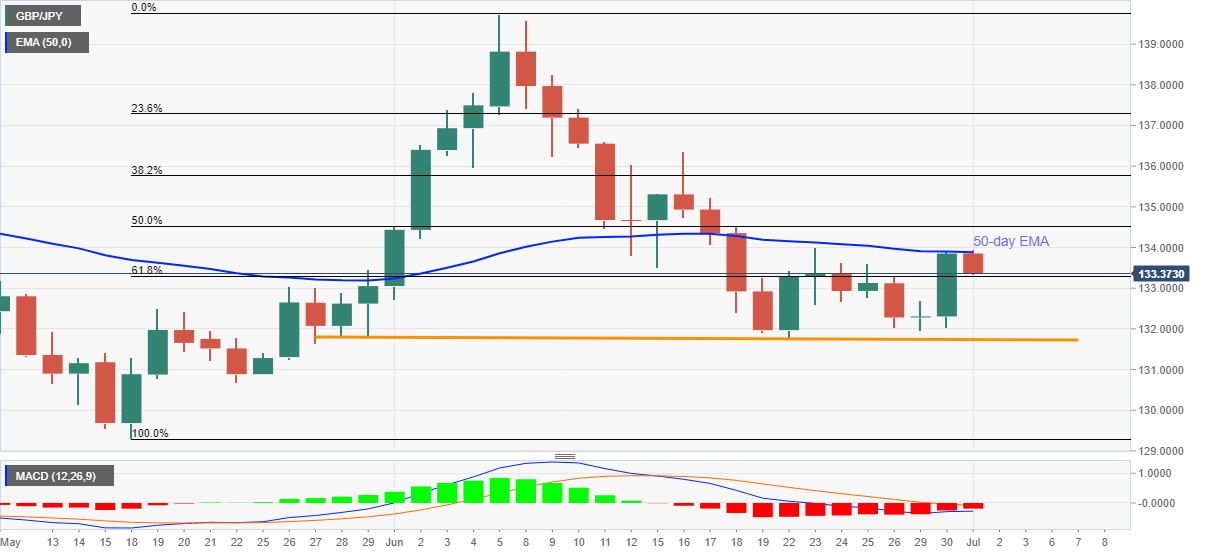

- GBP/JPY stays pressured after reversing from one-week high of 133.95.

- 61.8% Fibonacci retracement, monthly horizontal support on the bears’ radars.

- Mid-June top could lure the bulls during the fresh upside.

GBP/JPY prints 0.30% loss while taking a U-turn from the weekly top to 133.40 during the early Wednesday’s trading. In doing so, the pair respects 50-day EMA amid bearish MACD signals.

Hence, sellers are more inclined to revisit 61.8% Fibonacci retracement of May-June upside, at 133.30, as immediate support. However, a horizontal area comprising the lows marked since late-May, around 131.80/75, might offer a strong hurdle to further downside.

If at all the bears refrain from respecting 131.75 rest-point, May 22 low near 130.65 and 130.00 round-figure could offer intermediate halts during the south-run to May month’s low of 129.32.

On the flip side, a daily closing past-50-day EMA level of 133.89 can renew the pair’s upside attempt towards 50% Fibonacci retracement, at 134.53.

Should bulls manage to dominate successfully past-134.53, June 16 high close to 136.35/40 might become their favorite.

GBP/JPY daily chart

Trend: Pullback expected