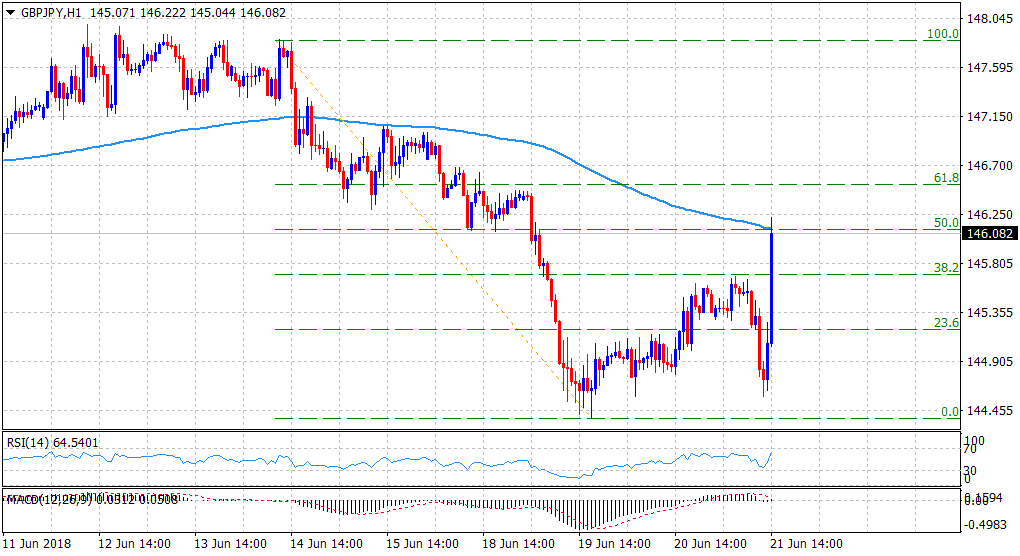

“¢ The post-BoE upsurge pauses near a confluence resistance comprising of 200-hour SMA and 50% Fibonacci retracement level of the 147.85-144.39 recent downfall.

“¢ Short-term technical indicators have gradually started moving into positive territory and increase prospects for a follow-through bullish momentum.

“¢ On a sustained weakness back below a confluence support marked by 38.2% Fibonacci retracement level and 100-hour SMA would negate the near-term bullish outlook.

Current Price: 146.08

Daily Low: 144.59

Daily High: 146.22

Trend: Bullish

Resistance

R1: 146.45-50 (61.8% Fibo. level)

R2: 146.86 (R3 daily pivot-point)

R3: 147.00 (round figure mark and weekly high)

Support

S1: 145.70-65 (100-period SMA H1 & 38.2% Fibo. level)

S2: 145.20 (daily pivot-point)

S3: 144.59 (current/previous day swing low)