The British parliament is moving forward with processing Article 50. What does it mean for sterling?

Here is their view, courtesy of eFXnews:

A positioning squeeze coupled with a broader dollar sell-off has made holding sterling shorts painful this year. We’re unconvinced the rally is sustainable.

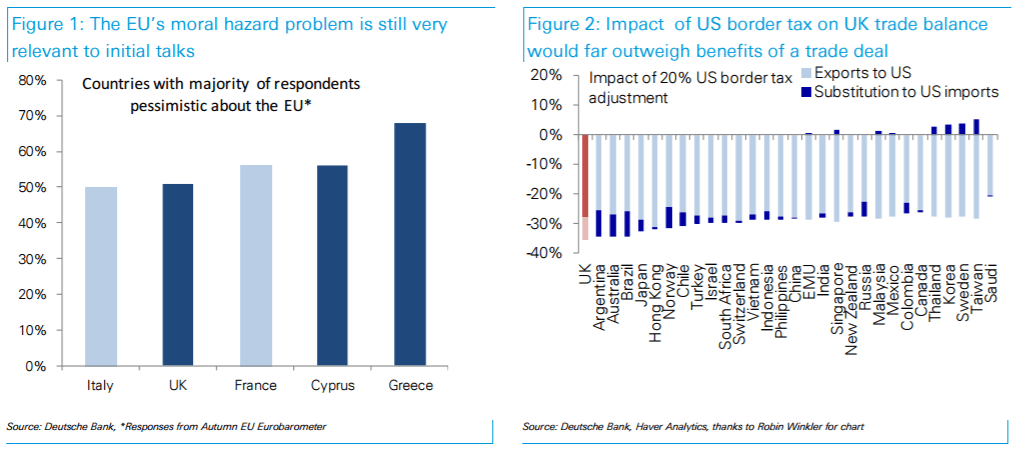

Article 50 negotiations should start badly. The likely date for talks to begin is the 9th March. A key stabilizer for the pound would be early clarity on a transitional arrangement between the UK and EU. This seems unlikely. Along with the UK, France and Italy are among only five countries where pessimism outweighs optimism about the EU according to polls and eurosceptic parties lead polls in both (figure 1). Spring elections in the former and likely summer elections in the latter means there remains a strong moral hazard incentive for a tough EU stance. Even assuming political goodwill, the sequencing is wrong. A transitional arrangement can only be agreed once the future relationship is clarified, i.e. towards the end of the Brexit process, too late for many firms.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Second, there are no fallback options for hard Brexit. Negotiating multiple free trade deals in parallel with EU talks over a two year time frame is neither realistic nor good policy. We are particularly pessimistic about the prospects of a US trade deal, as outlined in our recent special report. To agree a deal with the US, the UK would have to erect non-tariff barriers with the EU and tear up much of the county’s regulatory architecture. The benefits of a US free trade deal would also be more than offset by any Trump border tax. The UK would be the worst affected by a border tax, with exports falling 35% to the US, according to our colleagues (figure 2). The WTO fall-back option is not straightforward either

In sum, while volatility will remain elevated, we remain comfortable with our existing short GBP/CHF view from January and look to target either 1.10 in GBP/USD or close to parity in EUR/GBP at some point this year.