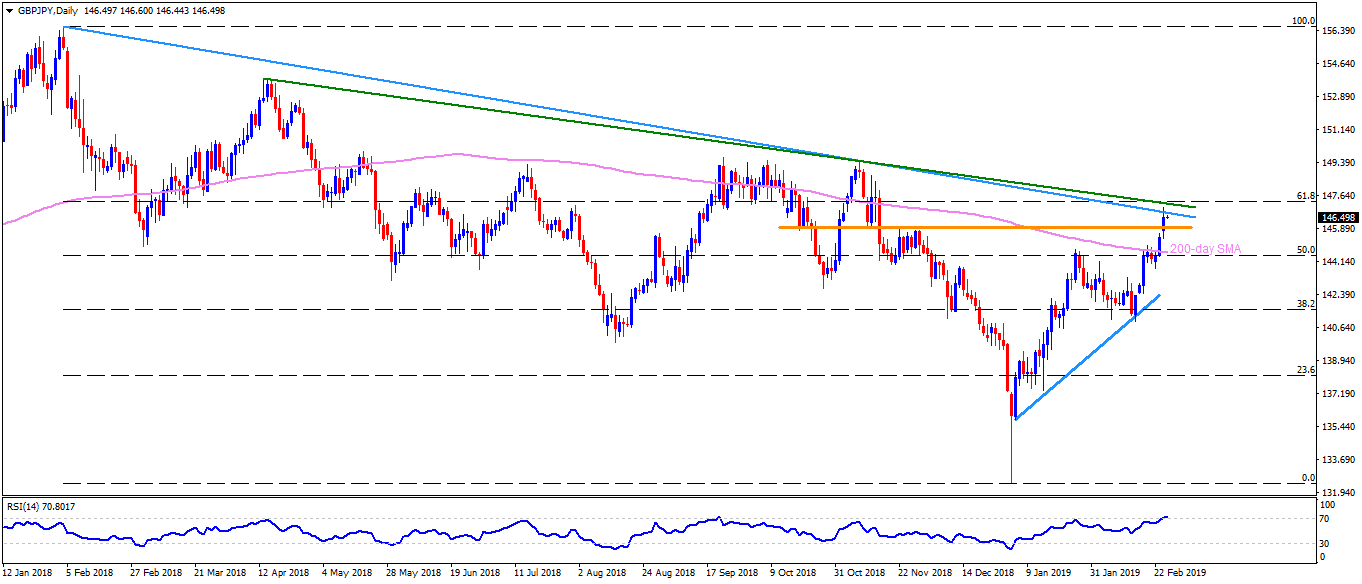

- GBP/JPY trades around 146.55 during initial Asian sessions on Wednesday.

- Yesterday, the pair crossed a yearlong resistance-line joining February 2018 high to November but failed to close beyond the same upside barrier.

- The pair has been trading well beneath the 146.85 resistance-line since morning, which in turn highlights the importance of 146.00 – 145.90 horizontal support area for the sellers.

- Should the pair slips under 145.90, Tuesday’s low around 145.35 may offer intermediate halt ahead of dragging it to the 200-day simple moving average (SMA) level of 144.65.

- Meanwhile, an upside clearance of 146.85 trend-line can’t be considered as a strong signal for the pair’s rise as another resistance-line connecting high of April and November 2018, together with 61.8% Fibonacci Retracement of February 2018 to January 2019 downturn, at 147.35 can challenge buyers.

- Given the bulls ability to cross 147.35, 148.45, 149.30 and 150.00 can come forward as favorites.

GBP/JPY daily chart

Additional important levels:

Overview:

Today Last Price: 146.53

Today Daily change: -3 pips

Today Daily change %: -0.02%

Today Daily Open: 146.56

Trends:

Daily SMA20: 143.25

Daily SMA50: 141.56

Daily SMA100: 143.48

Daily SMA200: 144.61

Levels:

Previous Daily High: 147.06

Previous Daily Low: 145.4

Previous Weekly High: 145.05

Previous Weekly Low: 142.46

Previous Monthly High: 144.85

Previous Monthly Low: 131.79

Daily Fibonacci 38.2%: 146.43

Daily Fibonacci 61.8%: 146.03

Daily Pivot Point S1: 145.61

Daily Pivot Point S2: 144.67

Daily Pivot Point S3: 143.95

Daily Pivot Point R1: 147.28

Daily Pivot Point R2: 148.01

Daily Pivot Point R3: 148.95