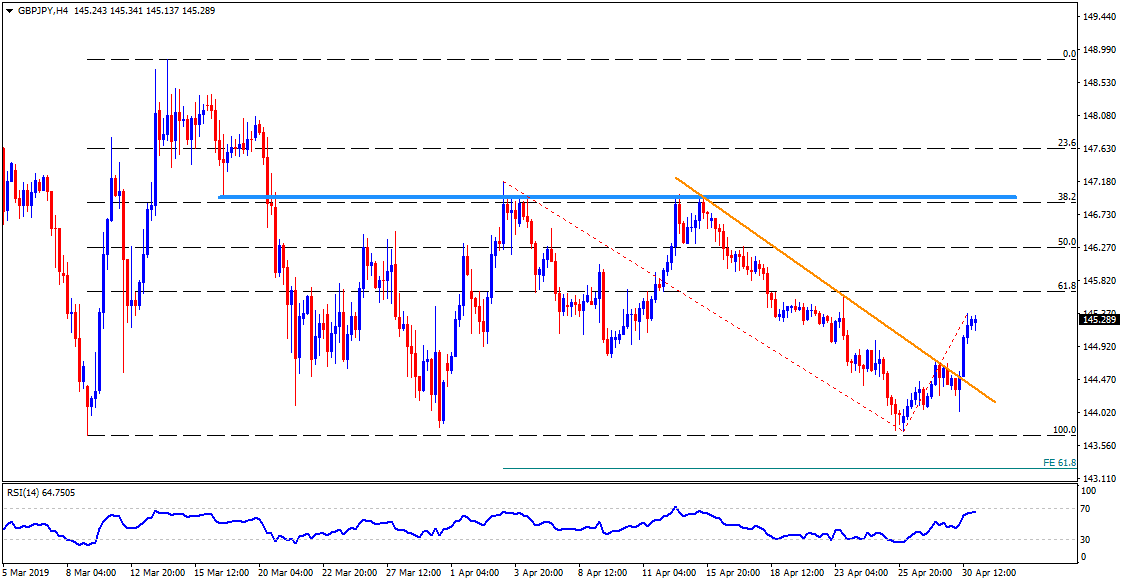

- The break of fortnight resistance-line shift market attention to 61.8% Fibo.

- Overbought RSI conditions challenge recent increase.

The GBP/JPY pair is on the bids around 145.30 during early Asian sessions on Wednesday. The pair recently crossed a two-week-old descending trend-line but is struggling with overbought conditions of 14-bar relative strength index (RSI) to target 61.8% Fibonacci retracement of its March month’s rise.

Should overbought RSI triggers the pair’s pullback, 145.00 seems immediate support to watch ahead of 144.70 and 144.00.

Though, multiple supports between 143.80 and 143.70 could restrict the quote’s downside past-144.00, if not then 61.8% Fibonacci expansion (FE) of its April month moves, near 143.30, could flash on the chart.

On the flipside, 145.70 comprising 61.8% Fibonacci retracement becomes nearby resistance for pair traders to observe during further upside.

If bulls refrain from respecting 145.70 resistance, 50% Fibonacci retracement near 146.30 and 146.90/147.00 horizontal area may regain market attention.

GBP/JPY 4-Hour chart

Trend: Pullback expected