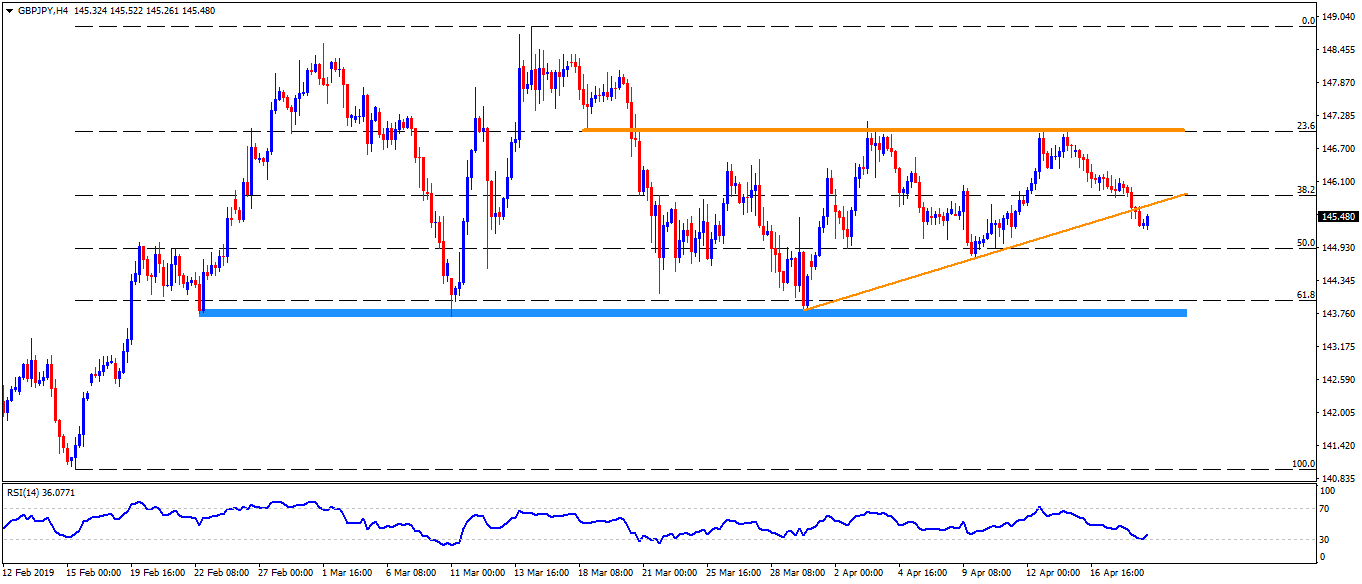

GBP/JPY remains under its ascending triangle breakdown area as it trades near 145.50 during early Friday.

Pair’s break of three-week of upward sloping trend-line confirmed short-term ascending triangle break on Thursday, which in turn signals further downside to 144.85 and 144.60.

However, 144.80/70 region comprising lows marked since February 22 could restrict the quote’s declines past-144.60, if not then 143.00 and 142.50 should gain bears’ attention.

On the flipside, pair’s break of 145.70 support-turned-resistance can help it challenge 146.30 ahead of confronting 147.00 mark including multiple highs and low since March 18 and 23.6% Fibonacci retracement of February 15 to March 14 upside.

If prices rally beyond 147.00, 147.50, 148.10 and 148.55 can offer intermediate halts during the rise towards March month high near 148.85.

GBP/JPY 4-Hour chart

Trend: Bearish