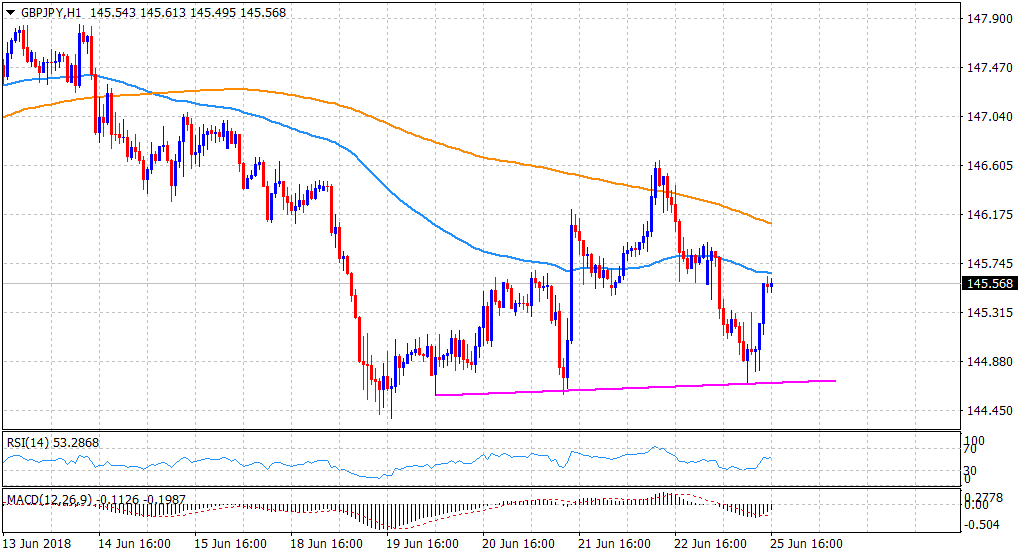

“¢ Rebound from the pre-BoE strong horizontal support and jumps back to test 100-hour EMA, albeit lacked any strong follow-through.

“¢ Mixed technical indicators fail to support any firm directional bias and hence, any subsequent up-move is likely to confront strong hurdle near 200-day SMA.

“¢ A decisive break below 144.70 horizontal support would negate prospects for any near-term up-move and turn the cross vulnerable to slide further.

Current Price: 145.57

Daily High: 145.93

Daily Low: 144.70

Trend: Neutral

Resistance

R1: 145.94 (static resistance)

R2: 146.11 (200-period SMA H1)

R3: 146.65 (post-BoE swing high)

Support

S1: 145.35 (S1 daily pivot-point)

S2: 145.00 (psychological round figure mark)

S3: 144.70 (current day swing low)