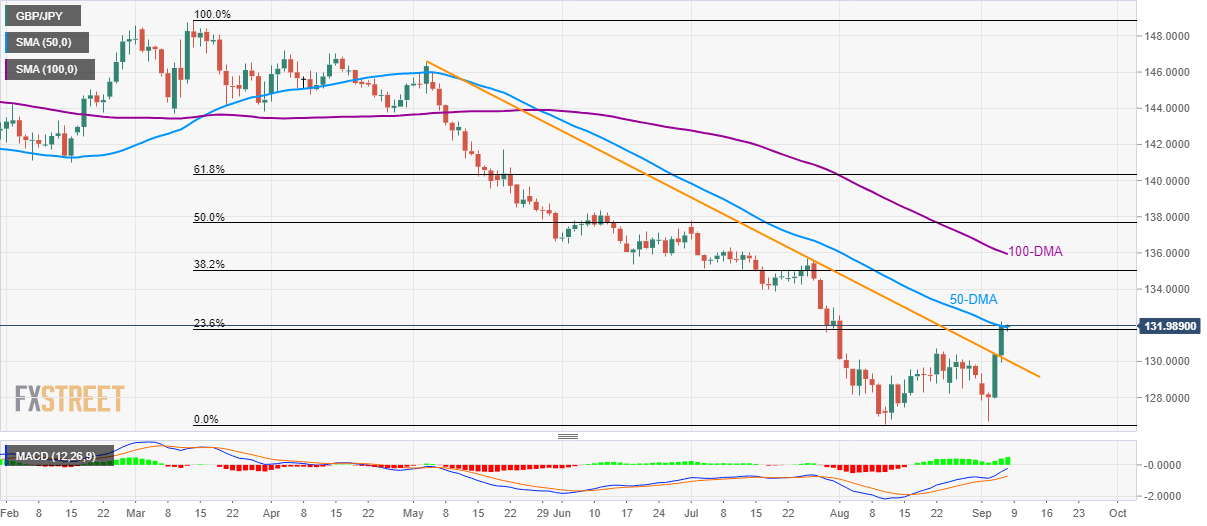

- GBP/JPY seesaws around key resistance-confluence after breaking a four-month-old falling trend-line.

- Bullish MACD favors upside but buyers await a sustained clearance of 50-DMA, 23.6% Fibonacci retracement.

The GBP/JPY pair’s rally to five-week high takes a break near the key upside barrier while flashing 131.98 as a quote during the Asian session on Friday.

While a successful break of four-month-old falling trend-line and bullish signal from 12-bar moving average convergence and divergence (MACD) favors the pair’s further rise, 50-day simple moving average (DMA) and 23.6% Fibonacci retracement of March-August downpour question the buyers.

With this, bulls await a sustained break above 131.75/85 confluence area in order to extend the latest recovery towards July 18 low of 131.85 and then head to 100-DMA level of 135.94. Though, 38.2% Fibonacci retracement near 135.00 could act as an intermediate halt.

On the contrary, a pullback can take rest on the resistance-turned-support-line close to 130.00 ahead of revisiting multiple supports around 128.30/20 and August month low near 126.50.

GBP/JPY daily chart

Trend: sideways